What is a patent for a foreigner, who needs it?

This document is necessary for a foreign citizen who wishes to officially find employment in the Russian Federation. A patent certifies the legality of employment for a foreigner.

What you need to know about this document:

- It is issued for a period of one month to a year.

- Its action is limited to a certain territory.

- Issued for a specific profession and type of activity.

- To obtain one, you must undergo a medical examination.

- Issued with the permission of the Migration Service.

Nuances of a labor patent

In order for the employment relationship with the employer to be considered completely legal, after obtaining a patent the following actions must be taken:

- Prepare a copy of the employment contract with the employer.

- Contact the Ministry of Internal Affairs for subsequent registration.

Important! The above actions must be performed by the foreign citizen no later than two months after signing the employment contract. It is necessary to pay the tax on time to avoid invalidation of the patent.

How can a foreigner return excessively withheld personal income tax?

A tax agent (for example, an employer) does not have the right to demand from a taxpayer (for example, an employee) documents to exempt him from paying personal income tax and to exempt from taxation income received from sources in the Russian Federation by an individual who is not a tax resident of Russia. The provisions of Article 232 of the Tax Code of the Russian Federation do not establish the taxpayer’s obligation to submit to the tax agent documents confirming that he has paid tax in the territory of a foreign state in order to exempt him from paying personal income tax.

To obtain exemption from personal income tax in Russia, the taxpayer must submit to the tax authorities official confirmation that he is a resident of a state with which the Russian Federation has concluded a double tax treaty valid during the relevant tax period. In addition, you must submit a document to the Federal Tax Service regarding the income received and the payment of tax outside the Russian Federation. The document must be confirmed by the tax authority of the relevant foreign country.

We recommend reading: What kind of business to open in a town

What taxes does a foreign worker pay?

Having an employment relationship on the territory of the Russian Federation, a foreigner pays types of taxes similar to those of local citizens.

Foreigners have received the right to a personal income tax refund, since they pay it twice. This occurs when paying tax, as well as when the employer withholds 13% when calculating wages. If there is no patent, but there is permission, taxes are calculated at a higher rate. It is tied to the period of residence in the territory of the state:

- A 30% rate is imposed on persons whose stay does not exceed six months.

- If a person has been staying in the Russian Federation for more than six months, the rate is reduced to 15%.

Interesting. Highly qualified specialists are allocated to a separate category. Regardless of the length of stay, the rate for them is 15%.

Certain groups of citizens are not required to purchase a patent. This:

- refugees;

- citizens of Belarus, Kyrgyzstan, Armenia and Kazakhstan.

Taxation of foreign citizens working under a patent 2021

The official employment of any professional can only be confirmed by signing a written employment contract. The method of consolidating relations with foreigners was no exception in this regard. Moreover, the Labor Code (LC) of the Russian Federation guarantees to all categories of visiting specialists that they can demand that the employer enter into a contract without limiting the duration of its validity. And although migration services insist that upon expiration of a work permit or patent, the contract loses its force, labor legislation only provides for suspension from work for the period of renewal or re-issuance of documents.

- Tax residents pay 13% on all types of income.

- Foreigners with refugee status, with a temporary residence permit, from the EAEU countries or who arrived by invitation as highly qualified specialists will give 13% of their earnings and 15% of dividends.

- The dividends of the founder of an economic company in the Russian Federation, a citizen of another state permanently residing in his homeland, will be reduced by 15%, and all other income will be “lost” by 30%.

We recommend reading: Compensation for unused police leave in 2021

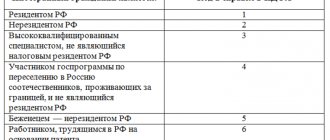

Personal income tax rate for foreign citizens

The personal income tax rate will vary depending on the type of income, status and residence. Residence status is determined by the time spent on the territory of the Russian Federation. Thus, foreigners who have stayed in Russia for less than 183 days (calendar) within one year are non-residents. And persons with a special status are recognized as:

- refugees;

- high-class specialists;

- foreigners holding a patent;

- residents of the EAEU countries.

Read also: Sponsorship letter for a Schengen visa

| Foreign citizen status | Personal income tax rate (%) | ||

| Income from employment | Other types of income, with the exception of winnings and dividends, which are taxed at a higher rate | Profits from participation in a joint stock company | |

| Special status/resident of the Russian Federation | 13 | 13 | 13 |

| Special status/non-resident of the Russian Federation | 13 | 30 | 15 |

| No special status/resident of the Russian Federation | 13 | 13 | 13 |

| No special status/non-resident of the Russian Federation | 30 | 30 | 15 |

How can a foreigner pay personal income tax himself?

If a foreign citizen arrives in Russia on a visa-free basis (for example, from the territory of Ukraine), then from this year, in order to obtain employment opportunities in our country, he must obtain a patent (Clause 1, Article 2 of Law No. 115-FZ). Please note: citizens of Belarus, Kazakhstan and Armenia do not need to obtain a patent to work in Russia (clause

Here is an example of such a statement. General Director of Lotos LLC Sharapov I.M. from Zakirov Rinat Karimovich I ask you to reduce the personal income tax withheld from my income for 2021 by the amount of fixed advance payments I pay based on the provided receipts for payment of the patent for the period of its validity in 2021.

We recommend reading: Do I pay my pension forward or backward?

Reduction of personal income tax by the amount of a patent for a foreign citizen

Taxes are withheld from foreigners in accordance with the law.

It is not possible to issue a recalculation and receive a refund in advance. This can only be done after the tax period, once a year. In 2021, the previously in force order has been maintained. A foreign worker can apply for a deduction in person by contacting the tax service. Or submit an application to your employer, who will prepare documentation for transmission to the tax authorities.

After receiving an application with a package of documents, a tax officer conducts an inspection with the participation of the migration service. A ten-day period has been established for verification.

Read also: Carry-on luggage on a plane in 2021

A prerequisite for approval of an application for a personal income tax refund is the implementation of legal work activities. The foreign worker must have all the necessary work permits, supporting documents, as well as a formal employment contract with the employer.

If an employee has several jobs, he makes a tax refund once, through the main employer. When conducting an audit, the tax officer will definitely check whether applications for a specific person have been received from other places of work.

If an organization employs several foreign employees, the accounting department prepares a separate package of documents for each employee to reimburse the tax.

How can a foreigner return excessively withheld personal income tax?

A tax agent (for example, an employer) does not have the right to demand from a taxpayer (for example, an employee) documents to exempt him from paying personal income tax and to exempt from taxation income received from sources in the Russian Federation by an individual who is not a tax resident of Russia. The provisions of Article 232 of the Tax Code of the Russian Federation do not establish the taxpayer’s obligation to submit to the tax agent documents confirming that he has paid tax in the territory of a foreign state in order to exempt him from paying personal income tax.

We recommend reading: Commercial offer for medical clothing

To obtain exemption from personal income tax in Russia, the taxpayer must submit to the tax authorities official confirmation that he is a resident of a state with which the Russian Federation has concluded a double tax treaty valid during the relevant tax period. In addition, you must submit a document to the Federal Tax Service regarding the income received and the payment of tax outside the Russian Federation. The document must be confirmed by the tax authority of the relevant foreign country.

Errors when withholding personal income tax from a foreign worker

The most common mistakes are as follows:

- Incorrect calculation of the amount to be paid to the budget. It happens that a foreigner mistakenly transferred a larger amount to pay taxes than he should have. Such actions can also be intentional. In this situation, you should not hope for a refund of the overpaid amount. In accordance with the Tax Code, such excesses will not be recognized as overstatement.

- Difficulties in identifying persons from the categories of refugees or those who have received temporary asylum in the territory of the Russian Federation who are entitled to the deduction. Refugees, as well as persons granted temporary asylum in the Russian Federation, pay income tax of 13% at a preferential rate. Such non-residents cannot claim deductions. However, having received resident status and continuing to pay income tax, they will be able to claim deductions provided for in Articles 218-221 of the Tax Code.

Article 218 of the Tax Code of the Russian Federation “Standard tax deductions”

Article 219 of the Tax Code of the Russian Federation “Social tax deductions”

Article 220 of the Tax Code of the Russian Federation “Property tax deductions”

Article 221 of the Tax Code of the Russian Federation “Professional tax deductions”

Are tax deductions provided to foreign citizens with work permits?

If the income is received by a migrant not as a result of fulfilling his duties specified in the employment contract, but, for example, after selling a car, then the foreigner must declare this independently by submitting a 3-NDFL declaration to the tax authorities.

For the purposes of the Code and other acts of legislation on taxes and fees, individuals mean citizens of the Russian Federation, foreign citizens, as well as stateless persons (Clause 2 of Article 11 of the Tax Code of the Russian Federation). For individuals whose child (children) is (are) outside the Russian Federation, a tax deduction is provided on the basis of documents certified by the competent authorities of the state in which the child (children) live.

We recommend reading: Benefits for disabled people of the third group and Chernobyl survivors for recreational purposes

Application for refund of overpaid personal income tax: sample 2021

Let us say right away that if you transferred personal income tax before the established deadline, then it can be returned, offset against arrears for this tax, as well as against arrears and future payments for other federal taxes. But offsetting the overpayment against future personal income tax payments is undesirable. Let us explain why.

We recommend reading: If the parents are divorced and the father has died, can the child receive survivor benefits?

The new personal income tax refund application form consists of three sheets. The first one indicates the TIN and name of the company (IP), the BCC of the tax with overpayment and the period of its occurrence, the amount and number of sheets of application documents. On the second sheet - enter account details - name, number and bank. If personal income tax is returned by an individual, then you need to fill out the third sheet.

Refund of personal income tax to a foreigner on a patent in 2021

Let's assume that a foreigner has paid fixed advance payments for 2021 in Moscow and the Moscow region. In 2021, foreigners in Moscow transferred 4,200 rubles. per month (RUB 1,200 × 1.514 × 2.3118) in the Moscow region – RUB 4,000. per month (RUB 1,200)

The rate of contributions to the Social Insurance Fund of Russia will be 1.8%. When crossing the border, a potential migrant worker must indicate on the migration card the purpose of the visit - “work” and, within 30 days from the date of entry, submit an application for a patent, which will be issued in the territorial divisions of the FMS. Since the new year, the cost of a work patent for foreign citizens in the capital has increased from 1.3 to 4 thousand.