Help 2 personal income tax

The most popular document for determining the material income and tax accounts of an individual for the required period of time is certificate 2 of personal income tax. Basically, it is filled out in the accounting department by the end of the year, summing up the results, and transferred to the tax office, but it can also be issued at the request of the employee.

Upon request, a certificate is issued in the following cases:

- 2 personal income taxes are required when obtaining auto, mortgage or consumer loans. Sometimes they may be required to take out a large cash loan.

- Issued automatically upon dismissal of an employee. If you haven’t done this, you will have to request a certificate for a new official employment.

- It is transferred to the tax service when a deduction is required. Let's say a deduction is possible for citizens whose children study at a higher educational institution on a paid basis.

- Upon retirement and further calculation of benefits.

- If a person decides to adopt a child.

- In litigation, one way or another, related to labor relations.

- When the issue of alimony obligations is resolved.

In its final form, the document must bear the seal and signature of the head of the enterprise. According to the standard, the certificate is issued within three working days, excluding holidays and weekends.

There is no need to return it to the accounting department. However, it is important to remember that the company has the right to indicate the calculation only for the time during which the employee worked at this particular workplace. This applies to cases where a person has managed to change several jobs over the past year.

How to find the code number

The numeric code has 3 digits. To avoid mistakes, you will need:

- open OKSM;

- find by name the country of citizenship of the taxpayer (the person about whose income you need to draw up a document);

- select a code by country name;

- enter it in the appropriate field of the form.

Most programs that offer to fill out 2-personal income tax make it possible to automatically select the desired code from a directory by country name. Those who fill out certificates manually will have to look for the number in the classifier themselves.

Filling rules

Issuing a personal income tax certificate 2 is a common matter, but sometimes it is not at all easy. An inexperienced accountant may have problems.

Feature selection

The first thing a specialist faces is identifying the sign. There are two types of signs:

- Filling out occurs for any employee receiving wage payments from the enterprise and deductions from them. This also includes funds protected from personal income tax withholding. A certificate with this indication must be submitted to the tax office no later than April 1.

- All other situations when it is impossible to deduct taxes from certain material assets. For example, if you need to pay for a gift for a person who is not an employee of the company. Temporary dates: until the first of March. In addition, you must indicate the amount of income that is not subject to taxation and the possible amount of tax.

Usually in the second case you have to make two certificates with different characteristics at once. The first is all income in aggregate, the second is the amounts protected from withholding.

Code of the country

The second task is to indicate a reliable country code. Today there is an OKSM classifier of country codes. It was approved on December 14, 2001 by Gosstandart under number 529-ST. Information from it can be found for free on many legal Internet resources, but it is important to remember that the database is constantly updated and subject to adjustments. Therefore, it is necessary to monitor the relevance of the information that comes across on sites and weed out outdated versions. For example:

- Russian citizenship code for personal income tax certificate 2 is 643.

- Belarus - 112.

- Uzbekistan - 860.

- Kazakhstan - 400.

- Armenia - 051.

- Ukraine - 804, etc.

The original classifier is located directly on the official website of Gosstandart. You can also find its changes there, but they are all located separately, which creates a number of inconveniences when searching for the necessary information.

Example document

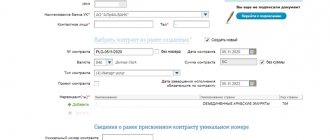

The standard certificate form has several parts to fill out. The first part includes:

- Full legal name of the organization that was involved in issuing this certificate.

- 1st or 2nd sign indicating the possibility of collecting tax deductions.

- Document data: number, date of completion, what time frame was taken as the basis for the calculation.

- Territorial code of the tax service with which the enterprise is registered.

- The serial number of the adjustments made. If there were none, you must enter the number 0.

- Landline telephone number of the work organization. Required with area code.

- Payment details of the enterprise: taxpayer identification number (TIN), All-Russian Classifier of Municipal Territories (OKTMO) and reason for registration code (KPP). For individual entrepreneurs, it is permissible to put a dash.

- Personal data of the employee for whom the certificate is issued: last name, first name and patronymic, tax identification number, residential address.

- Official taxpayer status. Usually for a Russian resident there is only one.

- State code from classifier 529-ST. This can be either the Russian Federation or any other country from which the employee arrived.

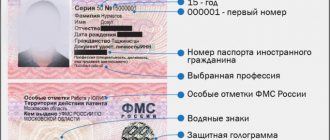

- Code of the employee’s personal identification document, as well as its number and series. Russian passport code is 21.

The second part is further divided into three more sections. Here they describe monthly material income, tax and other deductions, the amount of actual tax and that already paid.

The third part displays income in coded form.

For example, salary code is 2000, vacation payments are 2012, other one-time amounts are 2720. All this is subject to personal income tax. The fourth is coded deductions. For example, code 126 is a deduction for a minor child.

The fifth part is the total amount of personal income tax. To calculate, you need to add up the income for the entire previous year and subtract deductions. From the amount received, calculate 13 percent (if the rate is for the first taxpayer status).

TIN of a foreign citizen: what documents are needed, where and how to get it

After you have submitted all the necessary documents, an application, all information has been verified and clarified, you will be provided with a certificate containing a list of contacts for communication and verification of readiness. The number of days required to issue a TIN, according to the legislation of the Russian Federation, should not be more than 5 days (not counting weekends).

The line “Country code” or a line with another similar name indicates the three-digit code of the country of which the individual taxpayer is a citizen, for which tax reporting information is being filled out. To fill out this line, the All-Russian Classifier of Countries of the World (OKSM) is used (Gosstandart Resolution No. 529-st dated December 14, 2001). Exemption from taxpayer obligations also includes exemption from the obligation to file a tax return, that is, in this case, VAT.

Document for a foreigner

If a citizen of another country works for an organization and requires a 2nd personal income tax certificate, the procedure remains the same. However there is a slight difference :

- The amount of the tax rate directly depends on the length of residence and work in the Russian Federation. For 183 days or more of continuous stay, the rate will be the usual - 13 percent. In addition, in the certificate the taxpayer status will be standard - 1. If the stay is shorter than the established framework, then the rate increases to 30, and the status - 2. There may be other statuses. For example, visitors from the Eurasian Economic Community countries. Their rate is 13% anyway.

- It is necessary to indicate permanent citizenship according to OKSM, regardless of Russian temporary documents.

- It is not necessary to fill out the column with a Russian or foreign TIN.

- You can indicate your place of residence both in Russia and in your home country, but always with a code.

- The identity document of a foreign citizen is entered under code 10.

- In the fifth section, a column with fixed income is added. This is if the employee works on the basis of a patent. In addition, it is permissible to apply to the NFS to reduce personal income tax by an amount equal to fixed payments. After receiving official permission, indicate its number and date of receipt.

If you take into account all the above factors, then registering 2nd personal income tax should not cause much difficulty . The main thing is to correctly understand country codes and other encodings. These can be found in government legal documents.

Structure

Structurally, the classifier consists of three blocks:

- digital identification,

- names,

- letter identification.

Digital identification block

contains a three-digit digital country code of the world, constructed using the ordinal coding method.

Name block

includes a short name and the full official name of the country of the world. The absence of the full name of a country in the classifier position means that it coincides with the short name.

Letter identification block

countries of the world contains two-digit (alpha-2) and three-digit (alpha-3) letter codes, the characters of which are letters of the Latin alphabet. The basic principle that was used to create letter codes is the principle of visual association of codes with the names of countries in the world in English, French or other languages.

- Two-character alphabetic codes are recommended for international exchanges and allow a visual association to be created with the common name of a country in the world without any reference to its geographic location or status.

- Three-digit letter codes are used in special cases determined by the competent organizations.

The digital code has an advantage over the letter code in that it is not affected by changes in the names of the countries of the world, which may entail changes in the alpha-2 and alpha-3 codes. The formula for the structure of the digital code in OKSM: XXX. In the country classifier worlds are arranged in ascending order of their digital codes. An example of recording OKSM positions:

032 Argentina AR ARG Argentine Republic,

Where:

032 - digital country code; THREE DIGIT with leading zeros. Argentina is the short name of the country; Argentine Republic is the full official name of the country; AR - letter code alpha-2; ARG is the alpha-3 alphabetic code.

Country code russian citizenship

06.07.2018

Russian citizens will need to indicate the code combination of numbers assigned by the Russian Federation in the 2-NDFL certificate. It is written in paragraph 2.5 of the second block of the document called “Data on a civilian.” The OKSM of the Russian Federation is assigned the number 643. It must be entered in the above column.

Having received taxpayer status, you become the owner of a TIN. If this abbreviation is also relevant in your home country, both INNs are indicated in the personal income tax.

A foreign worker is allowed to write his personal data in Latin letters. For example, holders of Moldovan citizenship can enter their first and last names as is customary in their homeland. This will not be considered an error.

It is important that the certificate data corresponds to the data of the foreign passport and other documents.

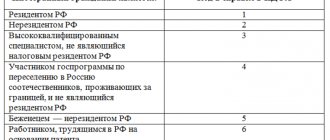

Russia country code for filling out personal income tax certificate 2

- for residents of Russia – 1;

- for non-residents of the Russian Federation – 2;

- for non-residents with a sought-after specialty (highly qualified worker) – 3;

- participant of the “Resettlement of Compatriots” program – 4;

- refugee – 5;

- a person who has a patent for work – 6.

Going down the document below, you can note that in paragraph 2.9 “Address in the country of residence” you also need to enter the country code. In addition to it, it is necessary to enter the full address of residence of the person without citizenship and the immigrant (in the state from which they came).

The legislation allows you to draw up a line in any form (both in Latin letters and Cyrillic).

Citizenship codes by country classifier

In world practice, there are many coding systems, both for different regions and countries, and for citizenship. There is no single system for this, but states try to adhere to the norms of the International Organization for Standardization, or ISO. Under its rules, the citizenship code is indicated in a two- and three-letter format. The Latin alphabet is used for this.

Another situation that requires knowledge of OKSM codes is filling out a certificate in form 2-NDFL . The encryption is entered in the second section entitled “Data about the individual - recipient of the income.” This is what the fifth point is for. Citizenship is indicated using numbers.

Citizenship and country code for reference 2 Personal income tax: formation features

The main document regulating the filling out of form 2 of personal income tax is the order of the Federal Tax Service dated October 30, 2015 with all changes registered as of the date of compilation of the indicators.

In addition to the Internal Revenue Service, for which information on income is generated at the end of the reporting year, a certificate may be needed from a physical person. face in many situations. Some fields are difficult to fill out, for example, which region code to indicate in the second part.

If there are no questions for a resident of the Russian Federation, what about non-residents? In the review, we will consider all the nuances of the formation of this graph according to the OKSM classifier of countries of the world.

We recommend reading: Domofond Surgut deed of gift

To fill out the report, they are guided by the order of the Federal Tax Service and the Tax Code. Forming a 2nd personal income tax return for a foreign citizen is practically no different from a resident of the Russian Federation, but there are several features for reflecting information in some fields:

Oksm - all-Russian classifier of countries of the world

Purpose: identification of countries of the world, used in the exchange of information at the international level. International standards: brought into compliance with the International Standard ISO 3166-97 “Codes for representing names of countries”, Interstate Classifier of Countries of the World MK (ISO 3166) 004-97.

Note: OKSM is part of the Unified System of Classification and Coding of Technical, Economic and Social Information.

The All-Russian Classifier of World Countries was developed by the All-Russian Research Institute of Classification, Terminology and Information on Standardization and Quality (VNIIKI) of the State Standard of Russia and the Central Bank of the Russian Federation (Bank of Russia). Introduced by the Scientific and Technical Directorate of the State Standard of Russia.

Country code 643 in personal income tax certificate 2: nuances of filling out the certificate

If it is impossible to collect personal income tax, then a separate certificate with sign 2 is drawn up. For example, if a gift worth more than four thousand was made to a person who is not an employee of the company. The certificate must be submitted before March 1 and indicate the amount of income from which it is impossible to withhold tax and the potential amount of tax.

This certificate may be needed in many situations, and questions often arise when filling it out. Such as: where the current country codes are contained or what attribute is included in the document. This text is intended to dispel doubts and help you successfully submit documents, for example, to the tax office to receive a deduction.

Russian citizenship code for reference 2-NDFL

In 2015, the Federal Law “On Standardization in the Russian Federation” was signed, the main goal of which is to create a unified state policy in the field of standardization.

The consequence of this was the adoption of the ESKK - a unified classification and coding system. Its components are OKIN and OKSM.

Without information about citizens presented in these classifiers, it is impossible to fill out most documents, including obtaining information about the income of individuals.

OKMS is a reference book for coding citizenship of a particular state adopted in Russia. It contains a complete list of encryption codes for all countries. To view the code of the state of citizenship of a foreign citizen, you must familiarize yourself with the table presented in the current version of the directory.

Codes indicating the passenger's citizenship

BHS Bahamas BGD Bangladesh BRB Barbados BHR Bahrain BLZ Belize BLR Belarus BEL Belgium BEN Benin BMU Bermuda BGR Bulgaria BOL Bolivia BIH Bosnia and Herzegovina BWA Botswana BRA Brazil IOT British Indian Ocean Territory VGB British Virgin Islands BRN Brunei BFA Burkina Faso BDI Burundi

BTN Bhutan

We recommend reading: Pension of a Childhood Disabled Person of the Second Group in Russia

When placing an order for issuing air tickets through our website, during the booking process, you are required to indicate the citizenship of the passenger, in accordance with the ISO 3166-1 reference book: In ticket booking systems, such an important parameter is used as a code indicating the citizenship of the passenger. Please note that citizenship and nationality are not the same thing. If a passenger has more than one citizenship, it is necessary to indicate the one indicated in the documents that the passenger intends to use during transportation.

To correctly indicate your nationality in the reservation system on our website, use the reference table below.

Title page 3-NDFL: country code, tax period and more

- 21 – if the taxpayer enters information into the declaration from a passport, which indicates that he is a citizen of Russia, and began to be valid no later than 01.10.

1997; - 12 – if an individual has the legal right to reside and stay permanently on the territory of the Russian Federation, but is not a citizen of this state (the so-called residence permit);

- 91 – if the applicant for a reduction in the tax base has another document, in addition to a passport and residence permit, intended to confirm his identity.

- 34 – this code is intended for deduction applicants who provide information on their income for a period of time equal to one year in the 3-NDFL form;

- 35-45 – code 35 is written in situations where an individual wants to reimburse the tax for a period of one month, 36 - two months, 37 - three, and so on until the number 45, intended for a tax period of eleven months;

- 50 – this code is necessary to indicate the last tax period in case of termination of the enterprise's activities.

Citizenship country code Russia

Filling out personal income tax certificate form 2 In paragraph 2.3 “Taxpayer status” the taxpayer status code is indicated.

If the taxpayer is a tax resident of the Russian Federation, the number 1 is indicated, if the taxpayer is not a tax resident of the Russian Federation, the number 2 is indicated, if the taxpayer is not a tax resident of the Russian Federation, but is recognized as a highly qualified specialist in accordance with Federal Law dated July 25, 2002 N 115- Federal Law

Here, perhaps, not only belonging to the British Commonwealth of Nations plays a role, but also the natural resources that Botswana has (countless deposits of diamonds). At the end of the year, the company must report to the tax office on withheld and paid personal income tax for each taxpayer.

Country code russian citizenship Link to main publication

Source: https://zakonandporyadok.ru/semejnyj-yurist/kod-strany-rf-grazhdanstvo

Classification of population information

Upon hiring, all new employees receive personal cards for all new employees. They also contain the following information:

- Family status.

- Presence or absence of education.

- Knowledge of languages of other countries.

- Citizenship, etc.

To fill them out, you will need OKIN - another classifier used in Russia to systematize information about the population.

Whether you are a stateless person or have been adopted in one of the countries of the world, this document must be created for you.

The current OKIN was approved in 2015. Having entered into force, it abolished its previously valid counterpart. The classifier used for T-2 cards is a set of digital blocks that can be used in various documents.

Information collected for population accounting is systematized and studied using OKIN. The advantage of the classifier is that it consists of facets that can be applied independently of each other.

We invite you to watch the video, which describes in detail how to correctly fill out the 2-NDFL certificate.

The population registration system continues to be improved and brought in accordance with international standards. Taxpayers must be aware of all changes that occur.

Author:

A specialist in creating analytical materials that require analysis and comparison of data for different countries and regions from official sources. Traveler, has been to 19 countries.

Loading…

Most commonly used codes

Most often, those filling out are required to use the citizenship of the country of Russia in 2-NDFL, since the filling out procedure does not allow any exceptions, including for its own citizens.

If a person has Russian citizenship, then the Russia country code for the 2-NDFL certificate is “643”.

The next most frequently used codes are the codes of the states that are members of the Eurasian Economic Union (EAEU) - Armenia, Belarus, Kazakhstan, Kyrgyzstan. Since it is with these countries that there is an agreement on free movement, movement of capital and labor. Here are the numerical values for them by citizenship, country code for reference 2-NDFL:

- Armenia – “051”,

- Belarus – “112”,

- Kazakhstan – “398”,

- Kyrgyzstan – “417”.

Since quite a lot of people with Ukrainian citizenship come to Russia to work, many employers may need the country code for the 2-NDFL certificate: Ukraine - “804”.

For citizens of Tajikistan the code “762” is indicated, and for citizens of Uzbekistan – “860”.

As for the “far” abroad, a considerable proportion of such workers are citizens of China, whose code is “156”.

If necessary, the necessary numeric codes can be found in OKSM yourself.

Grouping countries by region

The classifier also contains Appendix D

, which shows the distribution of countries of the world by macrogeographic regions (Africa, America, Asia, Europe, Oceania), which is missing in ISO 3166-97, used for statistical purposes in the United Nations (UN) in accordance with the document “Standard country or area codes for use in statistics”, developed by the UN Secretariat. The OKSM uses the following grouping of countries by region and location:

- Asia East Asia

- Western Asia

- Southeast Asia

- Southern part of Central Asia

- East Africa

- Eastern Europe

- Oceania (Australia and New Zealand)

- Caribbean

OKSM is maintained by VNIIKI of Gosstandart of Russia jointly with the Bank of Russia.