The concept of a non-state pension

Corporate and other non-state payments are currently a priority for people who want to ensure a comfortable old age.

Art. 3 of the Federal Decree “On Non-State Pension Funds” establishes the concept of a non-state pension. It should be understood as funds that are paid to the participant on a regular basis in accordance with the terms of the concluded pension contract.

The formation of such payments occurs through contributions transferred by people. In a non-state pension fund, this money can be used for co-financing programs and increased in the future.

Contributions to such funds can:

- employers;

- personal entrepreneurs;

- self-employed persons.

If during the Soviet Union government payments were considered more promising, now it’s the other way around. The size of corporate accruals allows us to draw a conclusion about contentment in old age.

Advantages and disadvantages of non-state pension provision (two pronunciation options: provision and provision)

The pension in a non-state pension fund can increase significantly. In addition, it can be disposed of at your own discretion , with regard to the possibility of lump sum payments. For example, after 5 years you can withdraw the entire amount of savings, including accrued investment income from the NPF.

Due to the interest accrued by the bank for the right to use foreign currency funds, it is also possible to increase the amount . Thus, there will be no risk of losing your own resources.

Also, the non-state part of the pension, or more precisely, part of the contributions for its formation, can be returned to the citizen with the introduction of tax benefits . A nice bonus is the opportunity to return 13% of the amount of contributions paid if you apply for a social tax deduction. The maximum refund amount is 15,600 rubles per year.

Since 2021, adjustments have been made to the law, according to which the age for non-state pension is 55 years for women and 60 for men.

However, in addition to the obvious advantages, such storage of funds has its own disadvantages. These include the need for a high level of awareness from the future retiree

on the formation and mechanisms of accumulation of own funds. A pension agreement, in accordance with which material support is accrued, implies the presence of many schemes and methods for accumulating payments.

Often their size depends on many factors:

- duration of work in the company;

- presence of children, property;

- disability;

- working conditions;

- rank, etc.

Also, these types of payments are characterized by the highest risk of loss when investing funds in other projects. Therefore, you need to carefully approach the possibility of such an investment.

Difference between non-state and funded pensions

The above law contains both the concept of the non-state part of the pension and the funded part. If the first one is paid in accordance with the pension agreement, then savings savings are formed and accrued in accordance with the legislation on funded pensions, on non-state pension funds and the agreement on compulsory pension insurance.

Unlike non-state payments, savings reserves are not the property of people , since they do not belong to them until retirement, and are stored in an individual account.

It is worth paying attention to the following characteristics:

- the procedure for making monthly contributions, their size;

- interest rate;

- the moment or age at which payments begin.

In addition, the accrual of corporate payments itself occurs according to the chosen plan , while savings have a clearly fixed formation mechanism in accordance with the law ( Law (law) - in the narrow sense, a normative legal act that is adopted by the legislative body of state power, regulates certain social relations

).

Important! You can transfer funds from the Pension Fund to the Non-State Pension Fund.

At the same time, a non-state funded pension will have the features of funded savings, since it will be calculated according to the legislation of the Russian Federation, and not an agreed upon agreement.

What is non-state pension provision

A non-state pension is understood as a benefit that will be paid to a citizen who has reached the age of 55 or 60 years (for women and men, respectively) from the budget of a non-state private pension fund to which the person voluntarily contributed money on a regular basis. The amount of the future pension is known in advance and agreed upon in an agreement with a private financial company. The size and frequency of payment of contributions are also regulated by the agreement.

At its core, a non-state pension is an interest-bearing long-term deposit. But with a private fund, unlike the Pension Fund, you can negotiate the conditions for the formation and calculation of benefits.

The main advantages of accumulating a future pension by concluding an agreement with a commercial company are:

- it is allowed to designate legal successors in the contract in the event of the death of the future pensioner;

- you can independently decide how much to receive an old-age pension by making small or significant contributions to the fund;

- it is possible to determine the period for accrual of pension benefits;

- the possibility of early withdrawal of funds from the account (almost all companies);

- the employee himself decides what percentage of his salary to allocate to the formation of a pension;

- many funds allow you to create a pension not only for yourself, but also for third parties;

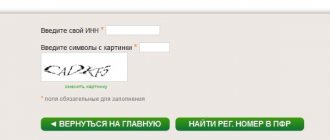

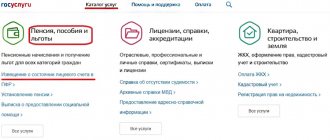

- quick and easy access to information about your account status (as a rule, it is enough to log into your personal account via the Internet);

- management of invested funds by competent financiers of a non-state fund who are able to increase funds and increase future pensions (money works and brings in more money);

- the ability to choose between a large number of options for saving and receiving money.

Today we can talk about the reliability of private pension funds. Firstly, there is already competition among similar companies. Secondly, companies insure savings, which acts as an additional guarantee.

A non-state pension allows you to avoid a situation in which a worker, accustomed to receiving large sums as wages, loses 50-70% of his usual income in retirement, which significantly reduces his standard of living.

Innovations in the law on payments from non-state pension funds

On March 5, 2021, the State Duma considered a draft amendment to the law on corporate pensions. It was recommended to reduce the retirement age for both sexes.

March 11, 2021 V.V. Putin signed an Order to lower the age for receiving payments from NPFs.

Currently, a non-state pension will be paid to women at age 55, and to men at age 60 . This will increase the attractiveness of the savings system in NPFs and increase the number of people who are conscious about securing their future. Such financial resources can be accrued in addition to government payments.

For certain categories of people, even earlier early retirement and financial support for the company are provided.

Such persons may be:

- disabled people injured at work;

- persons with adolescent children or dependents;

- have worked in the company for a long period, etc.

Please note : if the NPF’s interest rate strategy on deposits covers inflation, such storage and accumulation of savings can already be considered successful.

Thus, what are non-state pensions ( regular (monthly or weekly) cash payments to persons who: have reached retirement age (old-age pension), are disabled, have lost their breadwinner. Depending on the organization,

), is regulated by a special law on non-state pension funds. In the future, there will be a massive transition of citizens to this type of pension provision. Innovations will be additional measures of support for the population and will improve their financial situation.

Who needs a non-state pension?

04/06/2014 2 334 1 Reading time: 8 min. Rating:

Author

: Konstantin Bely

I have already described the most common options for creating alternative pension savings, and now I want to dwell in more detail on who needs a non-state pension in the first place, highlighting the categories of people who need to create pension savings without fail. The pension reforms currently being carried out in many countries and the modern laws of capitalist society tell us that relying on the state to provide for old age is no longer relevant. Just pay attention to today's retirees: they are living proof of this. Therefore, now not only people of pre-retirement age, but also middle-aged people are thinking about how to provide for their old age.

In any case, in order to meet old age with dignity, it is necessary to ensure a high and stable passive income, since it is problematic to engage in active earnings at retirement age, and it is not necessary, after all, it is better to think about maintaining health.

And one of the most accessible and understandable sources of passive income for old age to the average person is a non-state pension - alternative payments that can be received, as I already wrote, from three main sources:

- Bank deposits.

- Non-state pension funds.

- Endowment life insurance programs.

So, who needs a non-state pension? Personally, my answer is to everyone. Absolutely and without exception. But first of all, the following categories of people should think about alternative pension savings:

1. People who do not have enough official work experience to receive a state pension. Of course, it is worth taking into account that pension legislation may change a hundred times before retirement. But at least we can analyze the current situation: how many years of experience are needed to count on a pension from the state. I will not write specific numbers here, because, firstly, they are different in different countries, and secondly, they are constantly changing. Find this information and know that if you do not have enough official work experience or may not have enough, you need a non-state pension, and the sooner you start making pension savings, the better.

2. People who have the required work experience, but the amount of income requires a minimum pension or so. Simply put, these are those people who have had a small salary all their lives (or an official part of it) or whose work experience is not so long (for example, only a little more than the minimum standard). You need to find out what criteria are used to determine the current pension size and calculate what payments from the Pension Fund you can now count on. Are they satisfied with you? I'm sure not. Hope that everything will change for the better and we will live...? In my opinion, it’s not worth it. Therefore, only a non-state pension.

3. People working unofficially. I think it’s no secret that millions of people work, receiving salaries in an envelope and not paying any contributions to the pension fund. Accordingly, they are not accrued pension service, and, as a rule, they cannot apply for any payments from the state. Such people should also take care in advance of forming a non-state pension - a source of passive income in old age. These people include unofficial employees of various commercial structures, freelancers, sailors working abroad and others who, legally or illegally, do not pay insurance contributions to the pension fund. Only a non-state pension and personal pension savings will help such people meet old age with dignity.

4. Private (individual) entrepreneurs. First of all, those who work on all kinds of simplified taxation systems, which require minimum contributions to the Pension Fund and, as a consequence, in the future, a minimum pension amount. At some age, they will still retire, for example, for health reasons, and in this case, in order to support their lives, they will need passive income - a non-state pension.

5. For those who want to retire early. I think there are many such people, and the pension reforms currently being carried out in many countries, for the most part, on the contrary, only increase the retirement age. Or it happens that certain categories of employees planned to retire earlier, but then there are new changes in legislation, and they are already equal in such rights with everyone else. To insure against such changes “not in favor of people”, of whom, it seems to me, there are many more awaiting us, only independent care for one’s old age - a non-state pension - will help.

To summarize the above, I would like to once again note and emphasize: alternative pension savings are needed by everyone, without exception. Simply because the traditional pension from the state even now cannot provide a decent old age, and in the future the situation, most likely, can only get worse. But for the above categories of people, a non-state pension is simply necessary. After all, if they don’t have reliable sources of passive income in old age, they simply won’t have anything to live on.

Personal finance site Financial Genius strongly recommends starting to take care of your old age and creating alternative retirement savings as early as possible. The longer you create a non-state pension for yourself, the due to capitalization you will be able to receive more passive income with less investment. The less will be the load on your personal or family budget when allocating funds from it to create pension savings, and the greater will be the income into it in old age.

That's all. Stay with us, stay tuned and develop your financial literacy. See you again!

Estimate: