How to calculate your pension using the new pension calculator

Our pension calculator contains all the information about the length of service and points earned. All you have to do is add current data that has not yet entered the database. In addition, we have up-to-date information about PV and StIPK , as well as numerous tips to help you enter the information correctly.

After entering the information, all you have to do is click on the “Calculate” button - and you will get acquainted with a much more accurate version of your expected pension. A very useful thing for future retirees!

You should be aware that this online pension calculator is NOT applicable for military personnel and law enforcement officers who do not have insurance experience as employees in positions not related to military service.

Russia’s pension strategy remained the same, only the funded component had to be temporarily turned off. It has not gone away, but will remain frozen until approximately 2021.

By default, all citizens of the Russian Federation are participants in the distribution system for this period, and all contributions go directly to it. The Pension Fund of the Russian Federation is balanced by revenues from the budget; in 2017, the transfer amounted to 977.1 billion rubles, and the total income of the Pension Fund of the Russian Federation was expressed as 8181.6 billion rubles. The PFR budget revenues for 2021 amounted to 8.333 trillion rubles. Pension payments increased by 279 billion rubles, social payments - by 11.8 billion. In 2021, pensions are promised to be paid in full, they are going to index and increase them.

What is included in the insurance period

The calculation of length of service for a pension using the calculator is carried out taking into account not only periods of work, but also “non-insurance” periods, which are taken into account after 2002, according to Art. 12 Federal Law No. 400. The length of service for pensioners is calculated in accordance with Federal Law No. 173 “On Labor Pensions”. However, after 2002, the concept of length of service was transformed by the legislator into the “insurance” thesis, which often continues to be called labor experience.

It is worth considering that the insurance period is a broader concept, which means including only those working periods during which the employer paid insurance contributions to the Pension Fund for the employee. In addition, they are joined by periods of other activities that are established by law in Federal Law No. 400:

- military service;

- child care up to 1.5 years;

- being on sick leave;

- the period when you registered with the employment center and received unemployment benefits;

- care for disabled and elderly people over 80 years of age;

- spouses of military personnel and diplomats accompanying their husbands to the place of service in the absence of employment opportunities (up to five years);

- other periods (more details in Article 12 of Federal Law No. 400).

The insurance period includes:

- official employment through concluding an employment contract with the employer;

- service in municipal and other civil government agencies;

- periods of work as an individual entrepreneur;

- other additional periods established in Art. 12 Federal Law No. 400;

- continuous work experience until 2002, which is confirmed by entries in the work book and other documents that the Pension Fund may request.

Those periods that are not provided for by law are not included in the insurance period. We are talking about employment without official registration, when insurance premiums were not paid for the employee or were not provided for by pension legislation until 2002.

When calculating, every 30 days of work is converted into a full month, and every 12 months into a full year.

Calculation of pensions using the new formula

Note. In the form on the right you can instantly calculate the number of pension points that can be awarded to you for 2021.

How many pension points can you be awarded for 2021?

Enter the amount of your monthly salary before deduction of personal income tax:

Error!

Enter a salary higher than the minimum wage in the Russian Federation in 2021 - 9,489 rubles.

Number of pension points per year:

The insurance pension in Russia is formed for each citizen on the basis of his work activity, if we are talking about able-bodied persons, and is paid from the funds of the Pension Fund of the Russian Federation.

The rights of citizens to a pension today are reflected in the IPC coefficients, they are also called pension points. When introducing the pension reform, all existing achievements for pensioners, both current and future, were converted into these points.

In order to be able to calculate an old-age pension, the following conditions are generally necessary:

- age, for women 60 years and 65 for men;

- experience of at least a certain number of years. From 2024 this is 15 years; for previous years there are transitional values (find out what to do if it suddenly turns out that you do not have enough experience);

- the presence of a certain amount of points, from 2015 - 30, with transitional values of earlier years.

The number of points depends not only on the years worked, but also on the amount of contributions to the Pension Fund, both accrued and actually paid.

The number of points a citizen can receive per year is limited from above and has a maximum. In 2021 it was 7.83, in 2021 - 8.26, in 2021 - 8.7, in 2021 - 9.13, in 2021 - 10.

However, it depends on how the citizen defines his attitude towards the funded pension (CP): whether he will take part in its formation or focus only on the solidarity system. Those born after 1966 will have to solve this problem, and everyone who is older has only one option - only an insurance pension.

Here are the values of these main parameters by year:

| Year | IPC – minimum amount | Minimum experience | Maximum annual IPC including payroll | Maximum annual IPC without payroll |

| 2015 | 6.6 | 6 | 7.39 | 7.39 |

| 2016 | 9 | 7 | 7.83 | 7.83 |

| 2017 | 11.4 | 8 | 5.16 | 8.26 |

| 2018 | 13.8 | 9 | 5.43 | 8.7 |

| 2019 | 16.2 | 10 | 5.71 | 9.13 |

| 2020 | 18.6 | 11 | 5.98 | 9.57 |

| 2021 | 21 | 12 | 6.25 | 10 |

| 2022 | 23.4 | 13 | 6.25 | 10 |

| 2023 | 25.8 | 14 | 6.25 | 10 |

| 2024 | 28.2 | 15 | 6.25 | 10 |

| 2025 and beyond | 30 | 15 | 6.25 | 10 |

In the case when we are talking only about an insurance pension, all points collected go towards its formation. When, along with an insurance pension, there is also a funded pension, the maximum 10 points are transformed into 6.25, since 27.5% of the number of insurance contributions are directed to the funded part.

You need to understand : the state annually indexes the insurance pension. But the funded part is at the disposal of the management company or non-state pension fund and is not subject to indexation; instead, it is invested in certain financial projects. If such actions are successful and profitable, then the pension may increase. If the investment operation is unprofitable, the pensioner can only count on the amount of contributions paid.

Pension calculation in 2021

calculate your insurance pension in 2021 using the usual formula based on pension points. This calculation procedure has been introduced since 2014, and no significant changes have occurred in this formula. The size of the pension will depend on three main values:

If, as a result of the calculation, the pension payment turns out to be less than the pensioner’s subsistence level (PMP), then he will be assigned a social supplement up to the PMP. In fact, the pensioner will receive the minimum pension. This minimum payment will differ in different regions of the Russian Federation , since the amount of PMP is set by regional authorities.

In 2021, the procedure for assigning social supplements to PMP has changed, as a result of which all non-working pensioners receiving minimum pensions will be recalculated. You can read more in the article at the link.

It is important to note that the calculation of payments for working and non-working pensioners is different (see calculation examples):

- The cost of one point and fixed payment for them is “frozen” and is not indexed while they continue to work. Those points that are awarded during their working activity are taken into account during the August recalculation (but not more than 3 points per year).

- They are not entitled to additional payments up to the regional subsistence level, so they are paid only the calculated amount of the payment.

Pension calculation formula

The amount of the insurance pension in 2021 is calculated in accordance with the provisions of Art. 15 of Law No. 400-FZ of December 28, 2013. The formula for calculating the insurance pension (SP) in general looks like this:

SP = IPC × SPK + FV

- IPC - the sum of accumulated points;

- SPK - the cost of one such point;

- FV - the amount of a fixed payment (however, it differs for recipients of different types of insurance pensions - old age, disability or loss of a survivor).

Only the size of the IPC depends on the citizen , since it is formed as a result of deductions of insurance contributions to the Pension Fund. The size of 1 pension coefficient and fixed payment is established by the state. Every year their values are indexed by an amount not less than the inflation rate in the past year. Accordingly, a citizen cannot influence these values.

Important: for working pensioners, the SPK and FV are not indexed and remain “frozen” in the amount that was established by the state on the date of retirement . After dismissal, the pensioner will recalculate the amount of his pension payment in accordance with the standards established on the date of the recalculation.

The formula for calculating the pension will be different: SP = IPC × SPK + FV + D, where D are various additional payments to the pensioner . These may be surcharges:

IPC for pension calculation

Citizens' pension rights are formed in the form of IPC - individual pension coefficients or points. The total amount of the IPC used to calculate the pension depends on the insurance contributions paid to the compulsory pension system. Accordingly, the higher the official salary and the longer the length of service, the more contributions are paid to the Pension Fund and the larger the IPC value.

The individual pension coefficient is calculated using the following formula:

- SV - the amount of insurance premiums transferred for the year (at a rate of 16% of wages before personal income tax);

- CBmax is the amount of insurance premiums from the maximum base value, which is established by law (in 2021 it is 1,150,000 rubles, that is, CBmax is equal to 184,000 rubles).

In 2021, a citizen receives a monthly salary of 25,000 rubles. before deduction of personal income tax. Over the course of a year, he will transfer 25,000 × 16% × 12 = 48,000 rubles. in the form of insurance premiums. The maximum amount of insurance premiums in 2019 is 1,150,000 × 16% = 184,000 rubles. Therefore, the IPC for 2019 is equal to: (48000 / 184000) × 10 = 2.61 points.

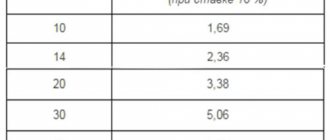

It should be noted that the law limits the maximum number of pension points that can be generated per year (table below).

YearMaximum value of annual IPC

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021, etc. |

| 7,39 | 7,83 | 8,26 | 8,70 | 9,13 | 9,57 | 10 |

You can obtain information about the size of the IPC in the citizen’s Personal Account on the official website of the Pension Fund. There is also information about the periods of work and the number of insurance contributions transferred to the compulsory health insurance system. If some of the periods of work are not reflected in the Personal Account, they will need to be documented in the Pension Fund of Russia.

How much is a pension point worth in 2021?

The value of the pension point used to calculate the pension is indexed annually by the state. Indexation in 2021 has already been carried out - from January 1, 2021.

the cost of one pension point is 87.24 rubles. When calculating the amount of payments for unemployed citizens in 2019, this coefficient value will be used.

By multiplying the number of accumulated IPCs by the cost of one coefficient, you get the value of the insurance part of the pension.

A non-working citizen has 50 IPC on his personal account. Consequently, the insurance part of his pension payment in 2021 will be 50 × 87.24 = 4362 rubles.

However, we note that

for working citizens the cost of 1 coefficient is not indexed throughout his working life.

This condition has been enshrined in law since 2021. The cost of one point for these citizens is determined at the value that was established on the date of retirement: Source: https://pensiology.ru/news/kak-rasschitat-pensiyu-v-2019 /

Fixed payment, its size in 2021

The fixed payment ( FV ) is so called because it is set every year by the state in hard monetary terms, that is, it is fixed for the year. As laid down in Law No. 400-FZ, the annual increase in the PV indicator is a consequence of indexation to the inflation rate of the past year.

However, this provision was suspended in 2021, and an indexation coefficient of 1.04 was adopted. In 2021, the result was a PV of RUB 4,805.11. for the bulk of retirees. In 2019, the size of the fixed payment after indexation amounted to 4982.9 rubles. per month. In 2021 - 5334.19 rubles.

PV has more than one meaning; it is set differently for different categories of citizens. It is indexed twice a year:

- February 1, based on the results of inflation of the past year;

- April 1, based on the results of the pension fund’s income for the previous period - this type of indexation is interpreted as possible, and the decision on this possibility is made by the government of the Russian Federation.

How to find out the time of retirement for early workers

Pensions may be assigned early. Certain categories eligible for early exit retain benefits. But not all. For example, those who worked in the Far North will not be able to maintain the age that applies in 2021. Their exit will be delayed for 5 years.

Note! Certain categories of citizens can retire early. Some privileges have been preserved from previous legislation, some have been removed, and new applicants have been added.

The category of persons who are not subject to the generally accepted rules of the Pension Reform related to the extension of the retirement period:

- working in dangerous, harmful working conditions and paying special insurance premiums;

- for social and medical reasons;

- past man-made and radiation disasters (Chernobyl, Semipalatinsk);

- flight test crew workers.

An expanded list of exceptions can be found on the PFR website www.pfr.ru. The Federal Law has added additional grounds for early retirement. In particular, these are the following conditions:

- Long experience. Applies to women who have worked for 37 years, and men who have worked for over 42 years. Their retirement is 2 years earlier, and their age cannot be less than 55 and 60 years for women and men, respectively.

- Mothers of many children with 3 or 4 children. If you have 3 children, you will retire 3 years earlier, if you have 4 children, you will retire 4 years earlier. But be sure to develop 15 years of insurance experience.

- Unemployed. Their pension is set a couple of years earlier than the generally accepted period.

How is the insurance pension calculated in 2021?

The insurance pension ( SP ) in Russia is calculated today using the formula:

SP = IPC x StIPK + FV

IPC is the sum of all pension points.

StIPK – the cost in rubles of one pension point.

FV – fixed payment.

As you can see, there is only one variable in the formula. This is an IPC that reflects how many points a future pensioner has.

The remaining two indicators are constants, that is, they have a constant value throughout the year.

In 2021, StIPK = 87.24 rubles. (in 2021 - 78.58 rubles, in 2019 - 81.49), FV = 5334.19 rubles. (in 2021 - 4982.9 rubles).

Both of these indicators are subject to indexation by the state, and their values change annually.

Strictly speaking, the task comes down to calculating the points scored - the IPC.

This is a rather cumbersome job performed by employees of the Pension Fund of the Russian Federation. They are required to calculate all points monthly, evaluate income and contributions paid from it to the Pension Fund, and also take into account the option with a funded part, if there is one.

In addition to points earned directly, some citizens can count on an increase in the IPC for other reasons. Additional points are awarded for other types of employment and added to the total.

There are quite a few such positions, all of them are specified. Here are some:

- 1.8 points are supposed to be added for completing military service according to conscription;

- 1.8 – for caring for a child under 1½ years old, added to one of the parents;

- 3.6 – for caring for the next, second child, up to 1½ years;

- 5.4 – for caring for the next children, 3rd or 4th, up to 1½ years each;

- 1.8 – for caring for a disabled or elderly person under certain conditions;

- others specified by law.

The possibility of increasing the IPC can be considered as an incentive prize if a pensioner applies for a pension after working for several years beyond the required age. For each such year of work, he receives a certain number of additional points - there are bonus coefficients for this.

This is a fairly significant increase in pension: if, for example, you continue to work beyond the required 5 years without applying for a pension, then the amount of the IPC will increase by 45%. And if we add here the increase in fixed payments over these years, we get a noticeable increase in pensions.

If a working pensioner quits his job, will his pension increase? Read the expert's answer.

How to calculate your old-age pension in 2021?

In principle, when preparing to apply for a pension, everyone tries to independently estimate the numbers they are looking at. This is quite possible, because the values of PV (fixed benefit) and StIPK (pension point price) are freely available. The most important thing remains - to correctly calculate the amount of the IPC .

Here is an example of a calculation when retirement took place immediately upon reaching retirement age.

Let's say it comes in 2021. The points earned will be 75, another 1.8 + 3.6 points are awarded for caring for two children, up to 1½ years old in each case.

∑ = 75 + 1,8 + 3,6 = 80,4

If in 2021 FV = 5334.19 and StIPK = 87.24, then we get the expected pension amount:

SP = 5334.19 + 80.4 x 87.24 = 12,348.28 rubles.

Disability pension

They are prescribed for medical reasons, with specification by disability group, without regard to existing experience, the causes of disability and the moment of its onset.

If there is no experience at all, then a social pension is established. If at least 1 working day is registered, then there are grounds to assign a disability insurance pension. Its size is set individually, based on the length of service available, the amount of contributions to the Pension Fund and earnings.

First of all SP , and based on its value, the pension is calculated. Its value is ultimately determined by the disability group.

Starting from 01/01/2015, the PV was removed from the joint venture, and its value is determined separately:

| From date | % indexing | 1st disability group | Disability group 2 | 3 disability group |

| 01.01.2015 | 7870.00 rub. | 3935.00 rub. | 1967.50 rub. | |

| 01.01.2015 | 11,4% | 8767.18 rub. | RUB 4,383.59 | 2191.80 rub. |

| 01.01.2015 | 4% | 9117.86 rub. | 4558.93 rub. | RUB 2,279.47 |

The size of the financial contribution increases for each disabled dependent supported by a citizen, but no more than three. This increase was:

- from January 1, 2015 - 1311.67 rubles;

- from February 1, 2015 - 1461.20 rubles;

- from February 1, 2021 - 1519.65 rubles;

- from February 1, 2021 by 5.4%.

Survivor's pension

The loss of a family breadwinner entails the assignment of a pension to the disabled dependents whom he supported. Of course, provided that their guilt in the death of their breadwinner has not been established.

The law clearly defines the circle of persons who can apply for a pension. In order for it to be assigned, the deceased breadwinner must have at least a minimum insurance period of at least 1 day.

From 02/01/2018, the fixed payment (FB) in case of loss of a breadwinner is exactly half of the FB of the insurance pension: 4982.9 / 2 = 2667 rubles 95 kopecks. This is the amount per disabled family member.

The assigned pension is paid every month, any delivery method can be chosen.

How to calculate your retirement date

The legislation states that the condition for reaching retirement age is the citizen’s birthday. Therefore, the retirement date is counted from the date of birth of the pension applicant.

Note! To calculate your retirement date, you need to understand what day your retirement age will be.

Based on the above tables of retirement age, compiled taking into account the transition period, you can accurately understand the retirement age by year. Let's give this gradation for men and women, starting from 2020:

- 2020, first half of the year. Men 60.5 years old/women 55.5 years old.

- 2021, second half of the year – 2022, first half of the year. Men 61.5/women 56.5.

- 2024 – men 63/women 58.

- 2026 – men 64/women 59.

- 2028 – 65/60.

Therefore, when calculating your retirement date, consider this simple rule. Additionally, you need to score the required number of points. It rises gradually, 2.4 are added every year, and for 2021 it is 16.7 points.

Military pension, calculation formulas

In 2021, the scheme according to which pensions are calculated for military personnel who have completed their service is as follows:

VP = (OVDZ + NDVL) x 50% +

+ 3% (for service over 20 years, for each year, but not more than 85%) x PC +

+ 2% (in case of non-indexation of DD – every year)

OVDZ - salary of military position and rank.

NDVL – long service bonus.

PC – reduction factor.

DD – monetary allowance.

Employees of the Ministry of Internal Affairs are also entitled to a military pension, for the accrual of which they must serve in the Ministry of Internal Affairs for at least 20 years.

It can be of three types:

- By length of service.

- Due to disability.

- In connection with the loss of a breadwinner (relatives receive it if the breadwinner died or went missing).

There is also a so-called mixed service pension. This is the case when 20 years of service have not been accumulated, but one of the additional circumstances is present:

- At the time of dismissal from the authorities, the total length of service reached 25 years.

- Of all the years of total experience, at least 12½ were in the Ministry of Internal Affairs.

- Upon dismissal, the employee's age was at least 45 years.

- The reason for dismissal was either health status, or regular activities, or reaching the service age limit.

Future military pensioners, knowing thoroughly all the vicissitudes of their service, are able to independently estimate what pension they are entitled to.

To help them, the Pension Calculator program has been created, designed specifically for employees of the Ministry of Internal Affairs. If you provide her with the necessary information, she will calculate the required pension herself. For the convenience of users, it is equipped with various tips.

Funded pension, size, sources and conditions of receipt

The formula for calculating a funded pension ( NP ) is extremely simple:

NP = PN / T

T – number of months until payment.

PN – the amount of funds accumulated in a special personal account.

The MT amount can be generated from the following sources:

- from pension insurance contributions;

- from additional contributions made by the employer in favor of the citizen accumulating a pension;

- from contributions for co-financing of PN ;

- from part of the family or maternal capital;

- from investment results from any of the sources.

NP funds can be received all at once, as a lump sum payment, or received gradually, in the form of an urgent pension payment, after reaching the required age.

How to check the amount of pension savings?

This is easy to do for an insurance pension.

Each pensioner has a personal SNILS - Insurance Number of an Individual Personal Account in the Pension Fund of the Russian Federation. With its help, you can find out the contents of your personal pension account, not only by visiting a Pension Fund branch, but also online via the Internet.

Moreover, you need to come to the department with a passport, and on the EPGU (unified portal of public services) you only need to enter your SNILS number.

So:

- We go to the website gosuslugi.ru.

- We select the necessary one from the catalogue.

- We request an extended account statement, to do this we enter its number.

After waiting a few minutes at the screen, we receive a letter with the amount of interest. If a user’s personal account has been created, then you can print out the information received.

If you want to get acquainted with the state of your funded pension, being a client of a non-state pension fund, then the Pension Fund is not your assistant; it does not have the necessary information.

The NPF has it, and to obtain it you will have to go to its website.

Pension calculator Online

Important! Before you start calculating your future pension, please read the following information carefully:

- The results of pension calculations are purely conditional and are intended only to familiarize yourself with the amount of your future pension. For a more accurate calculation, we recommend contacting the pension fund.

- All calculation data: coefficients, point value, fixed payment amount, which are used in the calculator, are given as of January 1, 2021 . This means that for the entire period of work experience that you indicate in the calculations, the values of the coefficients, fixed payments, your salary, etc. will apply. taking into account 2021 indexation.

- The calculator will be more useful to those users who are just starting their work experience.

- When calculating, it is conditionally assumed that in 2021 you have the right to receive a pension with the data you entered.

- If you need to pre-calculate the GIPC, you can do so on this page.

Amount of insurance pension (SP)*

: Your work experience is less than 9 years The number of accumulated PCs is less than 13.8 Your work experience is less than 9 years and the number of pension savings PC is less than 13.8: You are entitled to a minimum pension: 8703 rubles

Number of individual pension coefficients (PC)

:

Clear and recalculate

* Your pension calculations are approximate. To obtain more accurate results, we recommend contacting the Pension Fund of the Russian Federation. When calculating the conditional amount of the insurance pension, the following indicators for 2021 are used: Fixed payment - 5,334 rubles; The cost of 1 pension coefficient is 87.24 rubles;

The maximum salary before personal income tax, subject to insurance contributions, is 85,083 rubles per month.

Examples of calculations for those retiring in 2021

Victoria Sergeevna is retiring in April of this year at the age of 65. Until 2021, the woman had created pension savings, thanks to which she could receive a pension of 9,000 rubles.

She also has two children, and she spent 1 year on leave for each of them. For the last 2 years, Victoria Sergeevna has been caring for her father at the age of 84.

At the moment she receives a salary of 25,000 rubles.

- Moscow Moscow region:

- St. Petersburg and Leningrad Region:

- All-Russian:

To calculate the insurance pension, you need to know the amount of IPC = SCH (the insurance part of the labor pension as of January 31, 2014) / C (the cost of one point).

In this case, her IPC = (9000-5334.19)/87.24 = 42 points.

Now you need to find out how many pension points a woman will receive for 2021: (0.22 (22% - the rate of insurance contribution when calculating an insurance pension) × 4 (the serial number of the month of retirement in 2021) × 25000/212360 (the maximum possible annual contribution in 2021))x10=1.04 points.

For leave to care for the first and second child, included in the non-insurance period, she receives 1.8 and 3.6 points, respectively.

For caring for a citizen over 80 years of age, she receives 1.8 points for each year. In this case, 2 years.

The sum of all pension coefficients of Victoria Sergeevna = 42 + 1.04 + 1.8 + 3.6 + 1.8 + 1.8 = 52.04.

Since a woman retires 9 years later than the established period, she is entitled to bonus coefficients for a fixed payment and for an insurance pension of 2.11 and 2.32, respectively.

Attention! If you have any questions, you can consult with a lawyer for free by phone in Moscow, St. Petersburg, and all over Russia. Calls are accepted 24 hours a day. Call and solve your problem right now. It's fast and convenient!

The size of the insurance pension is calculated according to the following formula: SP = FV (fixed payment) × K (premium coefficient) + PC (sum of all annual IPC) × S × K.

According to the formula, the insurance pension will be: 5334.19 × 2.11 + 52.04 × 87.24 × 2.32 =

21787.87 rubles .

Boris Ivanovich decided to retire in April 2021 at the age of 63. The man worked in the village for 35 years and subsequently remained to live there. In his youth, he served in the army.

At the end of 2021, he already had savings that allowed him to receive a monthly pension in the amount of 14,000 rubles.

At the moment, the man receives an official salary of 40,000 rubles.

To calculate the insurance pension, you need to know the amount of IPC = SCH (insurance pension as of January 31, 2014) / C (the cost of one point). In this case, his IPC = (14000-5334.19)/87.24 = 99.33 points.

Now you need to find out how many pension points a man will receive for 2021: (0.22 (22% - the insurance premium rate when calculating only the insurance pension) × 4 (the serial number of the month of retirement in 2021) × 40000/212360 (the maximum possible annual contribution in 2021)) x 10 = 1.66 points.

Also, for military service in the army, which is included in the non-insurance period, he is entitled to another 1.8 points.

Sum of all pension coefficients for a man = 99.33+1.66+1.8 = 102.79

Let us recall that Boris Ivanovich worked in the countryside for more than 30 years and remained to live there, so he is entitled to a 25% bonus to the fixed payment, that is, its value will be equal to: 5334.19 x 1.25 = 6667.73 rubles.

It is worth noting that a man retires 2 years later than the established period, so he is entitled to bonus coefficients for a fixed payment and for an insurance pension - 1.19 and 1.24, respectively.

The size of the insurance pension is calculated using the following formula: SP = FV (fixed payment) ×K (premium coefficient) + PC (sum of all annual IPC) ×S×K.

According to the formula, the insurance pension will be: 6667.73 × 1.19 + 102.79 × 87.24 × 1.24 = 19054.17 rubles .

Calculating your pension using the pension fund calculator

The change was the increase in the retirement period. By 2024, this level is planned to be increased to 15 years. At the same time, its increase will occur gradually, per year - in 2015 it will take six years, in 2021 already 10.

If a citizen does not have enough length of service, he will still be able to retire, but five years later than the period established by law.

Therefore, those who want to understand how the old-age pension is calculated in 2021 need to know what age limit is set in a particular year.

Attention! If you have any questions, you can consult with a lawyer for free by phone in Moscow, St. Petersburg, and all over Russia. Calls are accepted 24 hours a day. Call and solve your problem right now. It's fast and convenient!

Such a system will definitely suit citizens who want to increase their work experience and plan to work after reaching retirement age, however, it raises a large number of questions among current pensioners, as well as among those who have the right to use preferential length of service, for example, if a citizen is a teacher or health worker or an employee of the Ministry of Internal Affairs. The main questions are how the funds will be distributed between the funded and insurance parts of the pension and how to calculate a preferential pension, for example, for disability? As far as is known, the state takes responsibility only for the second part. That is, the citizen is faced with a contradiction: will the funded part or is it better to completely rely on the state? Considering that the required length of service has increased, relying on the state is quite risky.

This system has also been severely criticized by experts because the labor pension will be calculated in points. Experts express the opinion that older people, who are much more comfortable with fixed payments, simply will not be able to understand how to calculate their future pension .

Procedure for calculating pensions Online

How to calculate your pension in 2021? The insurance pension is calculated using the same formula as in previous years:

SP = FV * K + PC * S * K

The formula for calculating pensions in 2021 includes the following:

- SP is the amount of pension for a specific year.

- PV is a fixed part of the pension.

- The bonus K coefficient depends mainly on the retirement age. For example, if a citizen retired 3 years later than the established period, then the coefficient takes the value 1.19.

The second part of the formula consists of the following indicators:

- PC – the sum of the citizen’s annual individual pension coefficients.

- C reflects the value of one pension point for the year for which the calculation is being made.

- K – premium coefficient.

In some cases, the pension may be calculated differently. For example, in order to calculate a military man's pension , you need to know his military rank - this is important for determining the military pension salary.

Calculation example for pensioners retiring in 2019

Anna Andreevna turns 55 in February 2021, but she has not been working since the beginning of January.

Using online calculators, the woman calculated that the amount of her IPC during her work was 75 , an additional 1.8 was accrued to her for the birth and care of a child.

She does not have any special (harmful, northern or rural) experience; she lives in the Oryol region, so she will not be assigned a regional coefficient.

The calculation of the pension amount in 2021 will look like this:

(75+1.8)*87.24 + 5334.19 =

12034.22 rubles .

More accurate calculations can only be made by Pension Fund employees who have the pensioner’s personal pension file.