Who is considered a working pensioner?

— The current legislation does not provide a definition of the concept of “employee”. At the same time, according to Article 11 of the Law of Ukraine “On Compulsory State Pension Insurance”, individual entrepreneurs, including those who have chosen a special method of taxation (single tax, fixed agricultural tax), are insured persons.

In accordance with Part 3 of Article 3 of the Law of Ukraine “On Employment,” employment of the population is ensured by establishing relations regulated by employment agreements (contracts), carrying out business and other types of activities not prohibited by law.

When is a pensioner considered to be working?

I have been retired for a year and a half now. During this period I did not work. I accidentally found out that I am still considered a working pensioner and cannot apply for indexation. I started to find out why. It turns out that I had previously published two articles (I write scientific articles). Apparently, the editor officially formalized deductions to the Pension Fund of the Russian Federation from the fee due to me. How legal is all this?

There is no violation of the law here. Since the beginning of 2021, pension legislation has been amended. Now everyone who works and (or) performs other paid activities (the employer makes accruals and pays insurance premiums) and at the same time receives a pension is assessed from the point of view of the law as “working pensioners”.

Disabled citizens - who are they? Payments to this category of population

- An application from a disabled person giving consent to care for him. If a person is declared incompetent, then the application is submitted by a legal representative. The document must be accompanied by a document confirming guardianship.

- Statement from the person who will be caring for or is caring for.

- A certificate confirming that the pension has not been assigned. She is taken to the Pension Fund of the Russian Federation at her place of stay.

- A certificate confirming that no unemployment benefits are being received.

- Extract from the certificate of examination of a disabled citizen.

- A conclusion that confirms that a person needs constant care.

- Passport.

- Work record book of the caregiver.

- Certificate of full-time training of the person providing care.

This is interesting: How to Pass Re-examination of 3 Disability Groups in Absentia

The legislation stipulates who and until what time must provide care for a non-working citizen. Thus, children must be looked after by parents or a parent or guardian until they reach adulthood. If the child goes to study abroad, then the status of a disabled person is extended until the age of 23.

Who is considered a parasite and who

If you raised a child under 7 years of age for 1 month, worked under a contract for 1 month, were at military training for 1 month, worked as a lawyer for 1 month, served 1 month in prison, after that 1 month were temporarily incapacitated - and in total this is more 183 days, then you are no longer considered a parasite.

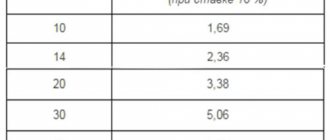

According to the Decree, tax authorities will search, track and collect money from parasites. The tax office will check the expenses and incomes of citizens and look for the unemployed. By the way, if you admit to the tax office that you are a parasite before July 1, 2021, they will give you a 10% tax discount.

Pensions of working pensioners

From 2021, all pensioners who stopped working will have their pensions indexed from the 1st month after dismissal , however, pensioners will be able to receive the full amount as before - only 3 months after dismissal, but they will be compensated in full.

This is interesting: Will of a House for Two in Material

The increase in the size of the insurance pension occurs due to the number of pension points earned from insurance contributions made in the previous year, if they were not taken into account in pension accruals and recalculations earlier (Article 18 of the Law “On Insurance Pensions”

).

New rules for indexing pensions

The time frame for restoring a new size remains the same, 3 months after dismissal. But already taking into account the surcharge. Thus, they will also pay additional payment from the date of dismissal for these 3 months. Let us remind you that previously such an increase was not paid for the past time. We recommend that you familiarize yourself with these rules in more detail using the examples in the video.

If a pensioner, for example, resigns in September 2021, then he will be considered unemployed for a full month only from October (1st month after termination of work). Accordingly, in November (the 2nd month after termination of work), the Pension Fund of the Russian Federation will not receive information about his work for October (information on the SZV-M form is submitted only for working pensioners).

Regional privileges

At the level of individual districts, municipal authorities can establish their own types of benefits for the population. This allows us to maintain a decent standard of living for citizens in each region.

In the Moscow region, the following additional benefits are provided for working pensioners:

- Exemption from payment for garbage removal;

- Reduced prices for utility bills;

- Partial compensation of funds spent on landline telephone payments.

Toll exemption is regulated by district authorities.

Decision-making by municipal authorities depends on the amount of available funds in the city budget. In some districts, in addition to ground public transport, discounted travel is also provided in the metro.

The main document that exempts elderly people from paying travel fees is a pensioner’s certificate.

As an example, in the capital and St. Petersburg, city authorities suspended preferential travel on certain types of transport. To clarify the full list of types of transport that can be used by free working pensioners in a particular district, contact your local legislative authorities.

Certain categories of pensioners can receive a fifty percent discount on electricity for water supply.

The discount does not apply specifically to working pensioners, but it can be received by veterans of labor activity, certain groups of incapacitated citizens, and liquidators of the Chernobyl nuclear power plant.

The size of pensions for working pensioners in 2021

It is important to know that in the event of dismissal of a working citizen receiving a pension, when recalculating his final payment amount, it will be indexed in accordance with the current percentages. Therefore, in this case, the person will receive it in the same amount as other non-working pensioners. However, the recalculation will also take into account those years that he worked additionally.

- work experience accumulated over the entire period of work as a citizen, including periods that are equivalent to work experience;

- the amount of deductions made monthly by the employer or the citizen himself;

- the individual coefficient of a pensioner, which depends on many factors, including the number of years he worked while receiving a well-deserved pension.

Tax benefits

Citizens of retirement age have quite important tax benefits - both at the federal and regional levels

. Moreover, such benefits do not depend on the fact of employment - that is, both working and non-working pensioners (and even pre-retirees) apply for them.

The first benefit concerns property tax for individuals

. Pensioners may not pay tax on one property in each category - regardless of the area and other parameters of the property. In other words, if a pensioner owns an apartment, a house and a garage, he will not pay property taxes at all. But if the property has two apartments, then the pensioner can choose not to pay tax for one apartment.

Previously, this benefit was assigned on an application basis (that is, you had to submit an application to the Federal Tax Service, where you could select an object of taxation for which the pensioner does not want to pay tax. Now the benefit is assigned automatically

, and if there are two objects in the property, then the pensioner will be exempt from tax on the more expensive of them (and on the second one will be entitled to a standard benefit of 10, 20 or 50 square meters). True, it is still better to double-check whether the benefit has been applied - this can be done on the Federal Tax Service website by logging in through State Services.

Tax relief is available to all women aged 55 years and older, men aged 60 years and older

, as well as to all pension recipients and those who would have already received the right to a pension under the law as of December 31, 2021 (that is, before the latest reform).

But property taxes are not the only ones where retirees have benefits. The Tax Code also guarantees them the following benefits:

- for land tax - a deduction in the amount of the cadastral value of 600 square meters of land. In other words, if the plot is less than 6 acres, the pensioner (and pre-retirement) will not be able to pay tax on it at all, and if it is larger, then the tax will have to be paid for the area in excess of 6 acres;

- for personal income tax - working pensioners have a special right regarding property deduction; they can receive a personal income tax deduction not only from the year in which they received the right to it (bought a home or paid interest on a mortgage), but also for the previous 3 years. True, the 3-year rule applies if the taxpayer has already been a pensioner for all these 3 years. If he retired a year ago, then this right applies only to this year. This right formally also applies to non-working pensioners, but in fact they do not pay personal income tax, so they have nothing to return the tax from;

- on state duty - pensioners may not pay state duty when going to court if the case concerns property claims in the amount of up to 1 million rubles;

- for transport tax – regions have the right to establish their own benefits, including for pensioners. For example, in Moscow, representatives of other preferential categories (many of whom are pensioners) are exempt from tax, and in St. Petersburg - all pensioners, but only for one car with an engine capacity of up to 150 hp.

All tax benefits apply to those who have already retired, and those who would have retired under the previously applied rules, and those who are already 55/60 years old or older.

Now the Pension Fund can deprive even a non-working pensioner of indexation

Such a citizen, who represents the sole executive body of a legal entity, the manager, performs labor functions (regardless of the existence of an employment contract). Even if the organization exists purely formally and there is no entrepreneurial activity, information about the head is transferred to the Pension Fund. And the employees of the latter body consider such a person to be working.

This is interesting: How to Find out the Owner of a House by Address for Free

It does not matter whether there is an employment contract or not, whether the chairman receives money for his activities or not. In fact, such a person works, and as a result, he does not have the right to index pension benefits from the Pension Fund.

Mortgage loan for pensioners in all its nuances and bank offers in 2021

Many people are interested in the question of whether it is possible to obtain or issue a mortgage without interest. In fact, interest-free loans do not exist. Even if the bank announces that the interest on the loan is 0%, there are various fees that the client must pay and which affect the cost of this loan product. A special point is the reverse mortgage, about it at the end of the post.

Some special features are provided for military pensioners, i.e. for those citizens who were considered military personnel. A special savings and mortgage system was developed for them. Participants in this system can apply for and receive a mortgage loan under more favorable lending conditions. Moreover, according to the terms of this system, military pensioners receive a certain amount each month from the state budget, which is used to repay the mortgage loan.

We recommend reading: Benefits for pensioners and honorary donors of Russia in the Sverdlovsk region

Who is considered a working pensioner?

However, a public organization should not submit reports to the UPFR, since it does not have employees or persons with whom civil contracts have been concluded, the subject of which is the performance of work, the provision of services, for which remuneration is charged insurance premiums, for which insurance premiums are paid.

From April 2021, in accordance with clause 2.2 of Article 11 of the Federal Law “On individual (personalized) accounting in the compulsory pension insurance system,” each insurer organization monthly submits information about each insured person working for it (report in the SZV-M form). This also applies to persons who have entered into civil contracts, the subject of which is the performance of work, the provision of services, for the remuneration for which insurance premiums are charged, for which insurance premiums are paid.

The difference between the pensions of a working and non-working pensioner

Indeed, the state does not make any distinction between working and non-working pensioners - for them everyone is equal. But a working pensioner cannot count on an increase in his pension payments this year. For many, this is quite a big problem, but for others, this is absolutely nothing to worry about, because they receive a quite decent salary, and a pension for them is just a pleasant bonus.

It is believed that working pensioners receive additional financial support that non-working citizens do not have. In this regard, pensioners can begin to receive increased payments only after retirement. What's new with pensions for working pensioners: the latest news for today The restriction that applies to the indexation of pensions for working pensioners is also valid in 2021.

How to recalculate a pension for a non-working pensioner in 2021

An increase in pension payments after 80 years of age is made without a request. Today, every Russian pensioner receives a pension payment in the amount of 4,805 rubles. In the case of those who are 80 years of age or older, they receive double the amount. However, only those who receive an insurance pension have this right.

Today, the pension payment consists of several parts, namely a fixed one and two independent ones. The latter types include insurance and savings. Note that the insurance pension is the most common in the Russian Federation and is guaranteed by the state. Citizens receive it in the following cases:

We recommend reading: Extract from the apartment passport office

Payment of insurance pensions to working pensioners

If a pensioner stopped working between October 1, 2021 and March 31, 2021, he can notify the Pension Fund about this. To do this, the pensioner must submit an application to the Pension Fund and provide the relevant documents. This can be done until May 31, 2021.

This is interesting: From what time can a Pensioner of the Ministry of Internal Affairs take advantage of the benefits of a Veteran of Labor?

After termination of employment, the pensioner does not need to submit an application to the Pension Fund. The fact is that from the second quarter of 2021, monthly simplified reporting has been introduced for employers, and the fact of the pensioner’s work will be determined automatically by the Pension Fund.

How to determine whether a pensioner is working or not working

If a pensioner belongs to the category of the self-employed population, that is, is registered with the Pension Fund as an individual entrepreneur, notary, lawyer, etc., such a pensioner will be considered working if he is registered with the Pension Fund as of December 31, 2021.

Thus, the upcoming indexation of insurance pensions in February 2021 will apply only to pensioners who were not working as of September 30, 2021.

To work in retirement or not

However, in this case, the working pensioner will not be affected by the annual indexation of the fixed payment and the cost of the IPC, since from January 1, 2021, the increase in pensions was canceled (in accordance with Article 26.1 of the Law “On Insurance Pensions”). But the state promises to take into account all amounts of indexation after termination of employment.

After reaching retirement age, a citizen can leave his job at his own request in connection with retirement. According to the Labor Code of the Russian Federation, in accordance with Article 80, an application for dismissal on the employee’s own initiative in connection with retirement may serve to terminate the employment contract within the period specified in it.

Indexation of pensions for working pensioners, what benefits are provided

- Small pension payments, which are not enough to maintain a comfortable standard of living.

- The retirement age in Russia is not high, so citizens are still able to continue working.

- Reluctance to lose position.

- Having free time that you want to fill with interesting activities.

To resume receiving an insurance pension, taking into account indexation, a citizen submits an application about the fact of termination of work. In most cases, a copy of the work record is attached to the application, from which it follows that the citizen has stopped working. You can submit an application after the relevant federal law comes into force, i.e. from January 1, 2021. Applications are accepted by all territorial bodies of the Pension Fund and MFC, which accept applications for the assignment and delivery of pensions. The application can be submitted in person or through a representative, or sent by mail.

16 Mar 2021 uristlaw 316

Share this post

- Related Posts

- Seizure of a Car by Bailiffs Without the Presence of the Owner

- Selling nasvay punishment

- How It Used To Be Spelled Gorono Or Gorono

- Car Loan at Another Bank Bailiffs Trying to Describe the Car

Working age limits will be reduced

All of the above applies to able-bodied people, that is, people who are physically and mentally healthy enough to work. Unfortunately, in every society there is a significant layer of people who are not healthy enough for this. Those. c people are disabled, although they are of working age. Such people receive the status of disabled people of the first or second group, which gives them the right to receive a pension regardless of age. The number and proportion of disabled people among the country's population is influenced by a set of conditions on which health depends. The environmental situation, level of material well-being (quality of nutrition, expenditure of vital energy at work), accessibility and quality of medical care, safety of working conditions, etc. are of great importance. You don’t need to be an expert to note a significant deterioration in all these conditions for the vast majority of the population of Ukraine in the last decade. Accordingly, the number of disability pensioners increased from 1,352 thousand people at the beginning of 1986 to 1,978 thousand people at the beginning of 1999. Those. by 46% *.

This is interesting: What is a citizen of the Russian Federation entitled to from the State under the Law

c) 16-59 years old - for men (inclusive). The working-age population is the bulk of the labor force of working age, possessing the necessary psychophysical development, knowledge and practical experience, which is able to fully participate in physical and intellectual labor. In world statistics, the working age population is considered to be between 15 and 64 years of age, and according to the UN, it accounts for about 3/5 of the total world population. Currently, the issue of increasing the working life is being considered, but in modern conditions the average life expectancy for men is 64 years, and for women - 74 years (The average life expectancy in the world is approximately 65 years). In industrialized countries it is 76 years, while in developing countries it averages 62 years, and in the least developed areas of the earth it is only 50 years.