Co-financing of pensions in 2021: latest news

Having studied the news, it becomes clear that the government has decided to divide the funded pension part. These are funds that are included in co-financing operations. You cannot receive the full amount. The amount will be divided and paid within ten days or for life.

The latest news is that co-financing as a procedure has been adopted on a mandatory basis. During the process of employment, the amount of money to pay contributions is automatically withdrawn from your salary. This is a beneficial scheme because as a result the person is guaranteed pension transfers in the future.

Inheritance by PGS

Legal successors can be:

- Citizens indicated in the application that the ASG participant submits to the Pension Fund. The completed application also indicates the percentage of cash savings between the heirs.

- In the absence of an application for payments under the funded part, the following can be counted: a child; spouse; parents of the deceased; brothers, sisters; grandparents; grandchildren.

It is important to know! Pension of employees of the Ministry of Internal Affairs: conditions, calculation, news

Rules of inheritance under ASG:

- Heirs must contact the Pension Fund or Non-State Pension Fund before the expiration of 6 months from the date of death of a particular person. If the deadlines are violated, payment is made through the court.

- Payment is made in the following cases: before the payment is made from the pension; before the pension is recalculated taking into account the PGS; after registration of an urgent pension payment for 10 years; before the first payment for co-financing.

- When an ASG is formed on an indefinite basis (18 years), the remaining funds are not returned to the heirs.

- During the inheritance procedure, it is necessary to submit to the Pension Fund a number of papers specified in Government Decree No. 710711 of July 30, 2014.

- Refunds under the ASG are carried out until the 20th day of the month that follows the month the decision was made to pay the heir the capital under the program.

- The final decision on payments to heirs is made 7 months after the death of the ASG participant. The Pension Fund inspector sends a copy of the decision on payment (or refusal) by mail within 5 business days after the decision is made.

The essence and principle of operation of the program

The main goal of co-financing is to encourage citizens to think carefully about their own old age and pension. This program began in 2008. A person can take part. It does not matter here whether he received an official labor pension or not.

All that was required of the person was to make the required deductions on time. Moreover, they could be small. The main condition is to pay the amount of 2000 rubles for the year. And this procedure had to be carried out for 10 days.

After the allotted time had passed, the authorities paid the person an identical payment. This is the amount contributed for the entire period of participation in the program. The amount for the year was 12 thousand. It was allowed to skip years. But the size of the deduction cannot grow indefinitely; it does not exceed 48 thousand.

Participants

The following can take part in the ASG:

- Persons registered in the compulsory pension insurance system (OPS for short).

- For those citizens who receive “black” wages.

- People with average wages.

- Children and teenagers from 14 years of age and older.

- Citizens born in 1966 and older.

- Working pensioners who have not made pension contributions - this category can increase invested funds by 4 times. For example, when transferring 12 thousand rubles per year, the state is obliged to increase savings by 48 thousand.

It is important to know! Pension system of residents of Belarus

Who can become a participant?

Individuals who can participate in the program can be divided into three groups:

- Citizens who wanted to increase future payments.

- Employers who decide to increase employee benefits in the future.

- The public authorities that act as the financier of pension contributions.

- To become an official participant in the program, you will need to submit an application to participate in the program. Then you need to make a minimum transfer to the program.

If these two conditions are met, you can apply for a beneficial old age support scheme. This is the answer to the question of what pension co-financing is – how pensioners can get money.

What is needed for this?

If you need to become a full-fledged participant in the scheme on the basis of a double increase in contributions, a person must submit a corresponding application before 2014. If a citizen submitted a request, but did not transfer the required amounts, the additional payment will not be received. The main conditions for inclusion in the program are the following actions:

- preparing an application;

- sending a request to the Pension Fund at the place of registration;

- opening a personal pension account.

After this, you need to wait for a notification from the fund, which will arrive within 10 days.

What happened to the co-financing program then?

Then 2014 came and the program began to be phased out. The first signs that all was not well with the Russian economy loomed back in 2013, when, despite an apparently prosperous situation, economic growth practically stopped. In 2014, there was a fall in oil prices and a collapse in the ruble exchange rate, there were sanctions over Crimea, and the country’s economy was saved only by accumulated reserves.

The government began to actively look for ways to save money, and many of the good initiatives of previous years were actually neutralized. One of the first to suffer was the pension co-financing program.

The program did not stop completely, but a deadline was set for working citizens to join the program - December 31, 2014.

After this date, it is impossible to join the co-financing program. Those who managed to submit the appropriate applications are still using the program, but every year there are fewer such people for several reasons.

Firstly, some people waited until retirement, reached it and are enjoying the benefits of co-financing.

Secondly, those who forgot to submit an application for participation in the program next year on time (and a person must confirm their desire to make voluntary contributions every year) or were unable to complete contributions dropped out of the program.

Finally, from 2021, the rule in the program will begin to work in practice - the state will co-finance a citizen’s pension for ten years after his entry into the program. That is, those who were the first to take advantage of the opportunity to participate in co-financing pensions in October 2008 will very soon not be able to continue participating.

Payment amount

An advantage of this well-thought-out program is the option to double the required insurance premiums. To receive a preference, it is not enough to enter the program and make a contribution in a timely manner. The following rules must be followed:

- Every year you need to deposit 2000 rubles. If the amount of transfers is less, the pension will not be increased.

- If funds arrive in the required amount, the amount will increase to 12 thousand.

- If the transfer amount is larger, the person will still receive the minimum.

- The state is able to pay transfers in the amount of up to 48 thousand.

At the same time, under the pension co-financing program, you do not need to count your own contributions.

State pension co-financing program

At the moment, the program is actively operating for persons who entered into it with a corresponding application from the Russian Pension Fund before the beginning of 2015 and who then made the first transfer of contributions, the amount of which is at least 2,000 rubles per year.

The program is considered one of the types of funded pension formation (which also works for government employees: details here). It allows not only citizens to take care of their future, but also employers and the state to take part, subject to certain conditions, providing reduced taxation.

Law on pension co-financing in 2018

The law on co-financing pensions has existed since the beginning of 2008. Most people have managed to study and understand it. The bottom line is that citizens can independently replenish the pension fund and increase their own pension savings. Military pensioners were not initially included in the category of recipients of payments under this program. After all, pension payments were accrued not by the Pension Fund, but by law enforcement agencies. But in accordance with the recently adopted presidential decree, additional amendments were made to the bill. This means that now military pensioners are also included in the category of citizens applying for a one-time payment. This does not include residents who live abroad. They will not be paid.

Is it possible to join the pension co-financing program in 2018?

Initially, the final period for participation in a state company was until the beginning of 2015. In other words, you could register until December 31st. But today, such a system is being extended by the Russian government and covers the entire year 2018.

The process of co-financing a pension in 2021 for working pensioners has not changed at all. In other words, if the total amount of accruals is from 2,000 to 12,000 rubles per year, the state will automatically increase this amount. If the total number of contributions for one year is less than 2,000 rubles per year, such a contribution is not taken into account.

Persons who have accounts accumulating an insurance pension have an additional right. If this person has not applied to one of the pension funds for subsequent accrual of payments, then contributions in accordance with the co-financing program will be increased by at least 4 times. Residents of the Russian Federation can make payments for 10 years. During this time, the amount will be increased annually by the government.

Pension co-financing program in 2021: how to get money

Don’t know how to get money from the pension co-financing program in 2021? Funds in accordance with it can be received after applying as an early pension and lump sum payment. Since the beginning of 2015, the procedure for receiving pension payments has been changed. Insured persons who received a lump sum payment can apply for this again no earlier than 5 years from the date of applying to the Pension Fund. The countdown of this period begins from the moment the insured person contacts the relevant company.

Sample application for co-financing a pension through an employer

To obtain the right to state co-financing of pensions, you must draw up an appropriate application. It can be transferred either personally when contacting the local authority of the Pension Fund at the place of registration, or transferred through your employer, who has an agreement with this company. In addition, you can also submit an application for admission to the Program through the Internet resource.

Have you decided to submit your application in person at your place of residence? First, you need to find out the date and time during which applications from citizens are accepted. In addition, the following documents should be attached:

- A copy of your ID or passport;

- Certificate of pension insurance.

Sample application

Frequency of contributions

Official participants of financial support are provided with three options for making contributions. It is allowed to carry out such operations:

- equal transfers throughout the year. This may be a monthly transfer;

- one-time deductions not fixed amounts;

- one-time payment.

In the process of filling out the receipt, you are required to enter SNILS data. The number should be entered in the appropriate box. At the end of each year, you need to calculate the transferred contributions to make sure that at least the required 2,000 rubles were paid. This is an indisputable requirement, without which the size of the ADV will not be doubled.

How to receive the money?

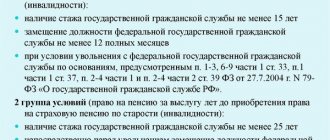

To receive the required cash payments for the insurance pension, you must meet certain conditions:

- It is not allowed to withdraw money at any time. The reason is that they are considered the basis for calculating pension payments.

- Receiving funds directly depends on the person’s age.

Despite the adoption of a law increasing the retirement age, it does not apply to the described program. To use the funds, you must reach the previously established retirement age - 55 for women and 60 for men.

Until what year is the pension co-financing program valid?

For those who managed to enroll in the program, support from the state will be valid without a deadline. However, according to the law, such a period is 10 years. Transfers begin after payment of cash contributions and savings. Due to the fact that the launch period lasted more than one year, it ends at different times.

Persons who managed to deposit funds in 2008 have already received all the required amounts of financing. Those who made the required investments at the beginning of 2015 will receive support until 2025 without changes in the main savings part.