The pension provision of ordinary citizens and military personnel has considerable differences, determined by law, and therefore the calculation of the expected pension amount will differ. Military service is associated with a large number of risks and injuries, and this has a certain impact on the pension security of these citizens. [vote2x id=”4458" align=”center”]

However, the reforms that have taken place in the field of pension legislation have introduced amendments to the formation of pensions, as a result of which the conditions for receiving them and the amounts have changed. The calculation involves establishing the size of the pension by combining the required values and substituting them into formulas specially created for this purpose. Let's look at what calculations need to be made taking into account the new pension legislation.

Necessary data for calculating a military pension

The pension is assigned at the end of service. If such a person later finds a job in civilian life, he has the right to another pension.

The basis of the calculation using the calculator or not is the basic value, which includes the result of summing up salaries by rank and position. The basic basis also includes increases in length of service.

What factors determine the amount of the pension benefit (taken into account using the calculator):

- salary value by rank;

- salary value for the position;

- amount of bonus for length of service;

- length of military service.

If, according to the last point, more years of service are established (than required), for each “extra” year an additional 3% is added to the base part (for mixed length of service - 1%).

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Also, the calculations made by the calculator involve a reduction factor, which is periodically indexed (increased).

Allowances

It is standard practice to include allowances in calculations. Among the standard allowances, it should be noted: EDV, intended for combat veterans, as well as “northern payments” (explained by the need to endure the unfavorable climate at the place of service).

You should also pay attention to the following legal provisions:

- The addition of amounts to the long-service pension is regulated by Art. 16 and 17 of Law No. 4468-1;

- the addition of amounts to the disability pension is enshrined here in Art. 24;

- adding amounts to the survivor's pension - in Art. 38.

The qualification category of the military airborne forces from the flight personnel also makes it possible to assign an increase.

Disabled members of the family of a deceased serviceman under Art. 38 of Law No. 4468-1 has the right to claim certain supplements to the survivor's benefit.

Scroll:

- if the recipient has a disability 1 gr. or over 80 years of age - plus 100% of the RRP;

- if these are disabled children and disabled children of 1st and 2nd grade, who have lost one or both parents - plus 32% of the RRP;

- if spouses, father or mother lost two breadwinners - plus 200% of the RRP;

- if children are studying full-time - plus 200% of the RRP;

- if these are disabled children of 1st and 2nd grade who have lost their parents - plus 200% of the RRP.

In some situations, when several grounds are found at once, only one can be used to increase the military pension.

Holds

The resulting amount varies due to deductions. They are not involved in the initial calculations. Only after you have made the calculation using the calculator and assigned a pension, can you withhold part of it by court decision. This is initiated by the plaintiff in accordance with his claims. They are no different from claims made against civilians. Often the reason for withholding is the need to pay alimony.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

But that's not all. You can collect the required amount in accordance with the debt to various credit institutions and simply legal entities. The deduction will be made by bailiffs, to whom the plaintiff will take the received court decision to begin enforcement proceedings. By law, no more than half of a military pension is subject to withholding.

If the military pension has not been credited to the account

This is why most pensioners depend so much on a pension received on time - after all, it depends on whether utility bills will be paid on time, whether all the necessary medications will be purchased, and, most naturally, whether there will be something to cook for lunch. Available ways to receive a pension:

- Receive money to a bank card.

- Through the post office. It is possible to receive your pension at the post office, or wait for the postman at home and receive the money in person.

The most common method in our country today is, of course, a Sberbank bank card.

This option for receiving a pension does not require standing in line at the post office and gives the recipient much more freedom. It doesn’t matter where you are because the money will come to the card regardless of location. Almost every locality has the necessary ATM. I dated 02.12.93 Where they receive it If a regular type pension is received directly from the regional branch of the Pension Fund of the Russian Federation, then in the case of a military pension things are somewhat different.

To receive the type of payment in question, it will be necessary to submit a corresponding application to the military registration and enlistment office.

You should apply at the place of registration of the serviceman himself.

It is important to remember that when changing location, it is mandatory to register with the military commissariat.

Info If any difficulties or questions arise, a serviceman has the right to contact this institution for clarification.

Its employees will be required to answer all questions posed to military personnel. It must be remembered that in order to obtain a pension of this type, you must have a special monetary certificate.

Important The financial crisis hit the most vulnerable category of citizens of the Russian Federation – pensioners – the hardest.

Payments from the state in the vast majority of cases are the only source of their income, since not everyone is able to get a job or receive any additional income. If the pension does not arrive on time, problems may immediately arise with paying for utilities, purchasing food or medicine.

What to do if your pension is delayed?

Where to go to restore a normal payment schedule and solve financial problems? Our article will answer these questions.

Methods of receiving a pension in Russia Today in our country, pensions are paid in two main ways:

- via Russian Post.

- In the branch of the Pension Fund of the Russian Federation you should find out the following:

- If an application/letter has not been received from the bank, then it must be completed on the spot, indicating the card account details from the certificate.

- Find out if they have your application or a letter from the bank to transfer your pension to the card account issued to you.

- If such an application or letter is available, then submit a more recent Sberbank certificate with details and ask to verify the details.

Salaries by military rank

Salary amounts depend on the military rank assigned to a person. When they increase, the resulting figures must be rounded to zero (upwards). This rule is stated in G.O. No. 225 of 2011.

Salaries by military rank are shown below in tabular form:

| Military ranks | Salaries by military rank until 01/01/2018 | Salaries by military rank from 01/01/2018 | Salaries by military rank from 01.10.2019 | Salaries by military rank from 01.10.2020 |

| Magnification factor | 1,03 | |||

| Private, sailor | 5 000 | 5200 | 5424 | 5 587 |

| Corporal, senior sailor | 5 500 | 5720 | 5966 | 6 145 |

| Junior sergeant, sergeant major of the second class | 6 000 | 6240 | 6509 | 6 705 |

| Sergeant, petty officer first class | 6 500 | 6760 | 7051 | 7 263 |

| Senior Sergeant, Chief Petty Officer | 7 000 | 7280 | 7594 | 7 822 |

| Petty Officer, Chief Petty Officer | 7 500 | 7800 | 8136 | 8 381 |

| Ensign, midshipman | 8 000 | 8320 | 8678 | 8 939 |

| Senior warrant officer, senior midshipman | 8 500 | 8840 | 9221 | 9 498 |

| Ensign | 9 500 | 9880 | 10305 | 10 615 |

| Lieutenant | 10 000 | 10400 | 10848 | 11 174 |

| Senior Lieutenant | 10 500 | 10920 | 11390 | 11 732 |

| Captain, Lieutenant Commander | 11 000 | 11440 | 11932 | 12 290 |

| Major, captain 3rd rank | 11 500 | 11960 | 12475 | 12 850 |

| Lieutenant Colonel, Captain 2nd Rank | 12 000 | 12480 | 13017 | 13 408 |

| Colonel, captain 1st rank | 13 000 | 13520 | 14102 | 14 526 |

| Major General, Rear Admiral | 20 000 | 20800 | 21695 | 22 346 |

| Lieutenant General, Vice Admiral | 22 000 | 22880 | 23864 | 24 580 |

| Colonel General, Admiral | 25 000 | 26000 | 27119 | 27 933 |

| General of the Army, Admiral of the Fleet | 27 000 | 28080 | 29288 | 30 167 |

| Marshal of the Russian Federation | 30 000 | 31200 | 32542 | 33 519 |

Algorithm for calculating a military personnel pension

You can calculate your military pension yourself, based on the existing formula. An alternative is to use a calculator. Such a calculator is also available on the website of the Russian Ministry of Defense.

Who receives a long-service pension:

- persons whose service period is 20 calendar years or more - the pension is 50% of the salary and for each subsequent year 3% is added (the final figure will not exceed 85%);

- persons whose total length of service is more than 25 years and half of them are during military service are entitled to 50% of the allowance + 1% annually.

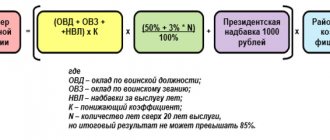

Formula

Calculation of military pensions without a calculator is carried out using the formula: P = BC * PK * (50% + 3% * ST) / 100%.

Values:

- P is the size of the pension;

- BC – base part;

- ST – number of years more than the prescribed norm;

- PC – reduction factor.

Using an online calculator, it is easy to calculate the size of a military pension, taking into account the law. The result of this calculation will be preliminary and the actual amount may vary slightly. The calculation in the calculator gives an approximate idea of the future benefit.

Disability counting

For military citizens who become disabled during service, or within a 3-month period after dismissal, a special calculation procedure is established. It is regulated in paragraph 2 of Federal Law No. 166 of 2001 on state pension provision in Russia.

How much is required when receiving disability due to a military injury:

- Disabled I gr. receives 300% of the calculated benefit amount, which may correspond to the social RP;

- disabled person II gr. receives 250%;

- disabled person III gr. gets 175%.

This takes into account wounds, concussions, injuries or diseases received while defending Russia or defending its interests.

How much is required when receiving disability due to illness:

- Disabled I gr. receives 250%;

- disabled person II gr. receives 200%;

- disabled person III gr. receives 150%.

Injuries received or illness experienced occur during the period of service, but are not directly related to the performance of one’s official duties.

Indexation of basic pension

Indexation of military pensions should be expected only in October 2021. Along with this, there will be a standard increase in salaries. It is believed that the expected increase will go to approximately 2.6 million citizens.

Since an indexation coefficient of 3% was assigned in October 2021, it is still in effect and is taken into account in the calculator. The expected indexation figure is 3.7%. It will also be taken into account in the calculator.

How to calculate the second pension?

For your next pension you will need the following:

- the retirement age for military personnel has been reached;

- the basic pension was approved before this;

- have a civil service record after retirement of 12 years;

- There is a required total of individual points - a minimum of 21.

If at the time of reaching retirement age the required number of points has not been accumulated, the person does not have the right to claim a second pension.

The second pension is calculated using the formula: RP = KIB * SB.

Values:

- RP is the size of the pension;

- KIB - number of points;

- SB - pension point value.

If the user knows the number of points available and the cost of one of them, it will be possible to make a calculation. The information is clarified when visiting the Pension Fund or viewing it in your account on the website. This information is also available in the account on the State Services portal.

Example

For example, a person has accumulated 62 pension coefficients and also has 2 years of military service experience. This was not taken into account when assigning a pension from the Ministry of Defense. This service is allowed to be counted in the “civil” period with the assignment of 3.6 b. Since one point in 2021 is equal to 98.86 rubles, the amount of another pension benefit will be 6485.21 rubles. The calculation is: 98.86 × (62 +3.6).

This amount of money is payable every month until the next indexation date. To make the calculation easier for yourself, you need to use a calculator.

How is the pension payment schedule drawn up?

Since January of this year, a number of pension reforms have been adopted in the Russian Federation, allowing people with disabilities, military personnel and families who have lost their breadwinner, as well as people of retirement age to receive state support at a new level.

The list of possibilities was expanded, which related to payment schedules for pensions of various categories, their documentation, receipt and amount of monetary financing. Starting this year, the amount of government funding will increase by five and a half percent. For the military, four more are added to this percentage.

In general, the amount of payments for an ordinary pensioner will increase by five and a half percent, and for a military pensioner - by nine and a half percent.

The amount of single cash payments (hereinafter referred to as UDV) will also increase by the specified coefficient. In this regard, in February of this year, pensioners received, along with the pension due, a single payment in the amount of 5,000 rubles. The payment schedule itself is a schedule for the “delivery” of mail to the person for whom it is registered.

This can be a person who has reached 55 or 60 years of age, or who has not; depending on the circumstances and under different conditions, persons of different age categories can apply for a pension. However, the payment schedule does not depend on the age of the recipient, but on which organization provides them.

Due to different reasons for obtaining funding, different government organizations are involved in this. So, the following organizations can finance citizens:

- The Ministry of Defense, or any Ministry of Military Affairs in which the current retiree served.

- Pension Fund (hereinafter PF).

The schedule also depends on the method of receiving a pension, which the pensioner himself chooses when submitting an application to the appropriate organization involved in financing it.

You can receive your pension through the following channels:

- State post office.

- Banks (Sberbank).

- Other financial organizations, for registration of which you must contact their branches directly.

The conditions for receiving a pension according to the schedule are complete documentation and a resolution to register the pensioner.

To receive the payments themselves, you only need the signature of the person to whom they are issued, upon receipt itself, if such is done by mail. To calculate payments using banking systems, you must obtain a card from the appropriate bank and contact a consultant at its branch, who will arrange for the receipt of pension funds through their bank.

Want to know how it's done?

Then we recommend following the link and reading our article. And you can find the answer to the question - is it necessary to return money if a pension is overpaid due to the fault of the pension fund? In this case, the money will come to the card and the client’s signature will not be needed every month.

We recommend reading: Which banks issue money to tourists returning from a trip abroad

You can also arrange payments in any other financial company, however, the initial agreement with them lies on the shoulders of the pensioner, and all additional conditions must be discussed directly in the branches of the selected companies at the place of residence.