The State Duma adopted in the second reading the final version of the draft Federal Budget Law, which for many pensioners brings good news about pension increases in 2021.

Increasing pensions from January 1, 2021: who will receive a pension increase next year and by how much?

The approaching 2021 will not be marked only by sad events for everyone (increasing the retirement age and utility bills).

The State Duma adopted in the second reading the final version of the draft Federal Budget Law, which for many pensioners brings good news about an imminent cash increase.

One of its consequences, as is known, was the often pronounced and no less often quoted in the media promise of the authorities to increase pensions by 1,000 rubles in 2019.

What does an increase in pension of 1 thousand rubles mean?

First of all, it should be noted that the amount of 1000 rubles declared by the Government is a conditional value . It is directly applicable only to the average pension in Russia (in 2018 it is 14,414 rubles). But in fact, the size of the increase, if we count it in rubles, will be different for all pensioners (the larger the pension, the greater the increase, but on average in the country it will be 1 thousand).

In fact, we are talking about the same indexation of the insurance (labor) pension that Russian pensioners until 2021 received annually from February 1 - the only difference is in its size. If previously, when determining the size of the increase, the guideline for the Government was last year’s level of actual inflation, but now, thanks to a significant decrease in inflation in the country, it is possible to increase pensions at a higher rate (that is, above the rate of inflation).

As a guideline, starting from 2021, the Government has determined an increase in the average size of pensions in Russia by 1000 rubles (for comparison: in previous years, inflation did not increase by an average of 500 rubles annually, i.e. twice as slow ). Thanks to this, starting from 2021, the income of the average Russian pensioner will increase by 1,000 per month or by 12,000 rubles. in year. The Government expects that with the help of such measures, by 2024 the average pension in Russia will increase from 14 to 20 thousand rubles .

However, it must be added that starting from 2021, not everyone will receive an increase of one thousand - only non-working pensioners . Working citizens, due to indexation being “frozen” from 2021, will not be able to receive an increased amount of payments as long as they continue to work. However, for them, all missed indexations (including in an increased amount from 2019) will be taken into account only after dismissal.

Forecast for the year

According to the budget of the Russian Pension Fund, the rapid pace will continue in subsequent periods. Thus, according to the document for the years 19-21, next year 6.6% will be added to the insurance type of pension provision, and then another 6.3%. These figures are higher than the forecast of inflation processes made by the Ministry of Economic Development (3.8% and 4%, respectively).

Thus, in 2020, revenues will be brought to the level of 16 thousand rubles on average, and after 12 months they will exceed 17,000. However, one should not confuse non-working pensioners with the employed. The latter, due to the moratorium on indexation, will not be able to count on such a generous increase.

However, the latter should not worry about the complete abolition of benefits for working senior citizens. The rumors did not lead to any action. Unfortunately, the current state of affairs will quickly depreciate the income received from the budget for this category of persons. Indexation will be unfrozen only when the citizen completes his employment activities or closes his individual entrepreneur.

One way or another, the reform process has begun and cannot be stopped; revenues are growing, but in order to earn them you need to spend five extra years. Such an exchange is not justified for everyone.

An increase in pension by 1000 rubles - per year or per month?

The fact that the income of pensioners in 2021 will be increased by 1,000 per month or 12,000 rubles per year was first detailed on June 16, 2021 by Deputy Prime Minister for Social Affairs Tatyana Golikova at a meeting of the Russian Tripartite Commission for the Regulation of Social and Labor Relations, in during which the Government's proposed bill on raising the retirement age was discussed.

Unfortunately, this statement turned out to be not entirely clear to the population of the country, and even confused many. The announced scheme was not obvious, and many clarifying questions arose - in particular, did they really mean a monthly increase in pensions by 1000 rubles? from 2021 , what in a year will allow you to increase its size by 12,000 rubles?

Working - nothing again

The situation is worst with pensions for working pensioners - annual indexation is still canceled for them. The only way to get a full pension is to quit your job.

For working pensioners, the pension will be increased only from August 2020 - when the individual pension coefficient will be recalculated according to the contributions of their employers for 2019.

The maximum number of pension points that a working pensioner can additionally receive is 3, and they will “cost” as much as they cost when he started working.

(or in 2021). That is, the pension of working pensioners in 2020 is maximum:

- if working in retirement from 2021 or earlier - 222.81 rubles (3 points for 74.27 rubles);

- if working in retirement from 2021 - 235.74 rubles (3 points for 78.58 rubles);

- if working in retirement from 2021 - 244.47 rubles (3 points for 81.49 rubles);

- if working in retirement from 2021 - 261.72 rubles (3 points for 87.24 rubles).

Therefore, the question - continue to work with a low pension, or quit and receive the full amount - is becoming increasingly relevant.

Details of old-age pension indexation in 2021

The average monthly increase in the old-age insurance pension for non-working pensioners by one thousand rubles annually was taken into account so that by 2024 the size of pensions for this category of citizens would increase to 20 thousand rubles.

At the same time, the average annual old-age insurance pension for non-working pensioners in 2021 will be 15.4 thousand rubles. Social pensions in 2021 will be indexed from April 1 by 2.4%, their average annual amount will be 9 thousand 215 rubles against 9 thousand 52 rubles in 2021.

“All other proposals by Russian President Vladimir Putin to soften the parameters of the draft law on the retirement age were also taken into account when preparing the Pension Fund’s draft budget (they will be formalized as amendments to the second reading),” the Pension Fund added.

Indexation of pensions in 2021 for non-working pensioners

The pension increase in 2021 will be carried out in the form of indexation (that is, by a certain percentage). However, its procedure will be noticeably adjusted. Starting in 2021, pensions will be indexed from January 1 by an amount exceeding the inflation rate in the past year.

In 2021, the Government’s guideline for indexation is to ensure an average increase of 1 thousand rubles. However, this applies only to insurance pensions and only to non-working pensioners!

The Government's preliminary plans for indexation in 2021 are presented in the table

| Increase in insurance pension (cost of one IPC and fixed payment) from 01/01/2019 | 7,05% |

| Indexation of social payments from the Pension Fund of the Russian Federation (funeral benefits, EDV, NSU, etc.) from 02/01/2019 | 3,1% |

| Indexation of the social pension from 04/01/2019, taking into account the increase in the pensioner’s cost of living | 0,4% |

Taking into account the data presented above, the following new values for various pension payments will be established in 2021

| Type of payment | Was in 2021 | Indexation, % | Coming in 2021 |

| Cost of one pension point, rub. | 81,49 | 7,05 | 87,24 |

| Amount of fixed payment to the insurance pension | 4982,90 | 7,05 | 5334,19 |

| Average annual old-age pension, thousand rubles. | 14,4 | +1 thousand rub. | 15,4 |

| Funeral benefit, rub. | 5701,31 | 3,1 | 5878,05 |

Thanks to this increase, in 2021 the size of the insurance pension will be 179% of the pensioner’s subsistence level and 34.3% of the average salary in the country. For comparison: in 2021 these values were 172.7% and 33.8%, respectively.

Increase in contributions starting from the current year

Thanks to adjustments to legislation and the strategy for developing the pension system, there is reason to expect that the income of the unemployed will increase. The profit generated as a result of cost savings after measures to raise the retirement age of Russians will be used to improve the standard of living of insured elderly people. Such measures will contribute to increasing the fortunes of unprotected categories. The mechanism for annual increases is included in the new law. Thus, we can conclude that the increase in the value of subsidies for the elderly will outpace the inflation rate.

Important! Working senior citizens should remember that indexing of their income from the Pension Fund is not provided. So, while a person is working, he cannot hope for an increase in pension benefits. The process is suspended until recipients finish working and become unemployed.

Previously, the increase was carried out in two stages. The first - from 01.02 adjustment according to the level of inflation), the second - from 01.04 (increase based on the capabilities of the Pension Fund). However, last year the procedure was carried out immediately (January 1). For this purpose, preliminary information about price increases was taken into account. This experience was considered successful and in subsequent periods this scheme will operate on an ongoing basis.

The question of the amount of indexation was raised last year. So in the current period, the increase in preference amounted to one thousand rubles. It is worth noting that in this case we are talking about average values. Thus, thanks to these actions, the subsidy amounted to 15.5 thousand rubles.

Officially, such progress was achieved only in percentage terms. Each component of insurance proceeds (fixed portion and points) increased the total amount by 7%. The increase in percentage led to the elderly receiving less co-payment. It was provided to those persons whose income did not exceed the subsistence level. On average, the increase was only 600 rubles.

From what month will pensions be indexed in 2021?

As mentioned earlier, starting from 2021, all pensioners who did not retire upon reaching a certain age but remained working at their previous place of employment cannot count on indexation of their pension in 2021. But they can count on social compensations paid by the government of the Russian Federation on a monthly basis.

The government claims that working pensioners have a sufficient level for normal life activities, so they do not apply for indexation of their pensions.

According to officials in the Russian Federation, as of January 1, 2019, pensions will be indexed for all non-working pensioners. Insurance pensions will be raised starting in April 2021, and in August pensioners can count on a recalculation of their funds, as well as additional payments.

As Russian President Vladimir Putin said, the government has a mechanism, thanks to which every year the state will raise the average pension for non-working citizens who have retired by 1,000 rubles. Thus, by 2024 it will be possible to reach the level of the average pension, which will be 20,000 rubles. Let us remind you that at the moment in Russia the average pension level is 14,000 rubles.

Aspen's illegitimate daughter entered the fight for his inheritance

About changes regarding the cost of living

At the moment, there are known cases of deliberate underestimation of the regional cost of living in thirty regions of the Russian Federation, since thanks to the lower minimum, an increased amount of payments is allocated from the state budget.

Next year it is planned to establish uniform rules by which the regional cost of living will be determined, and this, in turn, will avoid cases of such fraud. Indexation of pensions for 2021 is planned to be carried out fairly honestly and not to affect anyone’s rights.

Changes in retirement conditions from 2019

In 2021, the following changes are expected in terms of pension provision for Russians

- Changing the conditions for old age pension, including:

- raising the generally established retirement age and adjusting the conditions for assigning certain types of preferential pensions;

- a similar increase in the age for applying for a social old-age pension.

- Changes in the procedure for indexing pensions, including:

- increasing insurance pensions for non-working citizens at a rate higher than inflation (by an average of 1 thousand rubles).

The reform of the pension system, which the Government plans to implement in the coming years, is aimed at ensuring sustainable growth of pensions above the inflation rate, as well as bringing its value to 40% of a citizen’s salary.

The Government is solving all these problems with the goal of creating a sustainable (self-sufficient) pension system that will exist without the need to attract additional funds from the federal budget to cover the deficit of the Russian Pension Fund (PFR).

What will the new payment system be like?

Photo: pixabay.com

Who will be the first to feel the change in the pension indexation system in 2020? As the innovation states, payments will be made to those who have not reached the regional subsistence level. Those who earn above the regional subsistence level can only count on indexation.

What will the changes include? Previous calculations of budget payments for vulnerable segments of the population were practically invisible. They looked like this:

- Indexation of the amount of strictly prescribed additional payments (multiplying by a coefficient);

- Subtracting the resulting number from the minimum payment - the difference calculated from here was the amount of the payment.

It follows that a pensioner who retired from work received only the subsistence level of his region. This indexation is unprofitable and non-working pensioners did not receive any payments. In 2021, the mechanism for receiving financial assistance will look like this:

- First of all, the first payment is calculated by multiplying the coefficient by the amount of payments for each month;

- This is followed by the deduction of the non-indexed figure from the minimum amount of residence in the region;

- These two figures are added to the initial amount, and the output is income for each month.

For example, consider this option:

A worker receives 7,500, and the cost of living in his region is 9,000. This means that the calculation of additional payments will look like this:

- 7500×6.6%=495 – amount for the first additional payment;

- 9000-7500=1500 – amount of the second surcharge;

- 7500+495+1500=9495 – final amount of pension payment.

Under the old scheme, the payment would have been only 1005, because:

- 7500×6,6%=495;

- 7500+495=7995;

- 9000-7995=1005.

Ultimately, the difference will be 990 rubles, since: 1995-1005=990.

Such a system will make the indexation of pension bonuses and additional payments more noticeable in 2021, since the size of pensions will increase and exceed the subsistence level. The amount of pension payments for the next year will be calculated automatically in September of the current year.

How will the increase work?

First of all, it should be understood that the amount of 1,000 rubles is an average statistical value, which will only be valid for recipients of average-sized pension payments (this figure in 2018 is 14,414 rubles). The increase due from January 1, 2019 will actually be different for each pensioner.

But at the same time, a pattern will be traced: with a larger benefit amount, the increase will be larger, but the average figures for Russia will be the promised thousand. The specified additional payment will be accrued monthly during 2021 until the next indexation, that is, over the year the total income of a pensioner will increase by an average of 12 thousand.

This will be the same indexation that was carried out annually for recipients of insurance pensions on February 1. The only differences will be in the size and timing. In previous years, when calculating indexation coefficients, the Government was guided by actual inflation indicators for the past year: additional payments averaged 500 rubles. In 2021, benefits will increase at a faster rate starting January 1.

Considering the average figures for Russian pensions, the amount of an increase of 1000 rubles is exactly 7.05% of the average. The projected inflation rate for 2021 is estimated at 3-4%, so the increase will not only cover the depreciation, but will also contribute to the growth of pensioners’ incomes.

This rate of increase is planned to be maintained until 2024, that is, over 6 years, average pensions should increase from 14,000 to 24,000 rubles. But it is worth considering that the real purchasing power of this amount will be reduced annually due to inflation even in the absence of significant shocks in the economy. You can track changes in the amount of payments until 2021 (this is the period for which the State Budget is planned) using the data from the table presented:

Real growth rates will correspond to the difference between the indexation and inflation percentages for each year. Based on this, the growth of payments will indeed outpace the planned inflation rate, but in 2021 pensions will increase only by 3.95%, and not by the declared 7.05%. In subsequent years, the growth rate will be even lower: by 2021, growth will be only 2.3%. In addition, one should not forget about the change in the VAT rate from 18% to 20% from January 1, 2021, which will certainly provoke an increase in prices and the fact that real inflation may change significantly.

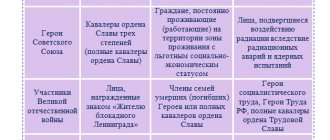

Who should expect a promotion?

The upcoming increase in pensions of 1000 rubles will not affect all pensioners. It will be implemented through indexation, so only non-working pensioners who are recipients of old-age insurance pensions can count on it. In addition, it should be taken into account that:

- The amount of additional payments in each case will not be determined by a fixed amount, but will be calculated as a percentage of the benefit already paid - for 2021 this figure will be 7.05%

- The majority of pensioners receive payments in the range of 8-10 thousand, and for them the indicated 7.05% will be calculated based on these values. For example, for payments of 10,000 rubles. the size of the increase will be only 705 rubles. Accordingly, recipients with higher incomes can expect that the increase will exceed the declared amount (for example, with 25,000 rubles, the additional payment will be 1,762.5 rubles). Thus, pensioners who received fairly high benefits will receive even more, and for recipients of minimal pensions the difference will be almost imperceptible.

On a note! To calculate the amount of pension payments from 2019 in a specific case, you need to multiply the amount of the actual pension for 2021 by a factor of 1.0705.

All innovations in terms of increasing pensions do not apply to those who continue to work after reaching retirement age. For them, the “indexation freeze”, which was introduced in 2021, remains relevant for the near future. All indexations missed during the years of work will be taken into account by him in the final recalculation of benefits only after dismissal.

How can working pensioners get a raise?

As described above, the indexation of pensions affected only non-working pensioners, for whom contributions to the insurance fund are not deducted. A working pensioner can receive an increase only after official dismissal. After this, his pension will be indexed taking into account all accumulated interest and points. All this will affect the size of his next pension payment.

After this, if you get another job, the increase in pension will be maintained. Thus, it turns out that you can quit at the end of December, wait until the pension amount is indexed and get an official job again with contributions to the pension fund. If a pensioner works as an individual entrepreneur, then you can close the individual entrepreneur status and then open it after 3 months.

This will also index the pension amount by 6.6%. Therefore, pensioners often quit their jobs and then get jobs again. Whatever the state’s indexation scheme is, such is society’s response in order to receive the amounts due to everyone. Naturally, with such a scheme, it is worth talking with the employer so that you can keep your job, otherwise you risk being left without a job or looking for a new one, which is not so easy at retirement age.

At what age will Russians retire?

The retirement age in Russia will be raised from 60 to 65 years for men and from 55 to 63 years for women.

The government proposes to do this in stages. The transition period will begin in 2021 and last until 2028 for men and until 2034 for women.

“The younger generation still has enough time ahead simply to adapt to new borders,” Medvedev added. And the money saved by raising the retirement age “will allow us to allocate additional funds to increase pensions above the inflation rate.”

What is the scheme for increasing the retirement age?

“The changes will be smooth, the increase will take place gradually,” Medvedev promised. Thus, men born in 1959 and women born in 1964 will be able to retire in 2021, at the ages of 61 and 56 years, respectively.

Men born in 1960 and women born in 1965 will be eligible to retire in 2022, at ages 62 and 57, respectively.

Men born in 1961 and women born in 1966 - in 2024, at the ages of 63 and 58 years; men born in 1962 and women born in 1967 - in 2026, at 64 and 59 years old; men born in 1963 and women born in 1968 will be able to retire in 2028, at the ages of 65 and 60, respectively.

At this point, having reached 65 years of age, the transition period of increasing the retirement age for men will end.

Women born in 1969 will have the right to retire in 2030, at the age of 61; women born in 1970 - in 2032, at the age of 62 years; women born in 1971 - in 2034, at the age of 63 years.