A social supplement to a pension is due when the total income of a pensioner is less than the actual subsistence minimum (hereinafter referred to as PM). In this case, the minimum wage for the country and in a specific region is taken into account, and the benefit itself applies to all pensioners.

The essence of this measure is to bring the pensioner’s income to a specific subsistence level. This installs:

- Federal social security payment - when the total amount of payments to a pensioner is less than the regional minimum wage, which in turn is less than the actual minimum wage for the country.

- Regional social security payment - if the total amount of all payments to a pensioner is less than the regional minimum wage, but it is higher than the established minimum wage for the country.

Accordingly, the regional PM depends on the region of residence: somewhere it may be lower than in other constituent entities of the Russian Federation. Therefore, the amounts of social benefits may be different. The indicator of this social benefit is based on the difference between the total financial support of the pensioner and the applied minimum wage. The legal side of this issue is formed by:

- Federal Law of the Russian Federation No. 178 of July 17, 1999 (social assistance from the state).

- Order of the Ministry of Labor of the Russian Federation No. 339n dated 04/07/2017 (Rules for the establishment and payment of federal social benefits, the procedure for applying for benefits).

- Federal Law of the Russian Federation No. 134 of October 24, 1997 (on PM in the Russian Federation).

Thus, a federal social security payment is assigned when the total amount of payment to a pensioner is less than the minimum monthly wage in the region where he lives. At the same time, the local PM is lower than the PM applied throughout the country as a whole.

It is self-evident that not all subjects of the Russian Federation have an established PM that is less than the PM in the country. Several such regions can be noted. These include, for example: the Pskov, Amur, Kaliningrad regions, as well as the Krasnoyarsk Territory, Primorye. In these regions, a federal social supplement to pensions is provided.

Important! It should be taken into account that in 2021, as a result of the already carried out indexation, the size of the monthly minimum wage, as well as pensions, will change.

Upcoming pension changes in 2021

Statistics show the following facts. For your information, the largest pension was paid in Chukotka (a little over 25 thousand rubles), the Nenets Autonomous Okrug, and the smallest - in Kabardino-Balkaria (about 11 and a little thousand rubles).

It has been established that in the coming 2021, due to the indexation that has taken place, the size of the social pension (SP), as well as the old-age insurance pension (ASP), will increase.

| Indexation of the ATP | Average annual value of SPS | SP indexation | Average annual value of SP |

| By 7.05% (increase by 1000 rubles for the “average” pension) | Growth to 15.4 rubles. | 2.4% increase | Growth to 9.2 rubles. |

The indexation carried out will be applied to non-working pensioners from January 2021. It is assumed that the fixed amount of payment to working pensioners will be 5334.2 rubles. per month. An increase in pension is provided only to those pensioners who will not work.

It should also be remembered that according to the Federal Law of the Russian Federation No. 350 of October 3, 2018 (not yet in force!), new parameters for the retirement age have been established. For women it is 60 years old, and for men it is 65 years old. The planned increase in the retirement age will be carried out gradually, starting in 2021 and ending in 2028.

The Pension Fund of the Russian Federation draws attention to the fact that those Russian citizens who will retire in 2021 or 2021 have the right to do so six months earlier than required by age.

So, if the retirement date falls in January 2021, then it can be postponed to an earlier period and a pension can be issued in July 2019.

Website of the Pension Fund of the Russian Federation.

Social payments to pensioners in Moscow in 2021

As you know, older people in Russia cannot receive a pension below the average annual subsistence level for a pensioner in their territory of residence. If the accrued pension is less than this level, then the Regional Social Supplement (RSD) to the pension is additionally paid from the budget.

In 2021, the cost of living for a pensioner in the city of Moscow was set at 11,561 rubles. Thus, the minimum pension in 2021 in Moscow, taking into account the Regional Social Supplement, was 11,561 rubles.

How is the total amount of financial support for a pensioner determined?

The size of the pensioner’s total financial support is necessary in order to find out whether it is higher or lower than the applicable minimum wage. Further, based on this, it becomes clear whether a particular pensioner is entitled to social benefits or not, and what type: federal or regional.

The total amount is calculated by summing up all cash payments intended for the pensioner. According to the Pension Fund of the Russian Federation, these include:

- regular monthly pension (or part thereof),

- additional social security (including material),

- EDV (along with a standard set of social services),

- other measures of material social support, except for one-time support.

The natural form of social support is not taken into account in this case. But compensation payments, such as reimbursement of expenses to a pensioner for paying for housing and communal services or travel on passenger transport, are added to the total amount.

Important! Such social benefits are established on the basis of a submitted application, starting from the first month immediately following the applicant’s application.

For your information, the basic amount of federal social security payment may be somewhere around 4982.9 rubles. Accordingly, each pensioner-beneficiary has his own and, moreover, is subject to change.

Example 1. Calculation of federal social benefits for pensions

For the calculations below, conditional digital indicators are given.

Citizen of the Russian Federation, disabled group 3, non-working pensioner M. S. Shchekachev receives a social pension (2995 rubles). In addition to this, he is paid 2 compensations: one for payment of housing and communal services (410 rubles), and the second for the disability group (1,535 rubles). Let’s say that in the region where he lives, the pensioner’s monthly minimum income by this time is 5,500 rubles.

It is necessary to find out whether in the situation under consideration pensioner M. S. Shchelkachev has the right to receive federal social benefits. If yes, in what size? For this purpose, the following actions are performed:

- Calculation of the total material support of M. S. Shchelkachev: 2995 rubles + 410 rubles + 1535 rubles. = 4940 rub.

- Comparison of the total amount of support for M. S. Shchelkachev with the regional pensioner’s PM: 4940 rubles. and 5500 rub. It is self-evident that the size of the monthly pension is greater than the total income of the pensioner.

- Conclusion: since the calculated amount of support for M.S. Shchelkachev turned out to be less than the regional minimum wage, the pensioner is entitled to a federal social supplement.

- Calculation of social benefits: 5500 rub. — 4940 rub. = 560 rub.

From here it follows that the calculated difference (560 rubles), which is a social security payment, will need to be added to the pensioner’s pension.

Who can get help?

The above compensation from the reserves of the Pension Fund of the Russian Federation (and for Moscow residents also from the city budget) can be counted on by persons receiving pension benefits who, at the same time, were recognized as low-income or single.

The full list of persons who are recognized as needy is contained in Article 15 of Federal Law No. 442-FZ of December 28, 2013 “On the basics of social services for citizens in the Russian Federation” (link).

These include:

- Persons who have completely or partially lost the ability to self-care, move or provide basic life needs due to disability, illness or age;

- Families of a disabled person who requires constant outside care;

- Families with children who have problems with social adaptation;

- Persons with a difficult financial situation, survivors of violence from family members with alcohol or drug addiction;

- Persons who do not have a means of subsistence and who cannot find employment due to the lack of jobs according to their qualifications.

In addition, subjects of the state can expand this list with other circumstances that on their territory will be considered to worsen living conditions and give the right to assistance.

The procedure for registering additional payments to pension benefits

The social supplement to the pension is established by the territorial branches of the Pension Fund of the Russian Federation on the basis of the application submitted by the pensioner. The procedure for prescribing this procedure will be general in all cases.

| What must the applicant do? | What to pay special attention to | General explanations |

| To write an application | Form used | As is customary, a standard application form for a pension is filled out, but a note is made about the assignment of federal social security benefits |

| Prepare other required documents | The applicant's passport is required | If the interests of the applicant are represented by his authorized representative, you will need a passport of this representative or it is enough to present a notarized power of attorney |

| Submit an application along with documents to the territorial branch of the Pension Fund of Russia | Available methods of submission: in person, by mail, through the State Services portal, MFC | The response to the applicant is usually given within 5 days (depending on the method of application) |

| Receive a response from the Pension Fund to your appeal | Answer options: establish social benefits or refuse it | When assigning this social benefit (if the answer is positive), information on the applicant is entered into the regional segment of the relevant Federal Register |

Refusal may occur most often due to the lack of grounds for assigning social benefits. As established, the refusal is made in writing and then sent to the applicant. It must indicate the reasons, as well as the procedure for appealing the decision.

If a person works, is payment due?

As a general rule, no. The authorities believe that since a person works and receives a salary in addition to a pension, he does not need social protection. This is the position of not only the Moscow Administration, but also the central government.

For example, the pension of working pensioners is not subject to mandatory annual indexation. And it may be less than the subsistence level - there are also no additional payments from the federal budget.

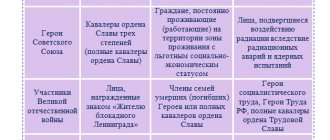

But at the regional level there are exceptions to this rule. When deciding on “Moscow” pension supplements, the City Administration identified a number of categories of citizens who retain the right to a social supplement, regardless of whether they work or not.

These categories include:

- Disabled people of the Great Patriotic War

- Disabled since childhood

- Disabled people of any age with disability groups I and II

- Disabled people of group III (limited ability to work) under 23 years of age

- Children receiving pensions for the loss of a breadwinner (one of the parents, or both)

- Pensioners employed in socially significant industries for the city

The last point requires special attention. The Moscow administration has compiled a list of professions that play a significant role in the social life of the city.

It included: health workers of state medical institutions (including junior medical staff), school teachers, kindergarten teachers/nannies and other teaching staff, librarians, civil registry office employees and some other municipal bodies, housing and communal services workers (janitors, cleaners, concierges and etc.).

A complete list of professions that give a working pensioner the right to receive a social supplement is posted on the official website of the Moscow Administration.

A working pensioner belonging to a preferential category can apply to the territorial social security authority with an application for an additional payment. You should have with you proof of your membership in the category of beneficiaries and documents confirming a ten-year period of residence in Moscow.

Example 2. Tver region: registration of social benefits for pensions in 2019

As stated, the size of the pensioner’s monthly pension in the Tver region for 2019 is equal to 8846 rubles. It follows that those pensioners living in the Tver region whose total income is less than this amount (8846 rubles) acquire the right to receive social benefits. The procedure for registering it for this category of beneficiaries varies somewhat, namely:

- Those beneficiaries who are already receiving social benefits do not need to contact the branch of the Pension Fund of the Russian Federation in the new year regarding its re-registration or extension.

- For initial registration (if the beneficiary has not previously applied for additional payment), you need to submit a proper application to the Pension Fund office at your place of residence (possibly through the MFC) in one of the convenient ways: in person, in electronic form, through a legal representative.

Reason: regional Law No. 47-ZO dated October 26, 2018 “On the amount of pensioner’s monthly income in the Tver region for 2021.”

Monthly additional payments for certain categories of citizens

According to the law in force in the country, persons belonging to federal beneficiaries have the right to receive a monthly cash payment (MCB). To receive them, a citizen must contact the Pension Fund at his place of registration.

For disabled people

The amount of the monthly supplement depends on the disability group of the individual. Thus, citizens from group 1 receive 3,782.94 rubles, and from group 2 – 2,701 rubles. For persons with the third disability group, an EDV of 2162.67 rubles is provided.

For pensioners of the Ministry of Internal Affairs

To be considered a pensioner of the Ministry of Internal Affairs or receive a military pension, the duration of pure service must be at least 20 years, or mixed service must be at least 25 years. Moreover, a person must devote 12.5 years of them to military service.

For each year that exceeds the specified standards, payments to a pensioner of the Ministry of Internal Affairs will be increased by 3% in the case of pure length of service and by 1% in the case of mixed length of service.

Northerners

The northern regions of the country are considered subjects of the Russian Federation with difficult climatic conditions. Therefore, persons permanently residing in such territorial units, as well as those who have worked in the north for a certain number of years, receive additional allowances.

Persons who have worked in the Far North for more than 15 years with a total experience of 25 and 20 years (for men and women, respectively) receive a fixed payment increased by 50%, the amount of which for 2021 is 5,334 rubles. This payment is calculated regardless of the citizen’s current region of residence.

For pensioners who worked in regions equated to the Far North for 20 years or more, the fixed payment increases by 30%.

After 80 years

Old-age insurance payments are automatically recalculated when the pensioner reaches 80 years of age. The size of the monthly allowance for this category of citizens is 5,344 rubles, which is equal to the amount of the FV. Thus, persons over 80 years of age receive double the old age benefit.

For mothers of many children and for children

Women who raise three or more children are considered to have many children. In this case, children can be either natural or adopted. These women are paid additional benefits for each child.

Payments to mothers

In order to receive additional payments for children, a woman needs to contact the Pension Fund with documents. When recalculating pension points, the period of maternity leave is taken into account:

- for the first - 1.8 points (RUB 157.03);

- for the second – 3.6 points (314.06 rubles);

- for the third - 5.4 points (471.09 rubles).

Civil servants

Persons who have worked in government agencies for more than 16 and a half years receive a civil servant's pension and can count on additional payments. Such additional payments include an increase in average monthly payments by 3% for each year of work in government agencies, which follows the required norm.

For length of service

Persons with a long work history can count on a pension supplement, the amount of which depends on the region of residence of the pensioner, since it is paid by social security authorities. This bonus is given to men with more than 40 years of work experience and women who have worked for more than 35 years. In addition, such citizens have 5 additional pension points, each of which in monetary terms is valued at 87 rubles and 24 kopecks.

For dependents

Pensioners who care for a disabled person receive an additional payment for each dependent.

However, such a payment can be assigned only to 3 dependent persons. EDV for 1 person after indexation will be 1,778 rubles.

Some nuances when applying for social benefits for a pensioner’s pension

So, social benefits are due to those non-working pensioners whose financial support in the aggregate does not reach the regional minimum wage. We are talking about the subject of the Russian Federation in which the beneficiary lives. This legislative norm, in fact, is the unconditional basis that determines the purpose of social benefits.

Based on this, all issues regarding any changes in the surcharge are resolved. As an example, the following common typical situations and explanations for them can be given.

| The pension is less than the minimum monthly wage, but social security payments are not provided | A pensioner who received social benefits got a job | A working pensioner quits his job |

| In addition to the regular pension, when assigning it, all payments issued to the pensioner by the territorial branch of the authorized body are also taken into account (see above). It is due to them that the total amount of payments to a pensioner increases and, accordingly, often reaches or exceeds the minimum wage | According to the law, social security payments must be stopped from now on. But it should be borne in mind that the pensioner must inform the Pension Fund office about his employment by submitting an application (in person or through his personal account on the fund’s website) | After dismissal, he regains the right to receive social benefits if his total income together with his pension is less than the monthly minimum wage. If this social benefit has not yet been assigned, he needs to contact his branch of the fund and submit an application for this |

You can obtain detailed, up-to-date information on all issues related to the registration of social benefits for pensions on the website of the Pension Fund of the Russian Federation through the online reception, as well as by calling the fund’s advisory service or by contacting the customer service located at your place of residence.

Website of the Pension Fund of the Russian Federation.

Travel payments

Russian legislation stipulates that federal beneficiaries have the right to free travel upon presentation of the appropriate identification. The benefit applies to public transport, which includes trams, trolleybuses, metro, buses and commuter trains. On long-distance trains free travel is provided:

- Twice a year for personal needs and once to the place of treatment and back - to Heroes of Russia and the USSR, full holders of the Order of Glory of three degrees.

- Once a year - full holders of the Order of Labor Glory, Heroes of Socialist Labor, persons awarded the Order "For Service in the Armed Forces of the USSR" of three degrees.

In order to take advantage of the benefit, they need to go to the ticket office of the railway station and provide an order book (Hero book, sheet of coupons) and a certificate confirming the availability of the benefit. Free travel is allowed on trains and carriages of all categories.

Regional and local authorities may establish additional lists of beneficiaries who are entitled to use public transport free of charge. Thus, for pensioners in Moscow and the region, if they have an issued social card, they are provided with free travel on public transport, including on trains within the Moscow region and adjacent regions.

Pensioners - residents of the northern regions have the right to preferential holidays. They are provided with free travel to the vacation destination (only in Russia!) once every 2 years.

To receive compensation, you must contact the social security authorities and provide a travel document. This can be done before or after the trip.

Airplane tickets (economy class), bus, river transport (category 3 cabin) are subject to compensation. If you plan to go on vacation in your own car, you must bring a certificate of the cost of travel in a reserved seat car to social security. You can obtain the document at the station information desk.

- Sneezing and runny nose without fever

- Frontline for dogs - composition and release form, instructions for use and indications, side effects and price

- How to track a smartphone on Android - enabling the function in Google and installing special programs

Common mistakes when assigning “pension” social benefits

Error 1. Contrary to the opinion of many pensioners, the amount of the social security payment they are entitled to initially established may change or it may be canceled altogether. The basis for such decisions may be the slightest changes in the pensioner’s PM or his total pension provision.

For example, as a result of indexation, the pension increased. Accordingly, the amount of previously assigned social benefits is reduced for this reason. And if, at the same time, the total amount of pension provision has increased so much that it has reached or exceeded the pensioner’s minimum wage, then the payment is suspended altogether.

Error 2. Indexation of the insurance pension (SP) is carried out only after the dismissal of a person. This norm was introduced and applied since 2015.

In other words, if a pensioner works, then nothing is indexed during this period. As soon as he quits, the pension is recalculated and all indices are added.

Error 3. Payment of the established social security payment to a pensioner also stops if he has left the Russian Federation or is planning to move to another place of residence, to another country.

But if a move (change of place of residence) is planned to another region of the Russian Federation, then the social supplement can be recalculated, taking into account the PM, which is established in the region of the move (at the new place of residence).

Social supplements for pensioners in Moscow in 2021

If a pensioner has finished working and his only source of income is a pension, he receives the right to a regional social supplement while living in Moscow. It can be issued only if you have registration in the capital. Moreover, such a citizen must receive a pension from the local budget.

- people who received honorary titles (Hero of Russia, USSR, Socialist Labor);

- disabled people and WWII participants;

- participants in the defense of Moscow;

- midgets and dwarfs;

- orphans left without parents as a result of man-made disasters and terrorist attacks;

- veterans;

- people who have made contributions in the fields of culture, sports and physical education.