What happened to the labor pension?

Since 2002, pension reform has been taking place in Russia.

Until January 1, 2015, the Law “On Labor Pensions in the Russian Federation” No. 144-FZ of December 17, 2001 was in force. According to its provisions, an employee applied for cash payments in old age when he reached the required age and had at least 5 years of experience. After January 1, 2015, the concept of “labor pension” is absent in the legislation. Instead of one law, there are two: “On insurance pensions” and “On funded pensions”. That is, the previous labor pension was divided into insurance and funded, which a person can claim at the same time . Let's take a closer look.

Types of insurance pension

Federal Law No. 400 establishes the following types of insurance pensions:

- Due to old age. Every citizen who has reached the established retirement age and has the minimum allowable number of pension points can receive it. The number of required points and the retirement age are currently increasing annually in accordance with Federal Law No. 350.

- Due to disability. Assigned to persons who have lost their ability to work as a result of illness or injury, and who have been assigned one of 3 disability groups by decision of a medical and social examination.

- Upon the loss of a breadwinner. This pension is provided to dependents in the event of the death of their sole breadwinner. Minor children are a priori recognized as such. Other members of the deceased's family are required to prove the fact that they were in the care of the deceased citizen.

In all of the above cases, the person or the deceased breadwinner must have the required number of IPCs in the OPS system. If their number is insufficient, the person is assigned a social pension in a fixed amount, from 5.2 to 12 thousand rubles.

How is the insurance pension calculated?

The employer pays a monthly contribution of 22% of the employee's salary to ensure his future pension. This money can be used to create:

- exclusively, the insurance part of the pension;

- insurance (16%) and funded (6%) pensions simultaneously.

An insurance pension is assigned for several reasons, one of which is that citizens reach a working age. As a general rule, it is 60 years for men and 55 years for women. Old-age insurance benefits are what most Russian pensioners receive today. Its size now depends on:

- the amount of insurance coverage of the employee;

- the number of points accrued (in other words, individual pension coefficients - IPC);

- application period.

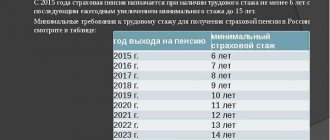

To count on a pension in 2021, an employee needs a minimum insurance period of 8 years. In the future, this value will increase and will be 15 years from 2024. Only the period during which contributions to the Pension Fund of the Russian Federation were paid for the employee are included in the insurance period. Additionally, the period when the person was engaged in socially significant activities is taken into account: he was in military service, caring for a child or an elderly person over 80 years old, etc. Moreover, such a period must precede or follow official employment included in the insurance period.

What is an insurance and labor pension?

The insurance pension was introduced with the adoption of Federal Law No. 400. It is available to persons who meet the following conditions:

- Those who have a specified number of pension points (IPC) in their assets.

- Having reached retirement age.

- Having a certain amount of insurance experience, calculated in years.

- Among the additional grounds for which a person is entitled to an insurance pension are disability and the loss of the sole breadwinner.

The labor pension, which became a thing of the past in 2015, was assigned to all persons with a minimum work experience. It meant all the years during which a person worked or was engaged in other activities specified in the Federal Law “On Work Experience.”

What is a fixed payment and indexation coefficient?

In addition to the above indicators, the old-age insurance pension includes a fixed payment, which the state constantly indexes. As of February 1, 2021, it is 4,805.11 rubles.

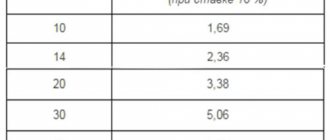

If a person applies for old-age benefits not upon reaching the required age, but later, an increasing coefficient is applied. For example, 3 years after age 60 for men and 55 for women, their pension points will be multiplied by a factor of 1.24, and the fixed benefit will be multiplied by a factor of 1.19. For comparison, if the application occurs 10 or more years after the permitted period, the increasing coefficient for the IPC and the fixed payment will be 2.32 and 2.11, respectively.

Important! Detailed information on the size of increasing coefficients and fixed payments, the cost of the IPC, as well as a calculation calculator are presented on the website of the Pension Fund of the Russian Federation.

Types of labor pensions

are provided. Pensions for long service have been transformed into early labor old-age pensions (Articles 27 and 28 of the Law on Labor Pensions), and social pensions are a type of state pension, which is regulated by the Law on State Pensions.

- - members of peasant (farm) households;

- - working outside the territory of the Russian Federation in the case of paying insurance premiums in the case of paying insurance premiums to the Pension Fund of the Russian Federation on a voluntary basis, unless otherwise provided by an international treaty

We recommend reading: What is a house for two owners called?

A little about pension savings

In addition to forming the insurance part of the pension, working people can make pension savings. In 2021, this right is available to those who submitted the necessary application to the Pension Fund before December 31, 2015, as well as those starting their labor activity for the first time.

These savings are formed from deductions from the employee’s salary (in the amount of 6%). The total amount at the time of the employee's retirement will consist of collected funds and investment income. The monthly benefit amount is calculated on the basis that payments will be made over a period of 20 years.

Insurance pension: terms of assignment

What do you need to be eligible for insurance compensation? As already mentioned, one of the requirements is age.

Each variety has its own characteristics. If this is a disability pension, then you need to get a certain group, confirmed by documents.

Survivor assistance is paid to those who have lost the only family member who provided financial support. In this case, family members must be disabled. Or be in dependent status.

Old age benefits require a minimum of 15 years of insurance coverage.

Receiving such assistance becomes possible if three conditions are met:

- A certain age.

- Insurance experience.

- The minimum number of points is 30.

About pension points

The formation of the insurance part begins at the same moment when a citizen gets a job. The employer is annually responsible for transferring funds for employees to the Pension Fund. From this money, the funds are automatically converted into the same points.

The number of points depends on what kind of salary the citizen receives. You can earn up to 10 points per year. The state itself increases the cost of this indicator and changes it every year.

Fixed payments

This part of the amount is added to the insurance. The name already says what the concept is.

They are paid to any citizen and are a guarantee from the state for everyone. Every year this indicator, as well as the insurance pension itself, is indexed.

Amounts of pension savings

The calculations are based on individual pension savings. Their records are kept in a special part of personal accounts that individually belong to each citizen. Or in a pension account that is owned by the insured.

Insurance contributions from the employer, income from investments.

Additional insurance contributions from the employee himself. This also includes maternity capital funds and the results of their investment, various types of additional payments from the state.

The second part can be calculated as the citizen says - either when calculating urgent payments, or when calculating the total amount of the funded pension. The pensioner himself chooses the option that seems most convenient.

The citizen himself determines the duration of receiving assistance. But term payments cannot last longer than 120 months. Or 10 years from the moment the amount was assigned.

The funded part continues to be paid if the citizen lives longer than the established period.

What is social pension

Those people who for some reason cannot qualify for an insurance pension are not left without government support. They are assigned a social pension. Let's look at how it differs from insurance. The reasons for the appointment are the same. The main difference is that you do not need work experience to obtain it. On the contrary, if a citizen works and insurance contributions to the Pension Fund are calculated in his favor, he cannot receive payments during such employment.

Social old-age pension is assigned:

- citizens of the Russian Federation if they are over 65 (for men) or 60 (for women) years;

- citizens who are representatives of small-numbered peoples of the North upon reaching 55 (for men) and 50 (for women) years.

It is also assigned to non-citizens of the Russian Federation if they have lived in Russia for at least 15 years. In 2021, the amount of social benefits for old age is 5,034.25 rubles per month.

What is the difference between a labor pension and an insurance pension?

For a variety of reasons, a person may lack a work history - for example, due to injury or loss of ability to work, but this does not at all deprive him of the prospect of receiving a guaranteed pension. Rather, on the contrary, disabled people, orphans, and elderly people can without mistake be classified as the most vulnerable category of the population, which requires special participation. Special social pensions are designed for them - this is monetary assistance from the state intended for disabled people who have not had time to earn the required length of service.

We recommend reading: Why the cadastral value of an apartment is lower than the market value

The basis for establishing and calculating length of service is the employment contract concluded between the employee and the employer, according to which labor or social activities are carried out. Typically, this length of service includes the period that the citizen officially worked, but there are exceptions. So, if the state recognizes the reasons why a person did not work during a certain period as valid, then this time will be added to the total length of service.