January 27, 2021

In 2021, Russian citizens who do not have the required insurance experience or the size of their individual pension coefficient is too small to apply for an insurance pension can count on receiving a social pension . This applies to Russians who did not work officially, worked too little or did not work at all, for example, people with disabilities, children who have lost their parents.

Grounds for assigning social pensions to disabled persons:

- loss of a breadwinner;

- obtaining a disability group;

- the onset of old age.

For each category, its own size of social pension is determined, and the payment is indexed annually. Thus, in 2021, indexation is provided from April 1 by 2.6% . A person whose social pension is less than the subsistence level in the region where he lives can count on receiving a social supplement .

To assign a social pension, you need to contact the Pension Fund office at your place of residence with a package of documents. The pensioner can apply personally or through a proxy.

Social pension - what is it?

Disabled Russians permanently residing in Russia, in the event of certain circumstances, have the right to receive a pension benefit from the state, which is provided for by Law No. 166-FZ of December 15, 2001 “On state pension provision in the Russian Federation.” Social pension is one of the types of benefits.

Features of social pension:

- the payment is due to persons who cannot work due to illness or age ;

- assigned to persons without sufficient insurance experience to receive an insurance pension payment;

- the Pension Fund of Russia (PFR) is responsible for assigning payments;

- funding is allocated from the federal budget.

Providing payments for the period of self-isolation

A separate decision was made regarding payments for the period of self-isolation in Moscow due to the pandemic caused by the new coronavirus infection. Working pensioners will receive assistance; all payments will be made from funds from the Social Insurance Fund. To receive payments, pensioners will need to provide a sick leave certificate, which is issued to form a salary for the period of illness.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Pensioners who do not work will not be able to receive additional payments. In addition, they will not be provided with compensation for inconvenience caused by the pandemic. The authorities explain this by saying that restrictive measures were introduced to preserve the health of citizens.

Who is the recipient of a social pension in Russia

Law No. 166-FZ determines who can become a social pension recipient. These include:

- Children with disabilities.

- Persons with any disability group.

- Children under the age of 18 (if we are talking about a student studying full-time, up to 23 years old) who have lost their parents or whose parents are unknown.

- Persons who belong to the small peoples of the North, if they permanently resided in the area where these peoples lived at the time the pension was established.

- Citizens who have reached the age when a social old-age pension is due.

- Persons who do not have Russian citizenship, but have resided in the Russian Federation on a permanent basis for 15 years or more, if they have reached the age for receiving a social pension.

A person loses the right to a social pension if he moves to another country for permanent residence. This rule also applies to citizens with dual citizenship.

What is social pension and who is it paid to?

A social pension is assigned to those who were unable to obtain the right to an insurance (labor) pension. The main conditions for assigning a social pension are:

- permanent residence on the territory of the Russian Federation;

- belonging to the category of “disabled citizens”.

Who has the right to receive a social pension?

Depending on the categories of recipients, it can be of different types and sizes.

1 Social disability pension is established:

- Disabled people of groups 1, 2 and 3, including from childhood;

- For disabled children.

2 Social old-age pension is assigned:

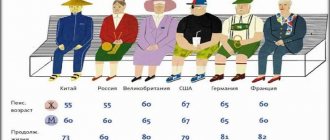

- Citizens of Russia who have reached the age of 70 (men) and 65 years (women);

- Persons from among the small peoples of the North who have reached the age of 55 (men) and 50 years (women), permanently living in areas inhabited by the small peoples of the North on the day of pension.

3 Social pension in case of loss of a breadwinner is established:

- Children under 18 years of age who have lost one or both parents. The period for receiving it is extended to 23 years, but only for full-time students.

4 Social pension for children whose both parents are unknown is assigned:

- Found (abandoned) children or babies abandoned by a mother who did not present identification.

A social old-age pension is also awarded to those who do not have enough length of service to qualify for an insurance pension. That is, those who worked unofficially most of their lives. Or maybe he didn’t work at all, like, for example, women housewives who were supported by their husbands.

Where to apply for accrual of social pension

An application for a pension can be submitted by a citizen to the territorial body of the Pension Fund of Russia or to the multifunctional center (MFC).

You can also send an application in the form of an electronic document through the “Personal Account of a Citizen” on the official website of the Pension Fund or through the “Unified Portal of State and Municipal Services.”

When to apply

You can apply for a pension at any time after your right to it arises.

Where to go for advice

If you have not found the answer to your question, call the hotline of the regional branch of the Russian Pension Fund.

OPFR in Moscow and the Moscow region; OPFR for St. Petersburg and Leningrad region: 8 (812) 292-85-92; OPFR for the Novosibirsk region; OPFR for the Sverdlovsk region; OPFR in the Krasnodar Territory.

☎ For hotline numbers of other regional branches of the Pension Fund of Russia, see the website: www.pfrf.ru/contact

You can also use your Personal Account on the PFR website: es.pfrf.ru

Types of social pensions in the Russian Federation

There are three types of social pensions depending on the reason for the appointment:

- upon loss of a breadwinner;

- on disability;

- by old age.

For each type, regulatory documents define the circle of recipients, the procedure for assigning a pension and the amount of payment.

On January 1, 2021, legislative norms came into force according to which children whose parents are unknown, if they were found or were dropped off at a medical institution, have the right to receive social benefits for the loss of a breadwinner.

When is the social pension expected to be indexed in the Russian Federation in 2021?

Contents

hide

When is the social pension expected to be indexed in the Russian Federation in 2021?

How the size of social pensions in the Russian Federation will change in 2021

In order to improve the well-being of citizens, the Russian government has developed a number of new bills. Currently, the indexation of pensions has ceased to depend on the level of inflation in the country. This calculation model appeared quite recently; before that, there was a clear link between these values.

The insurance part of citizens' pension payments will be indexed on January 1 next year. This time the increase will not occur as before, depending on the level of inflation, but by an amount definitely fixed by law.

Thus, people will not have to rely on the rising cost of goods; the size of the pension paid under the new rules will not depend on prices in the country as a whole.

Social old age pension

do not have the required insurance period or the amount of accumulated pension points to receive an insurance pension are entitled to receive a social old-age pension Every year the number of people applying for social benefits is growing. This is due to the fact that since 2015, not everyone can apply for an insurance pension, since the requirements for length of service and points increase every year.

In order to receive insurance coverage in 2021, a person must have 12 years of insurance experience and 21 IPC. Next year these standards will be increased and will amount to 13 and 23.4, respectively.

To receive old-age social benefits, the following criteria are established by law:

- Russian citizens, stateless persons, and citizens of other countries who have lived for more than 15 years in the Russian Federation must reach a certain age: women - 65 years old, men - 70 years old ;

- persons who belong to the small peoples of the North can receive a pension from the age of 50 if it is a woman, from the age of 55 if it is a man.

Only unemployed people can receive old-age social benefits . If a person gets a job after the payment has been assigned, it will be suspended in accordance with Part 5 of Art. 11 of Law No. 166-FZ.

Until the end of 2021, the retirement age for women was 60 years, and for men – at 65 years. As a result of reforms, starting in 2019, the retirement age began to rise; already in 2021, women can retire at 63 years old, and men at 68. By 2023, the retirement age for women will increase to a maximum of 65 years, and for men to 70 years.

What was wrong with indexation and the living wage?

According to the latest news about pension indexation, you should not expect this process to be implemented from April 1. According to previous legal norms, on February 1 of each year, subsidies were recalculated in accordance with the rate of depreciation. Then, exactly two calendar months later, an additional increase was made, determined by the capabilities of the main pension organization.

But it so happened that last year was marked by the combination of both payments on January 1st. By applying the initial depreciation information, policymakers were able to achieve success. Consequently, from now on, benefits will increase only from January 1.

The law is already in effect:

- The increase will be received by non-working pensioners whose pension is below the subsistence level in the region. Those who are higher will not receive it, because they have already been paid an increase since January.

- Pensioners with a small pension will have their accruals indexed from January 1 and will be paid this amount above the subsistence level. Additional payments will be made until July 1. Further payments will be based on indexation.

- Previously, indexation was included in the monthly supplement and was invisible. Now it will always be paid separately.

- The recalculation will be done automatically; you don’t need to formalize or write anything.

- Indexation does not apply to working pensioners: they have their own conditions and other deadlines.

Let’s say a teacher has an old-age pension of 8,000 rubles. It is indexed by 7.05% - the increase is 564 rubles. But the cost of living in the region is 8,700 rubles.

8000 R 564 R = 8564 R - this is the accrued pension taking into account indexation;

8700 R − 8564 R = 136 R is an additional payment up to the subsistence level.

Previously, pensions were indexed, and then they calculated how much they needed to pay in addition to the subsistence level.

Now pensions will be indexed as follows:

- First, they will calculate the increase taking into account indexation.

- The amount of the increase will be fixed.

- Then they will calculate how much you need to pay extra to the minimum subsistence level, taking into account the previous pension amount, before the increase.

- And only after that the fixed indexation amount will be added to the payment increased to the subsistence level. The increase will not reduce the additional payment to the minimum, but will increase the payment by the full amount.

8000 R × 7.05% = 564 R - increase during indexation;

8700 R - 8000 R = 700 R - additional payment up to the subsistence level;

8000 R 700 R 564 R = 9264 R - the final amount of the pension, taking into account indexation and additional payment.

8564 R × 6.6% = 565 R - increase taking into account indexation in 2020;

8850 R − 8564 R = 286 R - additional payment up to the increased cost of living;

8564 R 286 R 565 R = 9415 R - the total amount of payments taking into account indexation and additional payments in 2021.

In 2021, the 2021 pension will be indexed. But the amount paid in 2020 will be compared with the 2021 cost of living. And only then will they calculate the additional payment and add a new indexation to it.

The general algorithm for calculating the increase in each subsequent year:

- Last year's pension is compared with the new year's cost of living.

- The difference between them is fixed - this is an additional payment.

- Then they calculate the increase in pension taking into account indexation.

- An additional payment to the new year's minimum and indexation are added to the previous year's pension.

- When last year's pension turns out to be greater than the new year's subsistence level, additional payment from the budget is no longer due. Each year they will only add indexation.

Insurance pensions were indexed by 7.05% back in January. All this time they paid extra to the minimum according to the old rules. The law on recalculation came into force on April 1, but it will be applied retroactively, that is, the increase and additional payment under the new scheme will be calculated from January.

It turns out that approximately 12% of pensioners are entitled to additional payment for January, February and March. For some it will be 500 rubles, and for others it will be 5000 rubles. These amounts will be paid to pensioners by July 1, 2019.

The president’s order concerned those who did not notice the increase due to surcharges. And those who noticed it will continue to receive an increased pension as usual.

Some pensioners will begin to receive additional payments in January as early as May. But not all at once: some will receive it only in June. If your neighbor got paid in May, but you didn’t, wait. The alarm should be sounded only after July 1, but there should be no problems. Everyone who is entitled to recalculation from January 1 will receive this money and will see an increase in their current pension.

Social disability pension

This type of support, such as disability social pension , is available to people with disabilities of any group, disabled children, provided that they did not work officially and do not have insurance experience, as well as disabled children.

If a disabled person has even one day of insurance experience, he will be entitled to a disability insurance payment.

Features of the procedure for assigning and paying pensions:

Payments are assigned for the period that was determined during the medical and social examination and for which the group was assigned:

- Disability group 1 – 24 months;

- 2 and 3 – 12 months;

- disabled children - 1, 2, 5 years old or up to 14 years old or adulthood.

You will not have to undergo re-examination if the disability group was assigned for an indefinite period. The payment of the pension is not affected by the fact of employment. If the disability group or the reason for its occurrence is changed, the person will be transferred to another type of social pension, and the amount of the payment will be recalculated.

Survivor's benefit

The survivor's pension is paid to children who have lost their parents, as well as to children whose parents are unknown. The period for which this type of payment is assigned:

- before reaching adulthood, that is, up to 18 years of age;

- up to 23 years of age, if we are talking about a student who is studying full-time. If a child has been expelled from an educational institution or transferred to a correspondence course, he must report this to the Pension Fund.

Features of assigning such a pension:

- The payment will be assigned if the parent/parents do not have a single day of insurance coverage. Otherwise, the child will be assigned an insurance pension regardless of the length of service.

- Children under 18 years of age do not need to submit any documents to prove the fact of dependency. After reaching adulthood, you will have to provide documents confirming full-time study.

- In the event of a divorce, the parents will need to provide papers that confirm the fact that the child was supported by the deceased parent for at least 3 months before death.

- In case of adoption of a child whose parents were not known, the pension payment will be canceled starting from the next month after the adoption.

Amount of social pension in 2021

The state sets its own social pension amount for each category of recipient. Indexation of payments occurs annually on April 1, its level depends on changes in the cost of living. For example, from April 1, 2021, social benefits will be increased by 2.6%.

As of January 1, 2021, the following pension amount is established for various categories of recipients:

- minimum payment in the amount of RUB 4,765.27 . assigned to disabled people of group 3;

- pension in the amount of 5,606.17 rubles . received by people who have reached retirement age, persons with disability group 2 (except for childhood disabilities), children who have lost one of their parents;

- pension 11,212.36 rub . paid to disabled children of group 2, disabled people of group 1 (except for disabled children), children who have lost two parents;

- the highest payment in the amount of 13,454.64 is given to disabled children and disabled children of group 1.

If the assigned amount is less than the minimum subsistence level of a pensioner in a certain region, an additional social supplement is assigned, which corresponds to the missing amount. If you move to another region, the amount of social benefits will be revised.

Article 12.1 of Law No. 178-FZ of July 17, 1999 “On State Social Assistance” determines that the level of material support for a pensioner should not be less than the subsistence level for this category of the population, which is established in the region of residence. A pensioner whose pension is less than the subsistence minimum is assigned a social supplement to the required level.

Indexation of social pensions from April 1

On April 1, 2021, social pensions will be indexed taking into account the growth rate of the pensioner’s cost of living for 2021. According to preliminary calculations, the coefficient will be equal to 2.6% , this is precisely its value indicated in the law on the Pension Fund budget for 2021.

After the Ministry of Labor calculates the increase in the cost of living at the end of 2021, the exact index will be known. After this, it will be approved by Government Decree and indexing will be carried out using it.

Assignment and payment of social pension

After the right to payment arises, a citizen can apply for a social pension at any time. You can submit the required package of documents to the territorial structure of the Pension Fund , including through the online service Personal Account of the Pension Fund, to the Multifunctional Center, or send them by mail.

If a positive decision is made, the pension will be assigned on the 1st of the next month after the date of application. The following cases are exceptions:

- if citizens who have reached retirement age apply, a pension will be assigned to them from the day they reach the appropriate age;

- Children with childhood disabilities are granted a pension from the moment the disability group is established.

Along with applying for a social pension, you can choose the payment delivery method by submitting another application. You can receive money through:

- bank;

- Russian Post;

- organization that delivers pensions.

Conditions of appointment

Conditions for assigning a social pension:

- permanent residence on the territory of the Russian Federation;

- belonging to the category of “disabled citizens”.

List of persons entitled to receive a social pension

Applicants for receiving social benefits in old age are citizens:

- not having the required amount of experience;

- who have reached the age limit required for retirement (60 and 65 years, for women and men, respectively).

People with disabilities of groups 1, 2, 3 can apply for a disability pension .

Disabled citizens who have lost their sole breadwinner receive a fixed cash payment

- children under 18 years of age who have lost a parent(s);

- children (age over 18 years) studying in institutions under the Federal State Educational Standard and who have lost their parent(s). The deadline for appointment is reaching the age of 23 or completing your studies.

- spouses and parents who have disabilities and have reached 55 years of age (women) and 60 years of age (men).

- immediate relatives (brothers/sisters/grandchildren) under the age of 18 who have lost their parents.

- grandparents who have no other income;

Appointment dates

A state pension pension, regardless of its type, is assigned from the 1st day of the month in which the citizen applied for it, but not earlier than from the date the right to it arises. With the exception of:

- cases where a social disability pension has been established for citizens who have been disabled since childhood and have not reached the age of 19, who previously received a social disability pension provided for disabled children and the payment of which was stopped due to reaching the age of 18;

- cases where a social old-age pension is established for citizens who have reached 65 and 60 years of age (men and women, respectively), who previously received a disability insurance pension and the payment of which was stopped due to reaching the specified age.

The old-age social pension is established for an indefinite period. The social disability pension is established for the period during which the corresponding person is recognized as disabled, including for an indefinite period. The social pension in case of loss of a breadwinner is established for the entire period during which a family member of the deceased is considered disabled, including indefinitely.