Reasons for raising the retirement age in 2019

Government officials claim that they were prompted to develop pension reform by the labor situation.

The number of employed citizens is decreasing, while the number of retired people is increasing.

Because of this, the balance of the pension system may be disrupted, and it may reach the point that the government will not be able to fulfill its own obligations to pay pensions. Only by increasing the retirement age is it possible to guarantee a decent quality of life for retired people.

In 1971, there were 3.8 working people per pensioner. In 2021, this figure will decrease to 2 people. By 2045, there will be only 1.6 employed people per retiree.

Given the current demographics and economy, it is not possible to guarantee a normal standard of living for retired people, says Liliya Ovcharova, head of the social research department at the Higher School of Economics.

The increase in the retirement age in foreign countries was carried out in parallel with reforms of the healthcare system and the development of social programs aimed at employing pensioners. In the absence of such measures, there is a risk that the number of employed pensioners will significantly decrease. In addition, the number of citizens applying for pension benefits under the status of “disabled” may increase exponentially.

Rules for working pensioners

From September 1, 2021, a Muscovite’s pension cannot be less than 19,500 rubles. At the same time, it is separately stated that the pension is increased only for non-working pensioners. The fact is that the indexation rules for citizens who continue to work during their well-deserved retirement are different. In accordance with Federal Law-38 dated December 29, 2015. There is a moratorium on the annual indexation of the state standard for the maintenance of working pensioners.

Thus, the minimum pension in Moscow in 2021 for working pensioners will not increase in accordance with the decree of August 28. In August, the Pension Fund decided to index pensions for all citizens of the corresponding age in the country whose employers pay insurance premiums. The amount of the increase depended on income and insurance points, but did not exceed 262 rubles. Thus, working pensioners may well not have paid attention to the increase in pensions, since indexation was also carried out without a declaration.

Retirement age in 2021 – latest news about increases

Summary of the bill

The essence of the legislative project is to raise the age of retirement in old age. No other significant changes are envisaged in the reform. The main ideas were described in the version of the bill, which the State Duma adopted in the first reading. However, then the bill was edited, most of the changes were made by the President of Russia. The full list of adjustments was published on September 24, 2018. 09/26/2018 The State Duma approved Vladimir Putin’s amendments in the 2nd reading. Other adjustments did not find support.

From January 1, 2019, the retirement age will begin to increase. The legislative draft approved by the State Duma defines a new age limit - 60/65 years. The retirement age will gradually increase to maximum values until 2028.

The increase in the retirement age will first affect males who were born in 1959; females who were born in 1964. According to the bill, they will retire at 60.5 and 55.5 years, respectively.

Promotion announcement on social media

And on August 27, Sobyanin announced via Twitter what the minimum pension in Moscow will be established for non-working pensioners as of September 1. The state allowance for pensioners will be 19,500 rubles, that is, an increase of 2,000 rubles will be made. According to the calculations of the city head, additional payments will be received by:

- about 1.6 million inhabitants;

- Moreover, for 44,000 indexation will be carried out for the first time.

These numbers are given in the same message on a private social network account.

Pensioners in Moscow - benefits and payments in 2021

Pension reform - latest news about the project

The head of the Russian Federation said that pension payments in the country will increase. He stated this at the “Russia Calling” investment forum. The President said that the government does not forget about non-state pension funds. However, he added that it is necessary to ensure their effective management. The President believes that every 12 months pension payments can be increased by a thousand rubles.

The pension reform is criticized not only by the people, but also by deputies. For example, State Duma deputies from the Communist Party of the Russian Federation Valery Rashkin and Denis Parfenov wore T-shirts with the numbers 63 and 65 crossed out at a meeting dedicated to considering adjustments to the pension reform.

In addition, those dissatisfied with the reform organized a rally near the State Duma and held several pickets. None of those participating in the protests were detained. Representatives of the Ministry of Internal Affairs claim that they did not receive any information about the protests.

The head of the Russian Academy of Sciences, Alexander Sergeev, argues that the impact of pension reform on life expectancy has not yet been studied . He believes that it is necessary to conduct research aimed at establishing the factors of long life, finding a connection between the health of Russians and social and economic factors.

Has Putin adopted the bill?

On October 3, 2018, the head of Russia put his signature on the bill , according to which the retirement age of Russian citizens will increase.

Women will retire at 60, men at 65. This is 5 years more than before.

As of today, people who were supposed to become pensioners in 2021 and 2020 will receive minor benefits. They will have the opportunity to retire six months earlier.

There will be special conditions for mothers with many children . Women who have given birth to 3 children have the right to retire 3 years earlier. For women with 4 and 5 children, a similar rule applies.

In addition, the minimum length of service required for early retirement is increasing. For males, the length of service must be 42 years, for females - 37.

Special new benefits are provided for a new group of citizens called “pre-retirees”. These are Russians who have less than 5 years left until retirement. Now they cannot be fired, otherwise they can be prosecuted.

Important! Increased unemployment payments and 2 additional days off every 12 months for medical examination.

The draft new pension reform looks scary

Who can argue, you need to have savings. Not only due to retirement, but in general, at any age. And even more so when you reach adulthood, when you can no longer count on new job income.

Auditor of the Accounts Chamber Svetlana Orlova presented the following calculations: “The average pension, which is now just over 14 thousand rubles, of course, cannot provide an elderly person with a decent standard of living. A simple calculation of expenses, such as payment for housing and communal services (an average of 5 thousand rubles), the purchase of vital medicines (2 thousand rubles), expenses for personal hygiene items (at least 1 thousand rubles), suggests that for food (subject to the absence of expenses on clothes and shoes) only 6 thousand rubles remain, or 200 rubles per day.” For a clearer understanding of reality: a couple of years ago, one of the glossy magazines found out that keeping a cat in a large city costs 8.5 thousand rubles. per month. So in our current reality, the state equates the maintenance of one pensioner with one and a half cats.

Permafrost"?

Pensions for ordinary citizens in our country have always been modest. And the authorities, when at the beginning of the 2000s they began the first reshaping of the pension system, quite rightly cited examples of other countries where the emphasis of pension provision is not on state payments (they do not even exist everywhere), but on individual savings. With their mouths agape, Russians watched commercials in which “ordinary” ruddy Norwegian couples, both well over 70, in frivolous shorts, were exploring the sights of some Mexico. It wasn't like they were counting crowns until retirement.

“And so it will be with us!” said the authorities and introduced a pension system of three levels, one of which is funded. We experimented slightly with the age at which savings were “allowed”: at first 45–49 year olds (women and men, respectively) were allowed in, but after three years they were kicked out of the future pension paradise and only 38 year olds and younger were left. The logic in this was: so that those remaining in the system would definitely have time to accumulate something significant.

The population honestly saved for a carefree old age (more precisely, employers made contributions for workers) for 11 years (from 2002 to the second half of 2013), when the authorities announced a temporary “freeze” of their savings. Employers, who were still charged the same amounts, transferred the money not to the individual savings accounts of their employees, but to a common pot - the state once again needed money for ongoing pension payments. Then Crimean pensioners appeared, and the “freeze” was extended. Since then it has been extended from year to year.

Experts calculated the cost of this “freezing” in its first years. Personal savings accounts were shorted by about 500 billion in 2013, 243 billion in 2014, 309 billion in 2015, and about 340 billion in 2016. More than a trillion rubles at the beginning of 2017 alone. Then the experts lost interest in publishing the calculations: the public stopped being horrified. And hope.

Currently, the moratorium on previous pension savings has been set until 2022. Formally (and, I would like to believe, in fact), the funds accumulated by the time of the “freezing” are still registered with each individual citizen and will be paid to him upon reaching retirement age, which, however, has been advanced by five years from this year. It’s just that these savings have not been replenished with new income for six years now.

Photo: Natalia Muschinkina

Resuscitation plan

Last fall, the authorities made a knight's move and announced another pension reform. So far it has been expressed in raising the retirement age: for women - up to 60 years, for men - up to 65. The logic here is simple: in recent decades the country has had disgusting demographics. According to Rosstat, in the next 15 years the working-age population in Russia will decrease by 3 million people - to 79.4 million, which is less than half of the country's population. By raising the retirement age, the authorities killed two birds with one stone: they left the workforce on the labor market for another five years and for some time reduced the number of dependents applying for a pension.

As part of the pension reform announced for 2021, they decided to revive the savings system. It’s not that the authorities are worried about losing face. It’s just that the guaranteed labor pension, despite all the indexations, will continue to tend to zero (demographics: every worker will soon find himself the breadwinner of almost two pensioners), and the funded scheme is an excellent opportunity to shift responsibility for the financial security of their old age to the citizens themselves.

As an alternative to the irrevocably frozen previous savings scheme, a new instrument was announced back in 2021 - individual pension capital. As First Deputy Prime Minister Anton Siluanov once assured, thanks to this wonderful mechanism, in the future the pension will reach 60% of lost earnings.

No one has yet seen the new scheme - work is underway. But some general outlines have already been voiced by the authors (the Central Bank and the Ministry of Finance are the main ones on the IPC). The key innovation of the mechanism: funds will be transferred to the funded part not by the employer, but by the employee himself. The amount of deductions is 6% of the salary, but a person will reach this level progressively, increasing payments by one percent over five years.

The model is declared to be excellent: funded pension funds will receive the status of property and can be inherited; in some cases - for example, a serious illness - they can be used ahead of schedule, and not in parts in the form of monthly payments, but almost in full. A number of other wonderful options were mentioned.

But there is still no solution to the most important issue. If a citizen, according to the authors’ plan, saves money for his funded pension on his own, to what extent is this voluntary? Several years were spent discussing this issue, since initially the dominant idea was auto-subscription: with the best intentions, it was proposed to mechanically deduct money from the salaries of all workers who did not officially refuse this. But according to statistics, the median salary in the country is 25 thousand rubles. Where else can you write off “automatically”? It looks like only with a machine gun: these crumbs won’t yield any good.

It would seem that the president of the country put an end to the discussion. Authoritative sources claim that he approved the idea of the IPC, subject to the voluntary participation in savings.

But how many people are willing to voluntarily transfer funds? Especially taking into account the experience of a very recent “freezing” of previous savings? Deputy Director of the Institute of Social Analysis and Forecasting (INSAP) of RANEPA Yuri Gorlin recalled that since 2008, a mechanism has been in place that makes it possible to assess the activity of people in this area - the pension co-financing program. “It was really beneficial: for an annual citizen contribution of 12 thousand rubles. the state added its 12 thousand rubles. These were investments with a hundred percent return. But in practice, the “average bill” of private contributions over all these years was less than 20 thousand rubles. In terms of the size of the funded pension, this is less than 80 rubles. per month. That is, people did not even participate in such an extremely profitable program: because they do not have the financial capabilities and because there is no trust in the institution of savings,” the expert believes.

And in principle, can the poor majority of the population really save anything for their retirement? It is, perhaps, possible to launch an imitation of a “progressive savings model”, but to get real security for old age - don’t tell me!

Paradise is only for the rich

This spring, the idea of involving only relatively wealthy people in the pension savings model was discussed. The cut-off rate was named: salary from 80 thousand rubles. This initiative also stumbled over a fundamental bump: what can the official funded model give such people?

According to INSAP calculations, the return on mandatory savings in general for all non-state pension funds (NPFs) from 2005 to 2021 amounted to about 5% on average annually, despite the fact that the average inflation for this period was about 9%, and the deposits of the largest Russian banks gave returns are slightly higher than inflation. “Therefore, for those who have the opportunity to save, it is unlikely that saving for retirement using the products offered by NPFs may be attractive. Unless, of course, NPFs begin to show significantly better results in the future than in the past 15 years. But it is not yet very clear what significant prerequisites there are for this,” says Gorlin.

Indeed, why do non-poor people need an officially designated “piggy bank”, which, moreover, can be “frozen” for higher macroeconomic reasons without apologizing? However, if the authorities decide that saving for old age can only be done under their supervision, they will find a way to clearly “convince”: if we are talking about simply “cutting off” money from those from whom something can still be “cut off”, arguments are always found.

For whom will we save?

It is characteristic that during the discussion of the new pension model, the authorities never spoke about the age at which connecting to savings makes sense. But retirement is all about age. In the previous long-frozen model, let us recall, the generation older than 1967 was cut off from participation in the savings scheme: it was considered that they would not have time to collect anything worthy. Regarding the IPK, there is not a word about age. That is, if there is political will, an employee of any age can be connected to the system of deductions from wages. And even a 60-year-old person will, like a sweetheart, give away 6% of his earnings, if they “convince” him very clearly. The question is how much he will have time to save in the period remaining to his retirement. But this issue seems to be of little concern to the government.

The guess about the true types of power over the IPK system is confirmed by the recognition of Anton Siluanov a year ago: “For economic growth, it is necessary to attract long-term money. Where can I get them from? Therefore, we see the need to create a resource in the form of investment savings of our citizens, we are talking about pension capital.” After this passage, the high official did not fail to refer to world experience.

That's right: the savings of future retirees all over the world are indeed used for investment - citizens will not need the funds soon, but they can benefit the economy now.

But at the same time, Russian apologists for “world experience” forget to point out that in developed countries the pension system is not redrawn every five years. Indeed, a German young man begins saving for his pension from the very first salary received, relatively speaking, at the age of 25, and over the remaining 40-year working period he manages to provide for himself until the end of his days. But he, unlike us, is absolutely sure that his savings will not be “frozen” overnight with an uncertain future, that they will not launch the next pension reform at the most interesting moment.

If our compatriot, a hypothetical 25-year-old university graduate, had started saving for his old age in the same German manner 40 years ago, he would now be sitting broke. His savings would have been “eaten up” by crises three times, “frozen” in Sberkass in the early 90s, and in modern history – confiscated by a “temporary” moratorium.

By the way, Russian experts are unanimous that the viability of the current pension reform—as long as we are talking about raising the age—is very limited. In 10 years, another reform will have to be carried out, and its focus will again be on the retirement age. And no one can predict what will happen with the IPK.

Help "MK"

Milestones of pension reform in Russia:

— Until 2002, most pensioners received pensions from the state.

— In 2002, a radical pension reform began. The pension began to consist of three parts - basic, insurance and funded (individual). The opportunity to form a personal unit was given to men born in 1953 and younger (at that time they were 49 years old) and women born in 1957 and younger (45 years old).

— In 2005, citizens born in 1967 and older were excluded from the funded system.

— In 2010, the basic type of pension was abolished.

— In September 2013, the funded part of the pension was temporarily “frozen”: all employer transfers were sent to the insurance part.

— In 2021, the authorities announced the beginning of the development of a new model of pension savings - individual pension capital (IPC). It is declared that the IPC funds will receive the status of property.

— On January 1, 2021, a new pension reform was launched. For now, it is expressed exclusively in raising the retirement age: up to 60 years for women and up to 65 for men.

The positive side of the reform

After the government published a legislative draft to increase the retirement age, many Russians wondered whether this reform had any advantages. The following advantages of pension reform can be highlighted:

- The Pension Fund deficit is decreasing . The deficit of the Russian Pension Fund in 2021 was 106.6 billion rubles. In the spring it was proposed to increase it to 256.8 billion rubles. Every year the Pension Fund receives a transfer from the state treasury. Consequently, if the retirement age increases, this will make it possible to reduce the Pension Fund deficit and make its budget more balanced.

- It is possible to involve more citizens in labor relations and combat age discrimination. Raising the retirement age will mitigate the consequences of the demographic crisis of the nineties. At the moment, the population is aging, and the number of working-age citizens is decreasing.

- It is possible to increase pension payments . The head of the Accounts Chamber, Alexei Kudrin, believes that by increasing the retirement age, the quality of life of pensioners will increase by 30 percent by 2030. Deputy Prime Minister Tatyana Golikova claims that pension payments after the reform will increase by 1,000 rubles annually.

- It is possible to make regional budgets more balanced . Balanced regional budgets can be achieved due to a reduction in the amount of money spent on benefits for people of retirement age.

- The state budget will become more balanced . The population is aging, so budget costs to ensure a balanced pension system will increase. Increasing the retirement age reduces budget payments to the Pension Fund, therefore, a budget deficit will not arise even if the price of oil decreases. This makes the entire budget system more stable.

Putin postponed or canceled the reform until 2021

The media are actively disseminating information that the head of Russia, Vladimir Putin, has allegedly moved the start date of the pension reform by 1 year. However, not a single official media outlet or Kremlin representative office provides confirmation of this. Most likely, this news is fake.

Internet users believe that this “duck” about the cancellation of the reform was launched to reduce people’s dissatisfaction with the upcoming changes. The president himself has not yet commented on the sensational bill on increasing the retirement age, other than introducing his own amendments to it. Presidential press secretary Dmitry Peskov reports that the head of the Russian Federation does not take part in the discussion of the bill.

Reference! A petition was created on the Internet to Vladimir Putin and the government apparatus. Russians voted against pension reform. The petition was supported by 2,600,778 people.

The Pension Fund spoke about the indexation of pensions in the next three years

Old-age pensions will be indexed by 7.05% in 2021, by 6.6% in 2021 and by 6.3% in 2021, TASS reports with reference to the Pension Fund of Russia (PFR).

READ ON THE TOPIC:

For rural pensioners, an increase of 25 percent will be introduced from January 1, 2021.

The costs of paying insurance pensions for 2019-2021 were determined taking into account decisions to change pension legislation, prepared following an address by Russian President Vladimir Putin on August 29, the Pension Fund noted.

Thus, the average monthly increase in old-age insurance pensions for non-working pensioners by one thousand rubles annually was taken into account, ensuring an increase in old-age pensions to 20 thousand rubles by 2024.

In addition, from April 1, 2021, social pensions will be indexed by 2.4% according to the growth index of the pensioner’s living wage (PMP) for the previous year. After this, the average annual amount of social pensions will be 9.2 thousand rubles, that is, 104.2% of the PMP, explained the Pension Fund.

Also, in order to maintain a minimum level of material support for non-working pensioners, the Pension Fund budget includes expenses for a federal social supplement up to the level of the subsistence level of a pensioner in the region.

On July 19, the bill on changes to pension legislation passed its first reading in the State Duma. On August 21, experts, social activists, and politicians expressed their opinions on this issue at public hearings in parliament.

On August 29, President Vladimir Putin made an address in which he voiced his proposals for pension changes. The president's amendments will be submitted to the State Duma, where the second reading of the document will take place on September 24.

READ ON THE TOPIC:

The President signed laws on increasing the retirement age and social security standards (benefits)

. According to the bill, the PFR budget for 2021 was formed on income in the amount of 8.6 trillion rubles and on expenses - 8.6 trillion rubles, which is 358.2 billion rubles (at 104.3%) in terms of income and 115.9 billion rubles (101.4%) in terms of expenses higher than last year.

To provide financial support for pensions, benefits and other social benefits financed from the federal budget, next year it is planned to receive transfers from the federal budget (3.3 trillion rubles, of which 1.9 trillion rubles are for the payment of insurance pensions). The head of the Pension Fund (PFR), Anton Drozdov, commenting on the pension changes proposed by the Government to RIA Novosti, said that the PFR budget deficit will increase and the growth of pensions will slow down if measures to improve the pension system are not taken.

Comments and feedback from people about the changes

Below you can find out what Russian citizens think about pension reform. The real opinions of Internet users are given:

We need to go to the streets and demand answers there if we are not heard on the Internet.- People will go to the barricades.

- The government has deceived me three times already. Enough is enough, I can't stand it anymore!

- There are no words. Putin, Medvedev - don’t you want to retire?

- This fund is not a pension, but a funeral.

- I want to look at my own pension, and not die right at the machine.

- I don’t believe that this inhumane bill has even begun to be considered.

- Everything that the nouveau riche has must be confiscated.

- First create places for employment, and then carry out the reform! Ugh!

- This is genocide. I suggest that deputies look for work themselves after 40 years.

- Enough, stop building Crimean bridges and fighting in Donbass with my money.

- They've gone completely crazy.

- Reduce your salaries, nonhumans, to the subsistence level. And try to live like this for the rest of your life.

- Concentrated arrogance and lies. It's time for the president to become a pensioner himself.

As you can see, the pension reform did not receive popular support. It is possible that the bill will still be changed; adjustments will be made to it aimed at reducing the rate of growth of the retirement age.

Insurance and social pensions in the Russian Federation

Social pensions are a special category of pension provision. They are guaranteed at the state level and are paid to all pensioners who do not have rights to an insurance pension. However, they are appointed later for five years.

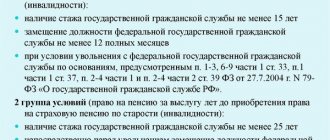

In order to be assigned an old-age insurance pension, a number of conditions must be met:

New rules for indexing pensions. What changes can retirees expect from the new year?

- developing a certain amount of work experience (in the future, at least 15 years);

- minimum pension points (calculated every year of employment).

At the end of the transition period due to the introduction of the new pension system, the minimum number of points required to assign a pension (insurance) will be 30. As you can see, the requirements are quite serious, so every year it is becoming more and more difficult for citizens of the Russian Federation to meet them.

Therefore, we can assume that every year more and more social pensions will be assigned (of course, this trend will only occur if the conditions for assigning insurance ones are not revised), and people will retire even later.