In conditions of an unstable economy and a difficult financial situation in the country, many enterprises are closing or are reducing their workforce in order to survive in the market. People who will soon retire may also be fired, and it will be much more difficult for them to get a new job. So that they are not left without a livelihood, this category of people can receive an early pension.

Early registration of pension in case of staff reduction at the enterprise

In accordance with Article 32 of Federal Law No. 1032 of April 19, 1991, Russians have the right to become pensioners early if they are laid off from their jobs for reasons that do not depend on them.

The text of this document reads:

“According to the proposal of employment centers, if there is no opportunity to employ unemployed Russians who have not reached the age of eligibility for old-age insurance pensions and have a work experience of at least 25 and 20 years for males and females, respectively, or who have the above-mentioned experience and the required length of service in the relevant types of work, which give the right to early registration of old-age insurance pensions in accordance with Federal Law No. 400 of December 28, 2013 “On pension insurance”, and were dismissed due to the closure of the company or the end of the work of the individual entrepreneur, reducing the number or staff of a company's employees, individual entrepreneurs, with their consent, pension provision may be provided for the period until they reach the age that entitles them to an old-age insurance pension, including one issued ahead of schedule, but not earlier than 24 months before reaching the established age. This pension provision is assigned according to the procedure and on the conditions provided for by the Federal Law of December 28, 2013 No. 400 “On insurance pension provision.

Upon reaching the age that gives the right to old-age insurance payments, including those issued ahead of schedule, a citizen has the right to switch to an old-age insurance pension.

Payments provided in accordance with this paragraph may include a pension for long service, in accordance with Article 7 of the Federal Law “On State Pensions in Russia”.

The standards according to which employment centers issue proposals for early registration of pensions for unemployed Russians are established by the Russian government apparatus.

Upon employment or resumption of other activities provided for in Article 11 of the Federal Law of December 28, 2013 No. 400 “On Insurance Pension Provision”, the provision of payments that are established for unemployed Russians is terminated. After termination of employment, pension benefits begin to be provided again.

The costs associated with the provision of pension payments are borne by the Pension Fund. The state treasury will subsequently compensate for the expenses incurred by the Pension Fund for the payment of early pensions to laid-off citizens.”

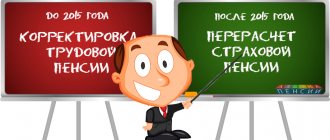

How is it calculated?

In the process of calculating early pensions, the same methodology is used as in calculating labor pensions. The main thing is the final amount accumulated from contributions to the Pension Fund and, therefore, the average monthly salary. Plus, this type of payment is indexed annually.

In addition to this type of accrual, a citizen can apply for a long-service pension. This is enshrined in the Federal Law “On State Pension Provision in the Russian Federation”.

The pensioner has the right to determine his preferred method of receiving a pension by notifying the Pension Fund office, where he applies for early retirement. He can choose one of the following payment methods:

- Handing over the amount at the post office (for this he will need to visit the post office every month, taking the title documents).

- Delivery of pension to your home (the postman will hand over the parcel).

- By transfer to a bank account or plastic card.

- Transfer of the amount through proxies (to withdraw money, a person must present a power of attorney certified by a notary).

The chosen method of receiving funds must be indicated in the application submitted when applying for early retirement.

Pension amount

A person who has been laid off may legally oblige his last employer to pay him an average salary in the next two months from the date of dismissal.

So, to begin with, a person receives payments from the employment service. Unemployment benefits are as follows:

- The first three months after registration with the employment service - 75% of the average monthly salary received at the last place of work.

- For the next 4 months, the benefit amount is 60% of the previous average monthly salary.

- For the last 5 months, the amount of allowance has been reduced to 45%.

Therefore, you can be on state support for no more than 1 year. The Pension Fund of the Russian Federation is responsible for payments, and their size is indexed annually by the Government. As soon as a person becomes a recipient of state benefits, he is removed from the register as unemployed and the right to the corresponding benefit is taken away.

So, payments for early retirement are calculated using the same formula as when determining the insurance pension. It looks like this:

It is important to know! Social card for pensioners

Amount of insurance payments = Number of accumulated pension points x Cost of 1 pension point in the current year + Fixed amount currently valid for different categories of pensioners.

Let's reveal some nuances.

- As of 2021, the cost of 1 pension point is 78 rubles. 28 kopecks

- The constant value is 4805 rubles. 11 kopecks, but for beneficiaries this amount increases.

If, based on the results of the calculation, it turns out that the due payment is less than the subsistence level in the region of residence, then the pensioner is entitled to an additional payment up to this figure. The money for this no longer comes from the Pension Fund, but from the municipal budget.

At what age is it possible

To retire early if there is a reduction in staff, you must reach pre-retirement age (PRA). This means that early granting of “pensioner” status is possible if the Russian citizen has no more than 2 years left before the onset of the pension period. It is likely that soon, against the backdrop of the pension reform, the PPV will be reduced, which will significantly expand the circle of Russians who have the right to become early retirees upon dismissal due to staff reduction.

Who can retire early?

Early assignment of pension payments to laid-off Russians is carried out under the following conditions:

A citizen is fired from his job due to the closure of a company

The enterprise was closed or the activities of the individual entrepreneur were terminated, and a reduction in the number of personnel of the enterprise or individual entrepreneur was established. Accordingly, the dismissal must occur for reasons that do not depend on the Russian. If a person resigns on his own initiative, he cannot become a pensioner early. This restriction was introduced by the government apparatus in order to prevent cases when a citizen specifically quits his job in order to start receiving payments.

In addition, it will not be possible to issue payments ahead of schedule in situations where a person is fired for the following reasons:

- the employee does not correspond to the position he occupies or the job duties performed due to low qualifications, certified by an attestation audit;

- the employee repeatedly failed to fulfill his work obligations without good reason, receiving disciplinary sanctions for this;

- An employee grossly violated work discipline once:

- missed work, that is, was absent from work without a valid reason throughout his entire shift or for more than 4 hours in a row;

- appeared at the workplace while intoxicated with alcohol, drugs or other toxic substances;

- disclosed a secret protected by law that became known to him in connection with the performance of his work obligations (including disclosure of personal data of another employee);

- committed theft, embezzlement at work, intentionally destroyed or damaged company property;

- violated labor safety standards if such a violation led to serious consequences (industrial accident) or created a real threat of these consequences.

Also, early pension is not issued upon dismissal for the following reasons:

- an employee who directly services material assets committed guilty actions that led to the employer losing confidence in him;

- an employee who performs educational functions has committed an immoral act that is incompatible with further work;

- the head of the company or his deputies once grossly violated their own work obligations;

- the citizen presented the employer with false documents when drawing up an employment agreement.

The citizen has a maximum of 2 years left until the PV

Accordingly, the opportunity to receive early pension payments appears for men at 63 years of age, and for women at 58 years of age. If you have the right to preferential pension provision - at 58 and 53 years old, respectively.

A Russian citizen has a work experience of at least 25 and 20 years for males and females, respectively

When calculating length of service, both direct work experience (periods during which the Russian carried out work activities) and other periods (for example, military service, temporary incapacity, maternity leave) are taken into account.

Assignment of payment amount

The amount of payments when applying for a pension early is calculated in the same way as for a standard pension. The pension points (PB) accumulated by a citizen are multiplied by the cost of one of them, and then summed up with a fixed payment.

Let's look at the calculation procedure using a specific example. Citizen V. accumulated 70 PB during his entire working life. As of the day of filing an application for an early pension, the cost of one PB was 90 rubles. We multiply 70 by 90, we get 6300. Add to 6300 the size of the fixed payment, for example, 5000 rubles. We find that citizen V. will receive 11,300 rubles monthly. as a pension.

Registration of early pension

To apply for a pension early, you must submit an application to the employment service. The institution’s employees will provide you with a referral for registration of pension payments. With this paper you need to visit the Pension Fund within 30 days. Remember that if more than 30 days have passed since the referral was issued and you have not visited the Pension Fund of Russia, this document will be cancelled. The only reason for prolonging the period of its validity is the illness of a citizen.

It happens that a Russian, having issued payments, finds a new job after some period of time. According to the legislative framework of the Russian Federation, in such a situation the pension ceases to be provided. The restoration of early pension provision can only be carried out if the Russian becomes unemployed again.

How to apply?

In case of layoffs, employees close to retirement age can apply for early retirement. But this measure allows you to remain with a source of livelihood even after dismissal.

This opportunity is enshrined in Federal Law No. 1032-1. Early retirement in the event of layoffs of employees near retirement age can be received by those who have no more than 2 years left before retirement. Plus, other appointment conditions are established:

- Relevant work experience of at least 20 (for women) or 25 (for men). It may be less if you work in special working conditions.

- Registration with the Labor Center as an unemployed person.

- Based on recognition as unemployed, a person must receive an official certificate of impossibility of further employment. This is not so difficult to do: as already noted, it is more difficult for older citizens who will soon reach retirement age to find a job.

- The applicant has reached the appropriate age: 53 years for women and 58 for men. Please note that the retirement age will increase in the future, so these limits will shift annually.

Only if these conditions are met can a citizen be granted an early pension.

But keep in mind that the Central Employment Service will do everything possible to find a job for a citizen, and not to accrue state benefits to him ahead of time.

The employment center can also offer further assignment of allowances. However, the citizen has the right to refuse this. But if he agrees, he will receive payments until he reaches retirement age. Then he can switch to insurance benefits or another type of security.

You can retire ahead of schedule in the manner prescribed in the Federal Law “On Employment in the Russian Federation.” To begin with, dismissed citizens can count on receiving an average monthly salary for up to two (maximum three) months. This responsibility falls on the former employer. But if during this time a person has not found a job, payments stop.

The former employee is recognized as unemployed and will be able to count on unemployment benefits if he registers with the employment center. But dismissed persons close to retirement age with the required length of service (25 and 20 years for men and women, respectively) can receive payments for two weeks.

The higher the length of service, the longer you are allowed to be on government support. But when receiving benefits for three years, its amount cannot exceed the total amount for 2 years.

To begin registration, a citizen must submit an application to the service. Once accepted, it will become the basis on which the person will be offered early retirement. Then this document must be submitted to the local branch of the Pension Fund of the Russian Federation within a month, otherwise the application will be declared invalid. The filing deadline can only be extended if the applicant is ill.

It is important to know! What kind of pension do former presidents receive?

Therefore, before applying for this type of payment, a person must be recognized as unemployed.

But it is classified in this category under the following conditions:

- The work book contains a corresponding entry about dismissal due to staff reduction from the last place of work. This payment is provided for this reason only.

- The applicant was registered at the territorial office of the Central Employment Service as an unemployed person.

- The employment service will offer a person a job, and he should not refuse it more than 2 times.

- The applicant has accumulated at least 11.4 pension points by the time of submitting documents.

The insurance period is understood as the total period of work activity during which contributions were made to the Pension Fund of the Russian Federation. They take into account both the duration of work and the performance of other activities, for example:

- Serving in the army.

- Study in secondary and higher educational institutions.

- Staying on sick leave (for health reasons, to care for children or disabled people, and in other situations established in Federal Law No. 173).

The longer the length of service, the longer the benefit accrual period. For each additional year in excess of the established norm, in the presence of which it is possible to issue an early pension, a person is entitled to 2 weeks of allowance. But the total period of early payments cannot exceed 2 years.

The district employment service provides the applicant with a written recommendation on the possibility of providing a pension ahead of schedule. It must be submitted to your local social security office. Plus, bring other evidence there:

- Application for payment, written on behalf of the future pensioner.

- Applicant's passport. Persons who do not have Russian citizenship can apply for a residence permit instead.

- Employment history.

- A document confirming registration at the citizen’s place of residence (temporary or permanent).

- SNILS.

- Men additionally submit a military ID.

- Certificate of pension insurance.

- Copies of documents (must be notarized) on deductions and deadlines for transferring funds to the Pension Fund of the Russian Federation.

- Certificate from the last place of work about the average salary for any period in the last five years of employment.

It is important to know! Thirteenth (13th) pension

This is a general list of documents. It, at the discretion of the authorized body, may be supplemented with other title documents:

- Certificate of change of personal data (full name, etc.).

- Certificate of completion of training at a specific educational institution.

- Certificate about the presence of disabled persons in the family, under 18 years of age (their birth certificate is needed), about dependents (then a paper must be submitted from the local government, housing and communal services, or a corresponding court decision).

In what cases can they refuse?

In certain situations, a Russian may be denied pension payments ahead of schedule. For example, a refusal will occur if a citizen several times refuses job offers from the employment service . In addition, payments will be denied if the amount of benefits for the unemployed is reduced.

The opportunity to become a pensioner ahead of schedule when staffing is reduced allows citizens to remain confident that they will not be left without a source of income if there are problems in the organization. The main thing is to comply with the conditions under which such a pension is awarded.

Early pension for the unemployed

First of all, a citizen must register with the municipal employment center.

This is a mandatory condition to confirm your unemployed status. If there are less than 2 years left before the statutory retirement age, the labor exchange employees themselves will offer the applicant to arrange early payments. Let us note that the procedure is possible with the consent of the citizen, on the basis of a personally drawn up written application to the Pension Fund.

Having received the application, employment center specialists prepare the following documents:

- proposal to the Pension Fund for early pension payments;

- an extract about the periods of work that are included in the insurance period.

Download for viewing and printing:

Statement of claim for early pension assignment

With these documents, the citizen applies to the Pension Fund, where a decision will be made on granting him an early pension. Note that this is the required minimum. When applying, Pension Fund employees give the applicant their list of necessary documents to be prepared.