All working citizens in one way or another think about their future pension security. The growing interest in this topic is evidenced by the fact that even very young workers who are just starting their careers know: the size of their pension depends on pension points and insurance coverage. In order to control the process of forming personal indicators in the Pension Fund, it would be a good idea to find out how to find out your work experience using SNILS.

Types of work experience in the Russian Federation

Based on legal requirements, different periods of an employee’s work activity are taken into account differently.

Conventionally, four types of experience can be distinguished:

- General labor.

- Work experience in the civil service.

- Special.

- Insurance.

The most important thing for the working population is to take into account the insurance period.

The insurance period is calculated down to the day, and the right to a labor pension and the amount of temporary disability benefits depend on how long it amounts to as a whole.

The length of service includes only the period when social contributions were paid for the employee. As an exception, the insurance period includes those days and months when a person was on sick leave, on maternity leave for up to one and a half years, did military service or was registered at the labor exchange.

Control over the accumulation of experience

Many young employees feel that the total duration of their official employment does not matter much. However, to receive a labor pension upon reaching 55 or 60 years of age, a Russian citizen must earn at least 7 years of full-fledged insurance experience. In the future, until 2024, this figure will increase to 15 years.

If the documented length of service is below that established by law, the employee may retire later than the established age, and his monthly pension will be paid in a fixed amount at the level of social benefits. From this point of view, monitoring the accumulation of insurance experience will help employees, firstly, track the size of their future pension, and secondly, it will encourage them to take active action to change their employer if it does not transfer pension contributions to the employee’s personal account.

What is work experience

The concept of length of service, although it still appears in pension legislation, has almost completely lost its practical meaning. When using this term, in most cases they now mean insurance experience , i.e. carrying out labor or entrepreneurial activities, during which insurance contributions were transferred for the citizen (or by himself) to the Pension Fund of the Russian Federation.

This also includes those periods in which the citizen did not make a contribution, but performed socially significant or socially useful activities (for example, cared for a child, an elderly person, a disabled person, performed public works in the direction of the employment service, etc.).

Reference! The work experience itself is taken into account when calculating periods of service in accordance with the previously effective pension legislation. The Law “On Labor Pensions” has not been repealed and is used in a number of cases to calculate the length of service that gives the right to an old-age pension, including early (preferential) provision.

Types of work experience in the Russian Federation

Based on legal requirements, different periods of an employee’s work activity are taken into account differently.

Conventionally, four types of experience can be distinguished:

- General labor.

- Work experience in the civil service.

- Special.

- Insurance.

The most important thing for the working population is to take into account the insurance period.

The insurance period is calculated down to the day, and the right to a labor pension and the amount of temporary disability benefits depend on how long it amounts to as a whole.

The length of service includes only the period when social contributions were paid for the employee. As an exception, the insurance period includes those days and months when a person was on sick leave, on maternity leave for up to one and a half years, did military service or was registered at the labor exchange.

Control over the accumulation of experience

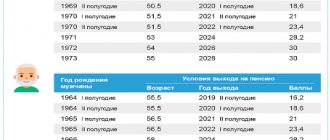

Many young employees feel that the total duration of their official employment does not matter much. However, to receive a labor pension upon reaching 55 or 60 years of age, a Russian citizen must earn at least 7 years of full-fledged insurance experience. In the future, until 2024, this figure will increase to 15 years.

If the documented length of service is below that established by law, the employee may retire later than the established age, and his monthly pension will be paid in a fixed amount at the level of social benefits. From this point of view, monitoring the accumulation of insurance experience will help employees, firstly, track the size of their future pension, and secondly, it will encourage them to take active action to change their employer if it does not transfer pension contributions to the employee’s personal account.

Why is it necessary to control the insurance experience?

For some reason, many people mistakenly believe that information about the insurance period is not important to them, because they will be able to receive a pension in any case: they will reach retirement age, that’s all. But with the reform of the pension system, this will not happen. To receive a pension, it is necessary that a person has enough insurance experience to apply for a pension. In 2021, to receive an insurance pension, you must have at least 11 years of work experience and 18.6 points. But every year the insurance period increases and will ultimately amount to 15 years. And it seemed that a person works all his life and therefore he is entitled to a pension in any case, because he has enough experience.

But here is the main paradox: the amount of time actually worked may not be equal to the amount of insurance experience.

The insurance period is the number of years for which the employer pays contributions for its employee. If a person does not work officially, or he did not work full time, then the amount of actual length of service may become an unpleasant surprise for the employee. Therefore, to prevent such a situation in the future, it is best to check such information periodically. Moreover, every SNILS owner has access to it. The service is absolutely free.

Methods for checking length of service

Information about the number of years worked and accumulated pension points is personal and is protected at the legislative level. Therefore, you can access it only after going through the identification procedure and confirming that the citizens’ data will not be used for other purposes.

However, to find out about the status of your personal account, you do not have to contact many authorities. Having an insurance certificate and passport in hand, any working citizen can easily figure out how to find out his pension experience according to SNILS.

Based on passport data

The citizen’s passport itself, like that of another person, is needed, first of all, when applying to the Pension Fund office at the place of registration. Passport data will be required when registering on and to gain access to.

Find out in more detail why else such an identification document of the applicant as may be needed.

If SNILS is missing or does not correspond to passport data

The number indicated on the insurance certificate is assigned to a person once. Moreover, parents can apply for it even for a newborn, long before their child reaches working age. The document contains information about the owner: full name, date and place of birth, gender and calendar date of registration with the Pension Fund. But to identify the person applying for information about the work experience, the certificate itself is not enough; it is also necessary to present a document issued by the authorities of the Ministry of Internal Affairs of the Russian Federation.

If for some reason a person changes his last name or first name, then the data on the certificate must also be updated. Without up-to-date information, you will not be able to get an answer during a personal visit to the Pension Fund.

Via employer request

This form is used mainly by employers themselves. To find out the duration of the employee's insurance period, the employer can write a request to the Pension Fund. The employee’s TIN and his/her are used as an identifier. If the information provided is sufficient, Pension Fund inspectors will respond within ten days.

Making a request on behalf of the company’s management is also advisable for those employers who prefer not to rely on the data specified in the resume, but believe that there is no better way to check the employee’s place of work using SNILS.

Where is verification possible?

It is clear that all information is available only in the Pension Fund. There are two reliable ways to check your experience:

- Personal appeal.

- Online request.

In both cases, you must have your passport and insurance certificate at hand.

Contacting the Pension Fund

A personal appeal provides an excellent opportunity to find out the length of service in the Pension Fund, as well as clarify the data on the pension coefficient. The option absolutely guarantees the correct result. In addition, the Internet is not available everywhere yet and the online service may temporarily not work.

You need to arrive at the regional office (convenient for visiting can be easily found on the Foundation’s website), present your documents to the employee or write an application in which you choose the method of obtaining information. The response period to a written request is ten days.

It’s better to immediately ask for everything to be done on the spot. A qualified specialist will provide information in a few minutes and explain the nuances of calculating length of service, and at your request will also explain what kind of pension you can expect. Moreover, with this option there is a chance to immediately correct possible inaccuracies.

Through the Internet

Of course, it’s much easier to find out your work experience using SNILS online, and this process looks modern. There are two main resources for this:

- State Services portal, launched in 2010.

- Website of the Pension Fund, developed in 2015.

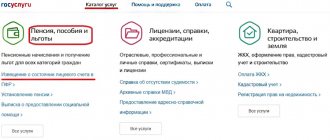

On the State Services portal

The full range of capabilities of this portal is revealed exclusively to verified users. For this purpose, you will first have to create a verified account.

This is available at any branch of the Pension Fund or Russian Post. The process may take up to two weeks, but you will only have to do this once. But if you have such an account, there are a few steps left to reach your goal:

- Log in to your personal account (you have a choice: by phone number, email address or SNILS).

- Enter the “Service Catalog”, and then go to the “Pension, benefits and benefits” section.

- Select “Notification of personal account status.”

- Read the information about the service and confirm receipt by clicking the appropriate button.

- A file with the requested information will appear in a new window, which you can simply view, save or send by email.

This search option is also available in the mobile application. The operating algorithm is completely identical.

Via the PF website

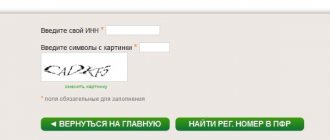

This resource allows you to receive information about the accumulated vehicle and pension points, understand whether insurance premiums are transferred by the employer, and calculate your future pension using a calculator. To find out the insurance period in the Pension Fund via the Internet, you should:

- Log in to the official website of the foundation.

- Find and open the “Personal Account” section.

- Click on the login button located in the upper right corner of the page.

- In the new window, click on the large “Login” icon.

- In this case, an account in the Unified Identification and Authentication System is used. For this reason, at this stage, a transition is made to the State Services website for confirmation.

- Specify the required one.

- The system will generate a Word file that you can immediately save or print.

Verification methods

Today, anyone or a person working in the country under special registration conditions has the opportunity to find out about the status of an individual insurance account.

This can be done in several ways:

- Personal request at the Pension Fund branch.

- Through an account on the State Services website.

- Through the operator of the servicing bank.

- Having gained access to the citizen’s personal account.

In person at the Pension Fund branch

For those who are interested in how to find out their work experience in the Pension Fund, a personal visit to the local Pension Fund office may seem like the most troublesome and time-consuming way. But if online services are unavailable for any reason, then to successfully visit the Pension Fund you need to take your passport and SNILS with you. After confirming your identity, a fund employee will ask you to write a statement in the prescribed form and choose a method for obtaining the requested information.

But even if you fill out the form in advance, you won’t be able to significantly shorten the process. The response time to a written request is approximately 10 days. The only convenient thing about a visit to the Pension Fund of Russia is the ability to immediately make clarifications if inaccuracies are discovered. This will also require supporting documents and a passport.

Online access

For those who prefer to use Internet services rather than find time to visit government agencies, the services of the State Services portal or the Pension Fund of Russia website will help you find out your work experience using SNILS online.

To obtain information about your work experience, you just need to go through a simple registration procedure on the government website and completely fill out your profile: indicate your passport details, date of birth, mobile phone number and SNILS.

Without providing complete information, that is, without having a verified account, access to all services of the service will be denied. To activate your account, you need to follow all instructions on the e-government website.

Through an account on the State Services website

In addition to providing complete information during registration, those wishing to receive personal data must undergo a verification procedure:

- In person at the nearest Pension Fund branch.

- Through Russian Post.

- Using a personal digital signature or a universal electronic card (UEC).

By doing this once, you will get full access to all sections of the site.

You must fill out a request form on the website or through the application on your smartphone.

The requested information is stored on the Pension Fund servers and will be provided after verification and processing in electronic form. Then it can be sent by mail or saved on your hard drive, it all depends on the choice of the employee.

In your personal account on the PF website

The State Services portal combines the websites of several departments, providing users with the opportunity to obtain the necessary certificates and pay taxes or fines, while eliminating the need to register on the website of each department. One of these specialized services is the personal account of the insured person for visitors to the official page of the Pension Fund of Russia. In order to use its functionality, you also need to receive confirmation on the State Services website.

Below are simple instructions on how to find out the insurance period in the Pension Fund via the Internet.

- Using the received login and password, mobile or electronic digital signature, log into your account.

- Select the required service (information about generated rights).

- The system will provide brief data on the total length of service, accurate to the day, and the amount of pension points.

Find out the length of service using SNILS: all ways.

Ideally, the pension (insurance) length of service should be constantly monitored in order to exclude dishonesty of the employer, who may stop making contributions to the Pension Fund or do so from the minimum, and not from the actual salary.

In this case, the issue can be resolved immediately, but after several years and with frequent changes of jobs, it will be impossible to prove anything.

In the Pension Fund.

know your length of service in the pension fund using your passport and SNILS. Both of these documents are provided upon a personal visit to the regional branch of the Pension Fund.

The citizen is given an official document, stamped and signed, which provides a detailed calculation of insurance contributions and total length of service.

This option is most optimal if you need to save data about your experience. For online requests and without a stamp or employee signature, the printout is not considered a legal document. If presented in court, it has no force.

Through State Services.

Having a confirmed account on State Services, you can send a request to the Pension Fund online. To do this, select and wait for a printout in PDF form or any type of document in electronic format.

The information is then transferred to paper using a printer.

“Personal account” in the Pension Fund of Russia.

If you do not have an account on State Services, you can register directly on the Pension Fund portal and use the services of the government agency.

Here you can find out your work experience using SNILS online; to do this, you need to order a statement of your personal account, which will be sent to your email address.

Next, you can view the information in electronic format or print it out.

PFR website

Additional documents for verification

In order to check your work activity according to SNILS, an insurance certificate alone will not be enough; to obtain information about your work experience, you must also present a passport.

If a citizen’s personal data has changed, then for a visit to the Pension Fund the following documents must be prepared:

- or divorce;

- certificate of change of surname or first name;

- certificate of adoption;

- papers on making any other changes to the information contained in the insurance certificate.

In case of any inaccuracies in the data of the Pension Fund and the employee himself, it will not be superfluous to have copies of other supporting documents with you. Timely elimination of any error will allow you to avoid difficulties when changing jobs or applying for pension payments.

conclusions

Numerous ways to check length of service, paid fees and accumulated points are not a waste of time and public funds. Comprehensive control allows not only to track the accumulated pension experience, but also to respond in a timely manner to errors and violations made during the preparation of papers. By controlling his pension savings, an employee can make corrections even before reaching the age limit, clarify information about the length of service, including “harmful” ones, and also decide on how to use the funded portion.