- December 1, 2020

- Documentation

- Ekaterina Gorbatova

Every person who has citizenship of the Russian Federation and has reached the age of 14 is required to have an identity document. In Russia, this document is a passport. To obtain it, you must contact the authorities of the Main Directorate for Migration Affairs of the Ministry of Internal Affairs (formerly the FMS) with a corresponding application in Form 1P to replace the passport or issue it. If the replacement of a passport is associated with its loss or theft, you need to contact the Ministry of Internal Affairs department, they will issue a temporary identity card and make a record of the loss of the passport in their database. In all other cases, the application can be submitted to the MFC or online through the public services portal.

What documents are needed to issue or replace a passport?

Before contacting the Main Department of Migration of the Ministry of Internal Affairs, each citizen must collect a number of documents confirming the legal grounds for issuing or replacing the main document.

Currently needed:

- birth certificate;

- old passport (in case a replacement is necessary);

- 2 photos;

- a receipt confirming payment of the state fee;

- marriage certificate (it is needed, firstly, if the passport is being replaced due to a change of surname, and secondly, without it they will not put a marriage stamp in the new passport);

- birth certificates of minor children, the data of which is entered into the new document.

Salary certificate for subsidy: form 1

Certificate request form 1 for a subsidy is a document that is sent to the employer of a potential recipient of state assistance to clarify all income and deductions for the six-month period preceding the date of application to the competent government agency.

- Information about the employee (direct recipient of the subsidy):

- FULL NAME;

- SNILS;

- Place of work (main or additional);

- Employer details:

- Legal entity – legal address of the enterprise;

- IP – address at the place of registration of the citizen, his passport details, TIN, contact information);

- Information about earnings and other accruals of a specific employee:

- For every month;

- Total for the year;

- For the current month, if there is sufficient income;

- Additional Information;

- Signature of the head of the employing organization and the chief accountant.

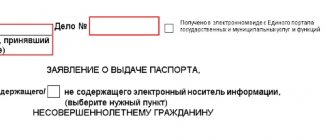

Drawing up an application

An application for issuance or replacement of a passport is submitted to the passport office. A sample of Form 1 is always available at the information stand, but it is better to familiarize yourself with the rules for filling it out in advance to avoid problems with obtaining a passport. In addition, it will save you time when filing documents in person.

- When submitting Form 1 to the passport office, it is completed in person by hand using a ballpoint pen with black or blue ink.

- Handwriting must be legible. It is best to write in block letters.

- Corrections should not be allowed. If an error occurs, then there is nothing left to do but fill out Form 1P again.

- It is imperative to calculate the space on the form, since no abbreviations are allowed, except in cases where the abbreviations are in the supporting documents.

Request form 1

A salary certificate is obtained from the source of income. For example, if a citizen works for a government organization or for an entrepreneur, then you need to contact the personnel department.

The company cannot refuse to provide this official document. If a person works in two organizations at once, then in all places you need to take a certificate. The manager must issue the document free of charge within three days.

You should first submit an application requesting a certificate of income. You need to write an application addressed to your superiors in free form.

After this, all you have to do is wait to receive the finished document from the manager, and then you can apply for a subsidy.

You can submit an application for government assistance electronically through government services, or contact the social service department in person.

Documents required for the subsidy:

- salary documents for all family members;

- certificates of registration;

- documents on kinship.

- certificate of no debt;

- checks or photocopies thereof for utility bills;

- statement;

- a copy of the passports of those who live with the person in need;

Government authorities may require information about the ownership of real estate, data on the payment of pensions and benefits. The application is reviewed within 10 days. If government employees give a positive answer, the subsidy will be credited this or next month.

The person who will receive financial assistance must open a bank account or provide government authorities with existing details. If a refusal occurs, it can be challenged in court. Any person who is employed can receive a salary certificate for the subsidy.

All he needs to do is contact his superiors and put his request on paper. Certificate for subsidy is needed:

- young families in which both people are under 30 years of age;

- military personnel and people in reserve;

- disabled people.

- people who work in government agencies;

- low-income families;

- orphans;

- a large family with three or more children under 18 years of age or 23 years of age (while undergoing training in government institutions or being conscripted in the army);

- veterans and participants of the Second World War;

A more complete list of grounds for receiving subsidies can be found in the legislation, for example, in Article 51 of the Housing Code of the Russian Federation. All listed citizens, if necessary, have the right to issue a certificate of income, which is needed to receive government assistance.

The income certificate is a mandatory document, so it must be prepared in advance.

This should be taken care of about a month or two weeks before contacting the government agency.

Front side of the form

Column No. 1. The full last name, first name and patronymic of the citizen submitting the documents are indicated. The data is indicated as it should appear in the new document. That is, if the passport is replaced due to a change in the last name, first name or patronymic, then new data is indicated.

Column No. 2. A mark is placed on the applicant’s field in the form of X or V in the corresponding box.

Column No. 3. Date of birth is entered in the format “hh.mm.yyyy”.

Column No. 4. The place of birth is written exactly as indicated on the birth certificate, that is, if it was during the existence of the USSR, then it is indicated as it was customary under the administrative-territorial division that existed then.

Box No. 5. Marital status must be indicated in the application submitted to the passport office. Form 1 involves one of 4 options.

- “I am married” - in this case, the fields relating to the identity of the spouse are also filled in: his last name, first name and patronymic, date of birth, as well as the date of marriage and the name of the body that carried out its registration, and the latter is indicated letter by letter exactly like this, as stated on the marriage certificate.

- “Not married” - when such data is indicated, the columns regarding the spouse remain empty.

- “Divorced/Divorced” - in this case, the details of the former spouse are indicated, and information from the divorce certificate is entered - the date and name of the registering authority.

- “Widower/Widow” - in this case, the details of the deceased spouse are not indicated in the application.

Box No. 6. Here you must indicate the details of the applicant’s parents. They are entered as they appear on the birth certificate, even if one or both parents have already died. This information is needed to additionally confirm the citizen’s identity.

Column No. 7. Place of residence is indicated according to registration data (permanent or temporary). Column No. 7.1 is filled in only if the application is not submitted at the place of registration. Then you must indicate the full address of your place of residence.

Column No. 8. If the citizen submitting the application has ever had citizenship of another country, then in this column you need to put an X or V icon next to the word YES and indicate in detail which country he had citizenship of. If there is no other citizenship, then simply put an X or V next to the word NO.

Column No. 9. The actual reason for the appeal is indicated here. If a citizen receives or changes a passport upon reaching a certain age, then this is indicated. Initially, citizens who have reached the age of 14 are required to obtain a passport in the Russian Federation, and a replacement is made at 20 and 45 years of age. Also, as a basis for replacing the main document, you can indicate such reasons as changing the surname due to marriage, changing the surname, first name or patronymic for other reasons, changing gender, as well as the unsuitability of the document for further use (damage or wear and tear) or its loss. In addition to all of the above, a passport replacement may be required if the applicant’s appearance has changed significantly (for example, after plastic surgery) and it is impossible to recognize him in the photo in the old passport. In this case, the column is filled in as in the photo below.

Column No. 10. To be filled out by the applicant in the presence of an employee of the Main Department of Migration of the Ministry of Internal Affairs, who accepts the documents. The date is indicated when the documents were accepted.

Column No. 11. The data of the old passport, if any, is entered here. If the passport is lost, then its data is entered from a temporary identity card issued by the police.

Forms of primary accounting documents

The forms of primary accounting documents developed independently by the organization, used to document the facts of economic activity, for which standard unified forms of primary accounting documents are not provided, are approved when forming its accounting policy (clause 5 of PBU 1/98 “Accounting Policy of the Organization”; approved by order of the Ministry of Finance of Russia dated 09.12.98 No. 60n).

Such independently developed documents can be: reports and memos (substantiating the need for certain expenses for the business activities of the organization), defective statements and acts justifying the need for repair work, acts on entertainment expenses, etc.

Example 1 On September 27, 2004, Intkompleks LLC incurred expenses for entertainment expenses. To write off spent inventories, a primary document independently developed by the organization was used.

ACT No. 41

on the attribution of expenses to entertainment expenses

Moscow September 27, 2004

We, the undersigned, financial director Sludnov R.M., chief accountant Derzhavets N.V., head of department Rykov V.V., with this Act, confirm the advisability of including as entertainment expenses related to commercial activities the costs of organizing the reception of representatives of Pasat OJSC (Tula) .

The reception took place on September 27, 2004 at the office of Intcomplex LLC at the address: Moscow, Leningradsky Prospekt, 47, office. 410 in accordance with the Business Meeting Program approved on September 20, 2004.

During the meeting, issues regarding the further supply of products under agreement No. 25/04-k dated March 29, 2004 were discussed.

Participants:

from OJSC "Pasat": general director Bykov I.V., deputy director Sherankov D.Yu., head of department Murzin K.L., leading specialist Roman A.L.;

from Intkomplek LLC: general director Slukhov M.D., financial director Sludnov R.M., head of department Rykov V.V.,

The following supplies were consumed during the meeting:

| Sausage “Festive” – 278 g | 87.57 rub. | |

| Pork boil – 198 gr | 42.58 rub. | |

| Wine and vodka products – Ararat cognac | RUR 415.00 | |

| Red fish “Salmon” – 264 g | 67.85 rub. | |

| Coffee | 58.00 rub. | |

| Candy - 1 box. | RUB 135.00 | |

| 7. | Bakery products. | 25.00 rub. |

| TOTAL: | RUR 415.00 |

Receipts confirming the purchase of the specified inventories are attached to V.V. Surkova’s advance report No. 98 dated September 27, 2004. The costs were incurred within the budget attached to the Business Meeting Program.

During the reception process, an electric kettle “Tefal” was used with an initial cost of 980 rubles (accounted for as part of fixed assets), dishes worth 450 rubles. (accounted for as household supplies).

Financial Director ______________________ R. M. Sludnov

Chief accountant ______________________ N. V. Derzhavets

Head of Department ______________________ V.V. Rykov

___________________

End of example 1

Among the independently developed primary documents, it is necessary to mention the accounting certificate. For budgetary organizations, the form of the accounting certificate was approved by Order of the Ministry of Finance of Russia dated December 30, 1999 No. 107n - Form No. 433. Accountants of commercial organizations can also use this form. However, nothing prevents an organization from developing a more convenient form based on it.

Note that accounting is forced to refer to this document quite often. Any corrective entry in the accounting accounts, various calculations, ranging from the calculation of monthly depreciation amounts to the accrual of taxes, penalties, fines, recalculation of tax liabilities, etc. must be documented with such a certificate.

Example 2 When conducting an inventory of goods in September 2004, Intkompleks LLC identified a shortage of goods in the amount of 5,300 rubles. The commission found the organization's employee guilty of the shortage. Sokolnik V.P., who bore full financial responsibility, voluntarily agreed to compensate for the damage from her salary (her salary is 10,500 rubles)

In accordance with the requirements of the tax authorities, the VAT previously accepted for deduction on the missing goods is 954 rubles. (RUB 5,300 x 18%) is being restored. This value increases the amount of the shortage to 6254 rubles. (5300 + 954).

The administration decided to withhold the amount due for three months, taking into account the limitation established by Article 138 of the Labor Code of the Russian Federation.

In September and October, the maximum possible amount is withheld from the employee’s salary - 2,100 rubles. (RUB 10,500 x 20%), in November - the remaining amount - RUB 2,054. (6254 – 2100 – 2100) .

The type of prepared accounting statement is presented below.

Organization LLC "Intcomplex"

ACCOUNTING REPORT No. 17

September 22, 2004

Date of preparation

Debt accrual Sokolnik V.P. for shortage of goods and deduction of due

reason for issuing the certificate, justification for accounting entries

_______________________________________ amount _________________________________

calculations of amounts reflected in accounting accounts

| № | date | Contents of operation | Qty | Sum | accounting entry | |

| Debit | Credit | |||||

| 1 | 22.09.04 | The cost of missing goods is reflected | 5 | 5300,00 | 94 | 41 |

| 2 | 22.09.04 | VAT on shortage of goods has been restored | 954,00 | 19 | 68 | |

| 3 | 22.09.04 | Recovered VAT is included in the amount of the shortfall | 954,00 | 94 | 19 | |

| 4 | 22.09.04 | Employee debt accrued | 6254,00 | 73-2 | 94 | |

| 5 | 22.09.04 | Partially repaid the debt | 2100,00 | 70 | 73-2 | |

| 6 | 29.10.04 | Partially repaid the debt | 2100,00 | 70 | 73-2 | |

| 7 | 30.11.04 | The debt has been repaid in full | 2054,00 | 70 | 73-2 | |

Accountant _________________ V.V. Serikova

signature signature decryption

Chief accountant _________________ N.V. Sovereign

signature signature decryption

____________________________

End of example 2

With the introduction of tax accounting, the importance of accounting information has increased. Together with other primary documents, the accounting certificate is the basis for making entries in the analytical tax accounting registers (Article 313 of the Tax Code of the Russian Federation).

Forms for tax accounting

When calculating income tax, income received is reduced by the amount of expenses incurred that meet the requirements provided for in paragraph 1 of Article 252 of the Tax Code of the Russian Federation. Among them, documentary evidence of costs is also mentioned. In this case, documented expenses mean expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation.

Tax accounting data can be confirmed by primary accounting documents (including an accountant’s certificate), analytical tax accounting registers and calculation of the tax base (Article 313 of the Tax Code of the Russian Federation).

The concept of “primary accounting document” is not specifically disclosed by the legislator in the Tax Code of the Russian Federation. Therefore, based on the norm of paragraph 1 of Article 11 of the Tax Code of the Russian Federation, which establishes that the institutions, concepts and terms of civil, family and other branches of legislation of the Russian Federation used in the Tax Code of the Russian Federation are applied in the meaning in which they are used in these branches of legislation (unless otherwise provided for by the Tax Code of the Russian Federation), the primary documents used in tax accounting must comply with the requirements for them in accounting.

This was confirmed by tax authorities in the Methodological Recommendations for the Application of Chapter 25 “Organizational Income Tax” of the Tax Code of the Russian Federation (approved by order of the Ministry of Taxes of Russia dated December 20, 2002 No. BG-3-02/729). The document states that the procedure for preparing primary documents is provided for by the regulatory legal acts of the relevant executive authorities. These bodies, in accordance with the legislation of the Russian Federation, are given the right to approve the procedure for drawing up and forms of primary documents used to document business transactions.

Therefore, the use of standard unified forms of primary accounting documentation, approved by the relevant resolutions of the State Statistics Committee of Russia in 1997-2004, or independently developed by the taxpayer of primary documents that meet the requirements of the law on accounting, when recording expenses incurred, will allow the taxpayer to take them into account in expenses that reduce income received when calculating income tax.

However, the standard unified form of the primary accounting document used in accounting will not always allow taking into account all the necessary data for tax accounting. In this case, additional lines and columns can be added to the form to reflect the missing indicators.

Example 3 When accounting for an object of fixed assets in depreciable property, the standard interindustry form No. OS-6 “Inventory card for recording fixed assets” (approved by Resolution of the State Statistics Committee of Russia dated January 27, 2003 No. 7) does not contain the information:

Reverse side of the form

The reverse side of the form is mainly filled out by an authorized officer. The only exception is column No. 12. It is filled in if there has been a change in personal data: last name, first name, patronymic, gender, place and date of birth. Only those data that are subject to change are entered in this column. That is, if the surname changed upon marriage, then only the old surname is indicated in the column, the remaining parts remain blank. In addition, the same column indicates the document number according to which the changes occurred. In most cases, this is a document issued by the civil registry office. A sample of filling out Form 1P when replacing a passport due to a change of surname upon marriage is given below.

Which form to use

A unified request form No. 1 is not provided for at the legislative level. Each housing subsidy department has the right to use its own forms and forms. The recommended structure consists of two blocks:

| Part No. 1 “Instructions” | The top part of the request form No. 1 for the subsidy is a tear-off notification slip. The block contains instructions for filling out salary information. |

| Part No. 2 “Information about earnings” | This section is the salary certificate for the last 6 months. The employer enters information about income according to the instructions provided in the top block of the document. |

The form is not handed out to the applicant - the recipient of the housing and communal services subsidy. The application is submitted by an employee whose job responsibilities include processing and assigning compensation. The paper is sent to the employer or other organization that makes income payments in favor of the applicant.

Application Procedure

Documents for obtaining a passport are always submitted only in person. This also applies to teenagers over 14 years of age. There are several ways to apply for a passport:

- Personally visiting the Department of Internal Affairs of the Ministry of Internal Affairs and providing a complete set of documents.

- By contacting the multifunctional. There are passport offices there. A sample of Form 1 can be found on the information stand there. In addition, employees can always provide assistance in completing documents.

- By submitting an application online through the government services portal, and then appearing in person on the appointed day with a complete set of documents. Recently, more and more citizens are choosing this method. However, you will still have to fill out Form 1 according to the sample at the passport office, since it must be filled out with your own hand.

The period for consideration of the application does not depend on the method of submitting documents, so the choice remains with the applicant. The passport is issued in the same place where the documents were submitted, that is, the citizen will have to visit the passport office again.

Correctly filling out an application for issuing or replacing a passport is one of the keys to success. If everything is done correctly and all documents are in order, there will be no problems with obtaining a passport of a citizen of the Russian Federation.

Where and how to get a certificate of residence: sample application

- Administration of the settlement/district. Local authorities, as a rule, issue certificates only in small settlements and urban areas where there are no other authorized institutions. In large cities, it makes no sense to contact the administration for a document about the place of registration.

- Department of the Federal Migration Service (passport office). Registration at the place of residence (registration) is carried out by the Federal Migration Service of the Russian Federation (Decree of the Government of the Russian Federation of July 17, 1995 No. 713), so every citizen can apply directly to the territorial division of this government body. Previously, the departments of the Federal Migration Service were called passport offices, but now they have been renamed, although the addresses remain the same.

- Management Company. Each company that services the housing stock keeps records of residents and has all the necessary information about them. The management company can be either a municipal institution - housing and communal services, or a private organization. In any case (regardless of the company’s form of ownership), you have the right to request the service of issuing a certificate free of charge.

- Archive. In rare cases, when you need to obtain a document about the place of registration, which will indicate information as of past years (a specific date), contact the archive. This institution can be located either in the local administration building or located separately.

- MFC. If a multifunctional center is open in your city, then the best option would be to contact this institution. The MFC operator will help you draw up and register a request (or will fill it out for you), check the documents, and perform all the necessary steps to obtain a certificate of residence. If the MFC electronic system is connected to the FMS database, the document can be issued within a few minutes.

- Unified portal of public services. If the FMS/administration information databases are connected to the gosuslugi.ru website system, then you can register a request without leaving your home.

We recommend reading: Certificate from the tax office

Request to the housing subsidies department in form No. 1: sample filling, content and submission procedure

The lower area of the document is the work certificate itself for a subsidy for utilities, a sample of which can be used for reference. It is filled out by the employer. Housing subsidies are issued based on reliable data of the person in need:

- the employee’s full salary is indicated without any deductions;

- if there were deductions under a writ of execution, then a copy of its form is attached to the certificate for a housing subsidy;

- corrections and blots are not allowed.

- The seal and signature of the first manager are required.

Filling out a subsidy certificate sample

Who is the housing subsidy intended for and who should apply for the certificate accordingly? The law establishes a closed list of persons entitled to apply to social security authorities to receive a subsidy. Among them are the following categories of citizens:

A prerequisite for receiving assistance is proof of financial insolvency. Thus, the question of what a sample income certificate for a subsidy looks like is very important. As already noted, there is no specific form for filling out this document. In this case, there is mandatory information. So, in the certificate for applying for a subsidy from the place of work, you must indicate the following data: