How to find out your TIN by last name?

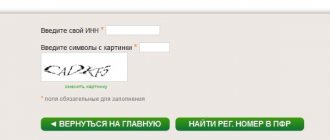

You can find out your TIN number on our website below.

Type of identification document:* Send a request Based on the information you provided, the Individual Taxpayer Identification Number assigned upon registration with the tax authority was not found in the Unified State Register of Taxpayers (USRN).

Attention! If the individual currently has a new identification document, it is recommended that you fill out the request form again, indicating the details of the individual's previous identification document. The information you provided was not clearly identified in the Unified State Register of Taxpayers (USRN).

How to find out your identification code by last name via the Internet Ukraine

If an individual has a document confirming registration, in order to clarify the information available to the tax authorities regarding such an individual, it is recommended that the specified individual contact the tax authority at the place of residence (you must have an identification document and a document confirming registration with you). accounting - certificate or notification), or send to the Federal Tax Service of Russia an application to clarify personal data through the Taxpayer Personal Account service for individuals, or use the Contact the Federal Tax Service of Russia service. If an individual does not have a document confirming registration, such an individual can, to register and obtain a TIN, contact the tax authority at his place of residence (you must have an identification document with you), or use the service Submitting an application for an individual for registration.

How to find an Inn by last name Ukraine

TIN issued in Ukraine by date of birth, checking the existence of the Ukraine TIN code, as well as obtaining data about the owner of the Ukraine TIN code.

To search for a TIN code by date of birth, you must enter the date of birth and, as a result, receive a list of correct TIN codes that correspond to the date of birth.

To check the Ukraine TIN code for its existence, you must enter the TIN code, and the program will display data about the individual encrypted in the code, and will also indicate whether this Ukraine TIN code exists or not.

The program for searching Ukraine TIN by date of birth can be downloaded from the link search Ukraine TIN by date of birth.

ATTENTION!

The TIN check is carried out to ensure that the code matches the algorithm with which the TIN code should have been issued by the tax authorities.

Find out your TIN via the Internet on the tax website or through State Services

If you are an individual, then in order to get a job you will be required to provide an INN; it will be indicated in the tax deductions item. And if you are a businessman, then to enter into contracts of various types you will also need to indicate its meaning. The same conditions should be observed by a foreigner if he needs to receive information through the Federal Tax Service on the website - enter his personal data in a special request form, agree with the processing of data and indicate the verification code. The necessary information will appear on the computer screen.

24 Dec 2021 marketur 240

Share this post

- Related Posts

- Sample characteristics from the place of study for the military registration and enlistment office

- Accounting for rental payments for land in Kosgu authorities

- How to pay an administrative fine to the Federal Tax Service based on a decision

- How can I find out which boiler house my house in Sumy belongs to?

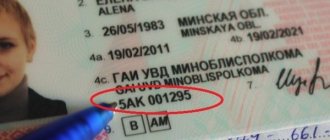

How to find out your tax identification number from a Ukrainian passport

Once the following page opens, you can see that the information is provided for free in real time.

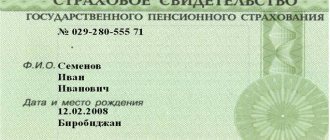

This abbreviation is translated as taxpayer identification number.

Each person has their own unique TIN. It is a set of numbers.

It should also be noted that in case of loss of the identification number certificate, you must personally (or by proxy) contact the district office of the State Tax Administration of Ukraine at your place of permanent residence and fill out the form in Form 5-DR.

A duplicate of the certificate of assignment of an identification number is issued on the day of submitting the corresponding application and absolutely free of charge.

How to find out your identification code by last name via the Internet Ukraine

When checking online, a citizen can find out his TIN only if he has any document proving his identity or identifying him as a citizen of the Russian Federation. How can I find out my TIN? There are only three ways to find out your TIN quickly and safely. Settlement bank NKO "MONETA" (LLC), license of the Bank of Russia 3508-K, OGRN 1121200000316 After registration in the State Register, an individual receives from the state tax service a document assigning an identification number - a card of an individual - a tax payer. The identification number is required for use by enterprises, institutions, organizations of all forms of ownership in the event of: - concluding civil agreements, the subject of which are taxable objects

Please note => How to rent an apartment in Moscow without cheating

Detective Agency LLC Bureau of Personal Situations and Business Security

Find out the identification code of an individual in Ukraine. Find out the identification code of a person in Ukraine.

Find out the tax identification number from your passport online Ukraine.

Checking the identification code of Ukraine. Find out the identification code of an organization in Ukraine.

We immediately draw your attention to the fact that you will not find information about citizen identification codes in the public domain on the Internet.

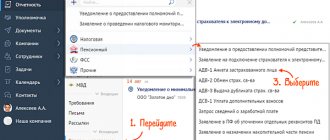

This is done as follows:

Using this service, you can quickly check online whether the required identification code exists in Ukraine, check whether the dates of birth provided by the individual and the information received on the personal identification number of the individual in Ukraine match, whether the gender of the information received from the identification code matches the information on the individual’s personal identification number. in Ukraine.

To check the tax identification number online in Ukraine, you need to enter the Ukraine identification code and you will be able to obtain information on the tax identification number online of an individual, such as the date of birth of the owner of the tax identification number in Ukraine, the gender of the owner of the tax identification number in Ukraine, and whether such tax identification number exists in Ukraine at all Ukraine.

Download the program to search for Ukraine TIN code by date of birth

TIN Ukraine is an individual tax number.

Attention! If you currently have a new identity document, you are advised to fill out the request form again, indicating the details of your previous identity document.

If you have a document confirming registration, for clarification. A taxpayer identification number (abbreviated TIN) is a code consisting of numbers that is assigned to each taxpayer in Russia (individuals, individual entrepreneurs and legal entities. TIN is an individual taxpayer number.

Essentially, this is a digital code that organizes taxpayers.

When contacting the tax office, you will need to fill out an application form 1DR.

Determining your TIN via the Internet using your passport in 2019

To find out the TIN of another person, on the Federal Tax Service page you need to click the link “Find out someone else’s TIN”. Based on who the interested person is (individual or legal entity, government employee), a certain item is selected in the “Applicant” line. For all categories of citizens, the forms are filled out differently. In the line “Type of identification document”, select a document indicating the identity of the foreigner (passport, residence permit, birth certificate, document on the possibility of temporary residence in the Russian Federation). All further instructions are similar to the procedure for determining the TIN of an individual based on passport information.

Please note => Types and signs of proceedings in civil proceedings

Information for citizens of Ukraine - Crimeans and residents of the ATO zone

Individuals who are registered in the ATO zone or in the Autonomous Republic of Crimea, in order to obtain an IIN or make a note about the refusal of the TIN for religious reasons, can contact any tax office on the territory of Ukraine, regardless of the address of the registered place of residence or stay.

If a certificate of assignment of a taxpayer identification number is damaged or lost, a person must contact the appropriate tax office and fill out an application to restore the certificate.

Features of obtaining, restoring and refusing TIN in Ukraine

If the TIN is lost or damaged, the owner can restore the document. To do this, you should contact the local tax office at your place of registration. You can also restore the code in any other branch. There are no penalties for loss. The document is issued within 24 hours, sometimes more time is needed. The new TIN is marked o. The issuance, verification and restoration of a taxpayer identification code is carried out at the place of permanent or temporary registration in the branches of the Ministry of Revenue of the region. The processing time for an application for a TIN is 5-10 working days. A person is not required to pay any government fees or charges for issuing an identification number.

24 Dec 2021 marketur 446

Share this post

- Related Posts

- Required work experience for retirement

- Income tax benefit for a third child if two are adults

- Who has benefits for transport tax in Belgorod

- Who has a discount on travel on trains?

How to find out your TIN?

According to the information you provided, the TIN assigned when registering you with the tax authority was not found in the FDB of the Unified State Register of Real Estate.

Inn on the passport of a citizen of Ukraine find out the official website

Let's start with the fact that only individuals, that is, people, can receive an identification number. Legal entities (enterprises, organizations, institutions) also have a specific number, but a completely different one, which is contained in another register - the unified state register of legal entities and individual entrepreneurs.

How can I get a TIN

Remotely. To do this, you need to contact a notary and issue a power of attorney to the person who can obtain a tax number for you in Ukraine. Particular attention should be paid to the text of the power of attorney. Tax authorities are very scrupulous, so your data, names of government bodies and documents must be entered correctly. Otherwise, you risk being denied the code.

If this is necessary for the country (where you will make the power of attorney), after certification of the power of attorney, you must affix an apostille stamp or do consular legalization to confirm its authenticity.

After this, you can send the original power of attorney and a copy of your passport to Ukraine. Once received, they will need to be translated into Ukrainian. Now your authorized representative can go to the tax office to obtain your identification code.

On one's own. To receive it yourself, you need a translation of your passport and a copy of the mark on crossing the Ukrainian border. With these documents, you can contact any tax service to assign you an identification code. If you want to submit documents through a proxy, you will need to contact a notary to issue a power of attorney.

Please pay attention to two important points! Firstly, your period of stay in Ukraine should not be overdue. Without information taken from the documents, any notary will refuse to issue a power of attorney, and they will also refuse to issue you an identification code if submitted in person.

Secondly, if you are drawing up a power of attorney and do not understand the Ukrainian language, the notary must have a certified translator present. Relatives and friends who can help understand the text are not enough for a notary.

The procedure for obtaining a code by a foreigner is very accessible. But, unfortunately, it contains a large number of practical details that can steal your time and energy. We recommend entrusting this issue to our professionals to effectively and quickly solve your problem.

Let's decipher the IIN code for Ukraine and Russia

- The first 5 digits are the number of days from the date 01/01/1900 to the date of birth of the owner of the number.

- The next 4 digits are the person’s serial number on his date of birth.

- The ninth category means gender.

- The tenth digit is the checksum number.

Decoding IIN of Russia - provides for a certain sequence of certain data about the individual. The individual identification number data includes four parts:

- The first six digits are the encrypted year, month and birthday of the person to whom the identification number is assigned.

- The seventh digit indicates the gender of the code owner. Moreover, it determines the century of birth - the twentieth or twenty-first:

- XX men – 3

- XX women – 4

- XIX men – 1

- XIX women – 2

- The next four digits. The decoding of this part of the IIN number lies in the assignment of the serial number of registration of a citizen of the state.

- Check digit. It is calculated according to a certain algorithm, but it does not contain any special important information.

For a more detailed decoding of registration numbers, public service centers have been created at the place of residence. The decoding itself reveals the essence of the individual identification 12-digit digital code. It should be remembered that the identification code is assigned to an individual once. The only exception is if the taxpayer's surname changes. IIN has already replaced RNN and SIC. When carefully deciphering the number, you should remember that the code numbers from 8 to 11 are filled in by the corresponding official body of Justice. It is possible to check the correctness of the personal number. Its essence lies in isolating the date of birth from the IIN number and carefully documenting it. It is important to note that when deciphering this group of codes, an error in the date will result in an incorrect value. It has been proven that the probability of error is almost 100% provided that the seventh digit coincides with a value of zero or greater than 6. There is no need to discount the omnipresent human factor. It all depends on the operator, who may make a typo. Therefore, checking the decryption is not only possible, but also necessary. This can also be done by the individual who received the code. The main code check is to recalculate the check digit (12th bit). To do this, use the 12th bit generation algorithm.

Individual Identification Number System

The transition to the IIN system entails a number of changes, since without its provision it will be impossible:

- for pensioners to apply for and receive a pension;

- work with banking institutions (receive loans, make deposits, manage accounts, etc.);

- formalize real estate purchase and sale transactions;

- register a particular transaction;

- obtain registration of citizens;

- conduct any kind of business.

This will soon lead to a reduction in the standard set of documents, because it is planned to enter the IIN code into the citizen’s identity card, and not issue it as a separate document. What is needed at this stage to obtain an IIN code? You should provide the following set of documents: write an application in the established form to receive a unique code, an identity card (possibly a birth certificate in some cases) or a passport. To check your IIN number, you need to find it in the database of the district or city tax department. It is also possible to perform such a check via the Internet. If you discover errors after deciphering your code, you simply need to immediately contact the tax office of your locality or district. Checking the Individual Tax Number (TIN): You can use the program for checking TIN and other registration numbers for individuals and legal entities:

download the program for checking TIN