Definition

What document are we talking about? It is important to understand that in Russia there are several concepts - TIN and TIN certificate.

An individual taxpayer number is a kind of citizen identifier in the Federal Tax Service system. This is a number consisting of some combination of numbers. It is assigned to every person at birth.

A TIN certificate is a document that contains the individual number of a person and information about the recipient. Usually it means A4 paper with relevant information and government signs. In Crimea and Sevastopol, together with the certificate, you can put a special stamp in your passport.

How to change your last name if you are an individual entrepreneur

No later than 30 days after marriage, you must submit documents to change your passport. You need to submit the application to the territorial bodies of the Ministry of Internal Affairs - they are also called passport offices. You can also submit an application through the MFC or government services.

We recommend reading: Inn and state registration number are different documents

You will also need a marriage certificate. If you already have a new TIN certificate, send it too. After communicating with the manager, you will need to sign the updated client questionnaire in your personal account:

Reasons for replacement

Is it necessary to replace the TIN when changing place of residence or not? In Russia, many documents have to be exchanged from time to time. For example, after their expiration date or when moving to another city.

The reasons for exchanging the TIN are the following circumstances:

- change of personal data;

- detecting typos in a document;

- theft/damage/loss of old paper.

It follows that there is no need to change the standard certificate when moving. But there are exceptions.

Change of documents when moving

What documents do I need to change when changing my registration?

Moving is a serious matter, requiring time and nervous tension. In addition, the changes will also affect the personal documents of the person who has changed his place of residence. Some of these papers remain unchanged, others require adjustments.

The first action that needs to be taken in a new place is to settle the issue of registration.

All institutions and services are tied to the territory assigned to them for service, so any application makes sense only with a passport with a stamp of registration in the given area.

The wisest thing to do is not to waste time on deregistration from the previous place of permanent location, but to immediately issue a simultaneous registration and deregistration by contacting authorized persons at the new location.

By the way, this is not only more convenient and saves time (one less visit to the relevant authorities), but also protects against delays: in this case, deregistration and registration at the new address will be dated on the same date.

You should not even try to visit any of the institutions without a re-registered passport; in any authority, first of all, they will check whether you are registered here.

When changing your address you will need to change:

- certificate of ownership;

- papers for the car - vehicle registration certificate.

You will need to change the license plates on your car and enter information about the driver who has just arrived in the region with his car into the traffic police database.

By registering again as a newly arrived car owner, a citizen will be able to move without problems in his new locality in his own vehicle.

It is important to keep in mind that the registration rules (Order of the Ministry of Internal Affairs No. 1001) oblige the re-registration of a car even within the same region, since the address has changed. They will correct the car’s passport, as well as the MTPL policy. There are opinions that this is not necessary, but it is advisable to bring all your papers into compliance.

There are two more documents that you cannot do without at your current place of residence:

- military ID;

- pensioner's certificate.

These papers do not change, they are valid.

And although the migration service must notify the military registration and enlistment office and the regional pension fund about the replenishment, it is worth coming to both of these departments without wasting time.

Without military registration, a citizen liable for military service will not be hired, and the question is not only this, but the notification nature of the registration: the military department must know that there is one more defender on their territory. The result of registration will be a mark on the military ID - a stamp of the corresponding content.

It is important for the pensioner to get to know his inspector and make sure that he is already registered here at the request of the registration authorities. If such a pensioner is not yet on the list, then you need to make sure that all the information is now entered into the card index, and at the same time clarify when to expect the money and choose the method of receiving it. But the funds will not be paid immediately; you will have to wait until the pension fund receives the senior citizen’s case upon request from its previous location.

If you have bank cards, you can use them throughout the territory, but you still cannot do without being linked to local branches of the relevant banking institutions. Employees will enter information about the client into local databases, correcting the address. Now, if you change your card after its expiration date, or if you lose it, you will not need to return to your previous city or village.

Urgent replacement

Under some circumstances, a change of permanent residence entails the need to urgently replace a certificate with an individual taxpayer number. But not the TIN as a whole.

When is this possible? For example:

- if the recipient is a government employee and the document is needed for work;

- if you need to prepare tax deductions;

- when the old certificate is lost.

As you may have noticed, changing your TIN when changing your place of residence is not a mandatory procedure. Therefore, if there are no compelling reasons for this, there is no need to rush into implementing the idea.

conclusions

Do I need to change my TIN when changing my registration? No. Remember, this document is issued once and for life. Even changing your place of residence does not affect this. With only rare exceptions.

Obtaining a TIN certificate also does not cause any hassle. Nevertheless, you can live without a document for the time being. There is no need to rush to receive it. As a rule, you need to obtain a TIN by the time of your first official employment. And nothing more. There are no penalties for missing a document. After all, you have the right to receive it when you consider it necessary, if you do not officially get a job.

TIN and certificate

However, sooner or later you will still have to change your TIN when changing your place of residence. A certificate of the established form is issued by regional tax services. It will indicate the city in which the document was issued. When moving to another region, you have to exchange paper. But not urgently. It's about testimony.

When changing place of residence, the TIN remains the same. As emphasized earlier, citizens are assigned an individual number once in their life. It remains unchanged throughout life. Therefore, the TIN cannot be exchanged under any circumstances. Data about the applicant will be transferred to the Federal Tax Service at the new place of registration. Accordingly, all tax notices will still reach the real recipient.

Where do you need a TIN and how do you find out your number?

Finding out your number is absolutely easy

A taxpayer identification number may only need to be presented in some cases, and in general no one is required to show their TIN to strangers.

You may be asked for your number only if you are applying for a job in government agencies. When applying for employment in all other organizations, the TIN is not included in the required package of documents.

Bank employees do not have the right to demand a TIN when a person takes out a loan, or even tax officials when accepting a declaration. In the declaration form, the required fields are last name, first name, patronymic, and you can specify passport data and identification number at your own discretion.

If it suddenly happens that a bank or any other organization requires you to provide an INN, although by law you are not required to present it, then it is in your best interests not to enter into disputes. By starting a conflict, you will only aggravate the situation and complicate things for yourself. It’s better to go and get a TIN certificate, because it’s not at all difficult to do.

You can obtain a certificate by contacting the tax office to which your place of residence is attached. You don’t need any special documents for this; you just need to take your passport and a copy of it with you, just in case. You will submit a statement to the tax office.

It is written on a form, not in free form. Next, within five days you will be issued a certificate of taxpayer identification number. However, this is usually done on the same day or at most the next day after submitting the application.

You can find out your (or even someone else’s) TIN much faster if you do not need to have the certificate itself. On the official website of the Federal Tax Service of the Russian Federation there is a service “Find out TIN”. There you can enter the necessary data for yourself or any other person, and the system will give you a number. To find out your TIN, you need to enter in the form:

- Full name

- date of birth

- type of ID

- series and document number

- date of issue

If you are asked for an INN number at work, then, in principle, the employer can find it out on his own if he has your data.

Where to change

Where is the TIN changed when changing place of residence? In Russia this issue is dealt with:

- tax authorities;

- multifunctional centers.

You can also produce or change a certificate with an individual taxpayer number by using a service called “Government Services”. No other institutions in the Russian Federation are engaged in solving this problem.

The TIN number of an individual is not changed; another one is assigned and the TIN is replaced after a last name change

TIN is a Taxpayer Identification Number , a set of numbers, a digital code that organizes the accounting of taxpayers in the Russian Federation. Assigned to both legal entities and individuals. It has been assigned to organizations since 1993, to individual entrepreneurs - since 1997, to other individuals - since 1999 (since the beginning of the first part of the Tax Code of the Russian Federation).

We recommend reading: Law on Citizenship of Kazakhstan

If the surname changes, the Certificate of Registration is replaced by the tax authority at the place of residence on the basis of a completed Application for a Certificate and upon presentation of a previously issued Certificate of Registration, an identity document and a document confirming registration at the place of residence.

Procedure

There is no change in TIN when changing place of residence. As already mentioned, a citizen can exchange a certificate issued to him earlier, but nothing more. What does that require?

The instructions below will help you exchange your TIN under any circumstances. Citizens will have to:

- Prepare some documents to add new information to the TIN certificate.

- Pay the state fee (not always).

- Send a written request along with documents to the Federal Tax Service or MFC for registration.

- After some time, receive a completed certificate with an individual taxpayer number.

This is the procedure for exchanging TINs that is in effect on the territory of the Russian Federation to this day. This is a very simple operation that requires little preparation. In particular, regarding the provision of documents for the production of a certificate.

What documents need to be changed when changing registration

Good evening. A pensioner who has moved must notify the territorial department of the Pension Fund about his move. This must be done in order for the Russian’s pension file to be transferred to the Pension Fund department at the new place of residence. The pensioner comes to the district Pension Fund at his new place of residence and reports his stay at the new address. This must be done in writing. To do this, you need to fill out a special personal pension file request form.

First, you need to contact the traffic police to register and, if necessary, make changes to the certificate of ownership of the car. You can keep the old numbers if you wish. Then, if changes have occurred, then you need to enter new data into the insurance; if not, then you need to look at the CASCO insurance contract to see if there is a regional limitation, since compulsory motor liability insurance is valid throughout the entire Russian Federation.

List of documents for TIN

Do you need to change your Taxpayer Identification Number (TIN) when you change your place of residence? The procedure for dealing with this situation is already clear to us. The proposed instructions will help you obtain a new certificate with an individual taxpayer number not only when moving, but also in any other case.

What documents are needed to receive the service? Among them are:

- old certificate;

- passport (or other identification document);

- receipt with paid duty (300 rubles for individuals);

- statement;

- certificates indicating the citizen’s registration (not needed if the applicant has brought a civil passport).

This list of documents is not exclusive. Other papers may be useful if the recipient is a minor child.

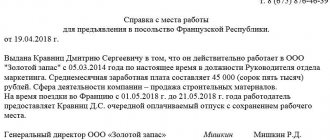

We prepare personnel documents when an employee’s personal data changes

Let's start with probably the most common situation, which, nevertheless, raises constant questions. We are talking about an employee (usually an employee) changing their last name. Obviously, in this case, it will be necessary to make changes to the personnel documentation, for example, to the employment contract, work book and personal employee card. However, making such changes requires a basis. Such a basis will be documents confirming the change of name, submitted by the employee himself. But you should ensure that the employee submits these documents in advance, and include in the employment contract a standard condition that the employee is obliged to inform the employer about a change of name, passport, place of residence and other personal data specified in the employment contract.

We recommend reading: Vek uk extended what is it

In this article, we decided to limit ourselves to only the minimum necessary explanations for a particular situation that may raise questions for an accountant performing the functions of a personnel officer. The main place in the article will be devoted to specific tools for solving the problem. After all, you see, finding an explanation of how to act in a given situation is usually not difficult. It is much more difficult to find specifics - what exactly needs to be done, what documents and how to complete them, etc.

TIN and minors

You can change your TIN when changing your place of residence in the shortest possible time if you follow the instructions provided. What documents do the Federal Tax Service require when exchanging a certificate of the established form for children?

Among them are:

- passport of the legal representative;

- application for TIN exchange, written on behalf of the parent;

- child's birth certificate;

- certificates indicating registration (parent and minor).

From the age of 14, children can obtain a TIN and exchange it themselves. If we are talking specifically about the reissue of paper, you will have to pay a state fee in the established amounts. Otherwise the operation will be denied.

Do I need to change my tax identification number when changing my passport?

Please note that at the moment, when changing your last name, it is not possible to replace the TIN through the government services portal; this procedure may appear in the future, but for now such a service is provided only by the Federal Tax Service website.

We recommend reading: Young family program 2021 Karelia

After registering for them, you can issue many documents, including a new TIN; you can apply for a new TIN due to a change of surname. In addition, these services allow you to track the receipt of an application, its consideration and receive information about the results of consideration of the submitted application.

Waiting time

Sooner or later you will have to exchange your TIN certificate if you change your place of residence. This service takes about 5 working days. This is exactly how long you need to wait before picking up the completed TIN certificate from the Federal Tax Service or the MFC.

In some cases, the waiting period increases. Usually, when a certificate with a TIN is ready, the citizen is informed of the need to obtain it. For example, by phone or mail. The operation being studied is not too long.

Is it necessary to change SNILS at all when changing a passport?

Until the new PS is issued, you will have to use the old one, so it is better to make a copy of it. But in fact, the insurance number itself is requested from various authorities. Therefore, it is possible to urgently present a new passport and an old document with an insurance number.

If you have a power of attorney, a representative will fill out the application. Then the application will indicate his data based on his passport, as well as a good reason why the citizen himself cannot fill out the application.

Let's sum it up

It is now clear whether a TIN change is necessary when changing place of residence. This operation is not mandatory, but it is advisable to carry it out. Otherwise, if you need to file tax deductions or obtain information about a person through the Federal Tax Service, problems may arise.

All of the listed nuances and features are relevant for each region of the Russian Federation. Therefore, all cities have the same rules and principles for issuing/exchanging TINs.

Tax authorities assure that the initial production of a certificate with an individual taxpayer number is the personal desire of the citizen. If he does not want to, he is allowed not to draw up the relevant paper. You can find out your TIN using a special service. It is located on “GosKnow your TIN”. With its help, it will be possible to obtain information about the taxpayer number, based on the citizen’s personal information.

Do I need to change the TIN when changing my last name?

Contact the tax office with a completed application form (you can print it out yourself and fill it out at home, or you can do it directly at the tax department) and a passport, which already contains your new last name. Of course, you also need to take your old tax registration certificate with you. Since this procedure is not considered a reissue of the document, you will not be required to pay a government fee for it.

Typically, replacing a TIN does not take longer than a week. Moreover, in most cities, a citizen has the right to receive paper “delivered to his home.” It is not necessary to go to the inspectorate again to pick up a new certificate. You have the right to ask for it to be sent to you by mail. However, be careful when specifying your delivery address. If you make a mistake, you will have to pay a state fee to obtain another certificate.