Cooperation with foreign counterparties is not only about profitable deals, new markets and unique contract terms. This is also additional attention from the tax service, currency and export control authorities and other inspectors. Plus there are major financial risks - no one can give guarantees of the partner’s reliability and integrity. A Russian company, considering international cooperation, simply must know how to check a foreign legal entity.

Why check foreign counterparties?

The current conditions for conducting commercial activities make verification of counterparties, especially those with foreign registration, a mandatory stage of any adequate cooperation. Of course, such concepts as “bad faith”, “unreliability” or “problematic character” of a foreign partner are not contained in either civil or tax legislation. Nevertheless, they are constantly encountered in law enforcement and judicial practice, in particular in the context of tax proceedings.

Indeed, cooperation with foreign legal entities carries a number of financial and reputational risks for Russian partners:

- Risk of tax violations. In judicial practice, there are common cases where Russian companies, being bona fide taxpayers, are responsible for failure to fulfill tax obligations by foreign partners. There is really no obligation in law to check the counterparty for its tax reliability. But the logic of the courts is that companies independently choose foreign partners, and therefore are obliged to exercise due diligence in relation to them, which would allow them to verify their integrity and count on the counterparty to fulfill tax obligations (resolution of the AS of the West Siberian District dated May 31, 2021 No. A75- 10708/2015, determination of the Armed Forces of the Russian Federation No. 304-KG16-11685 dated September 23, 2021).

- Financial risks. When concluding transactions with foreign partners, it is important to ensure their financial solvency. Even the threat of bankruptcy in the future can cause delays and failure to fulfill financial obligations. Collection proceedings opened against them, the presence of seized property, large debts - all this creates considerable financial risks of cooperation.

- Risk of incapacity. A transaction can be concluded with a representative or person not authorized for such actions, with a non-existent enterprise (for example, if it has already been liquidated or reorganized) or with an enterprise that does not have the right to carry out commercial activities in the Russian Federation. All this will lead to the invalidity of the concluded agreement.

- Reputational risks. Due to the specifics of business, failure to fulfill obligations by a foreign partner may cause the failure of contracts with other, reliable Russian partners (for example, under subsupply agreements). In addition to fines and penalties, there is a risk of termination of cooperation with them.

Such risks exist regardless of the type of economic activity. One of them may be distribution.

Information about foreign organizations contained in the Unified State Register of Real Estate

The composition of the information is established by Order of the Ministry of Finance of the Russian Federation dated September 30, 2010 No. 116n (as amended by Order of the Ministry of Finance of the Russian Federation dated September 7, 2011 No. 106n).

Information about a foreign organization contained in the Unified State Register of Taxpayers includes the following information:

1) full and (if any) abbreviated name of the organization;

2) the address indicated in the constituent documents of the organization;

3) information about the registration of the organization in the country of incorporation;

4) taxpayer code in the country of registration or its equivalent;

5) information about a separate division of the organization (with the exception of branches specified in paragraph 6 of this chapter):

a) full and (if any) abbreviated name of a separate division of the organization;

b) address (location) of a separate division of the organization;

c) information on the accreditation of branches (representative offices) of the organization;

d) information on entering information about a branch or representative office into the register of branches and representative offices of international organizations and foreign non-profit non-governmental organizations;

e) information on entering information about branches of foreign non-profit non-governmental organizations into the Unified State Register of Legal Entities;

f) date of commencement (termination) of the organization’s activities on the territory of the Russian Federation;

g) types of activities carried out by a separate division of the organization;

h) information about the head (manager) of a separate division of the organization;

i) information about the dependent agent (counterparty) of the organization;

6) information about the branch of the organization that has opened separate divisions on the territory of the Russian Federation:

a) full and (if any) abbreviated name of the organization’s branch;

b) address (location) of the branch;

c) information about the registration of the organization in the country where the branch is located;

d) taxpayer code in the country where the branch is located or its equivalent;

7) name and code of the tax authority with which the organization was registered;

date of registration (deregistration) of the organization with the tax authority;

date of registration (deregistration) of the organization with the tax authority;

9) taxpayer identification number (foreign organization code);

10) code of the reason for registration (deregistration) of the organization with the tax authority;

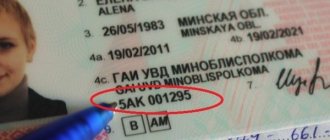

11) series, number and date of issue of the certificate of registration with the tax authority (certificate of registration with the tax authority1);

———————————

1) For foreign organizations whose registration was carried out before the entry into force of Order of the Ministry of Finance of the Russian Federation dated September 30, 2010 N 117n “On approval of the Peculiarities of accounting with the tax authorities of foreign organizations that are not investors under a production sharing agreement or operators of the agreement” ( registered by the Ministry of Justice of the Russian Federation on November 11, 2010, registration number 18935, Rossiyskaya Gazeta, 2010, N 265).

12) number and date of issue of the notice of registration (deregistration) with the tax authority;

13) information about real estate objects owned by the organization (including land plots);

14) information about vehicles owned by the organization;

15) information about the types of activities of the organization in respect of which the taxation system is applied in the form of a single tax on imputed income for certain types of activities, as well as information about the places where the organization carries out the relevant activities;

16) information about subsoil plots provided for use in accordance with the legislation of the Russian Federation to an organization that is a taxpayer of the mineral extraction tax, and about granting it rights to use subsoil plots;

17) information about the organization’s participation in the production sharing agreement;

18) information about the organization’s accounts opened in banks;

19) the date of the last submission by the organization to the tax authority of reporting documents provided for by the legislation on taxes and fees.

How to check a foreign company

Business does not tolerate mistakes, because any of them carries financial risks for the enterprise. Therefore, verification of the counterparty is primarily in the interests of the shareholders and founders themselves, and only then can it be considered an obligation to the Federal Tax Service and other government agencies. There are several ways to check the legality of a foreign company:

- Request the necessary documents from the counterparty himself. Conscientious partners will never refuse such a request. These must be: constituent documents;

- an extract from the state register confirming the status of a legal entity;

- documents confirming the identity and powers of the representative acting on behalf of the foreign partner;

- documents confirming the availability of the necessary resources, including tax reporting;

- documents confirming the availability of current accounts and so on. However, it would not be superfluous to check the submitted documents.

We suggest considering these and some other methods in more detail.

Receiving information in electronic form

Probably the easiest way to check the reliability of a foreign company for free is to use electronic databases. Many of them are indeed freely available.

But it is important to remember that any such publicly available information is for informational purposes only and cannot be considered an official response from a government agency. This is usually due to the need to constantly update information and a huge amount of information, the administration of which is inevitable.

Please note that the registers of different countries may contain different amounts of information - from a minimum set of data to detailed information, including the names of shareholders. The most popular registers include:

- The European Business Register (EBR). It is a united network of national business registers from 25 European countries. Access to information is provided through official information distributors. Some of them operate in Russia. Statements are provided for a fee.

- Companies House. The official Companies House of Great Britain, through which more than 300 thousand companies are registered annually. Provides both personal information (address, name) and data on wealth, information on annual income, copies of constituent documents, and so on.

- The Register of Enterprises of the Republic of Latvia. The Latvian Enterprise Register provides open access to constituent documentation, insolvency data, tax identification number, types of economic activity and other data.

- Department of the Registrar of Companies and Official Receiver (DRCOR). The Cyprus Business Register provides up-to-date information on companies registered on the island. Information about management is also open.

- Krajowy Rejestr Sądowy (KRS). Polish court register containing information about companies registered in the country. Online information is provided free of charge; written copies of extracts and certificates are provided for a fee.

- Registro Publico de Panama. Panama Public Register, which provides information about counterparties registered in Panama after registering on the site.

- The e-Business Register. The electronic register of Estonian companies provides information about the name, registration address, legal status, authorized capital and other information.

- Handelsregister. Registration portal of the German federal states, where you can find information both on companies registered throughout the country as a whole, and registered in individual regions.

- Unified state register of legal entities. Ukrainian state register, which allows you to obtain information about Ukrainian enterprises according to 30 criteria. General information is provided free of charge; for extended information you will have to pay 70 hryvnia (or about 2.5 US dollars).

- Veřejný rejstřík podle právnických osob v angažmá. The Czech State Register of Legal Entities provides information on the name, date and place of registration, address, identifier and even copies of financial reporting documents.

- EDGAR is an American system for collecting and analyzing business information about all American companies that are required to fill out SEC reporting forms.

- NECIPS. Chinese database containing corporate credit information of Chinese companies, as well as a list of untrustworthy and illegal enterprises.

- The Accounting and Corporate Regulatory Authority (ACRA). Singapore Accounting and Corporate Regulatory Authority.

Receiving information in writing

Of course, any of these registers (and all other existing ones) produces not only electronic information, but also written extracts. But their provision is always carried out on a paid basis. Many of these registers initially offer to choose not an electronic, but a written extract as a form of receiving information - after paying for the service and generating documents, they will be sent to the address specified by the applicant.

Notarization of such extracts is not required; they are certified by the signatures of officials and the seals of competent foreign authorities. Since they are requested primarily for personal use, a notarized translation into Russian is also not required. If necessary, an apostille is suitable.

If the registry does not provide the opportunity to order a written form of an extract, you can request it individually by drawing up an appropriate request.

It must necessarily:

- be written in English or the official language of the recipient country;

- contain all information about the applicant, starting from the company name and ending with registration data;

- contain the reasons for the request - in this case it is a verification of the counterparty;

- contain an indication of the contracts and agreements signed with the foreign partner;

- contain an indication of the normative act in accordance with which the information is requested - therefore, entrust its preparation to the legal service;

- be signed by the head of the organization.

Considering the delivery time of correspondence, it probably makes sense to use the services of intermediary companies that operate at the company’s location. However, other sources of information can be used to check the counterparty.

Countries with an open register of foreign companies in 2021

A database of foreign companies, beneficiaries and business founders is a current service of government portals in many developed countries of the world. The leader in this area in disclosing information and providing access to the open register of companies is the UK. On the jurisdiction's website you can obtain information about shareholders, directors and ultimate beneficiaries, as well as the history of document filing.

We suggest that you familiarize yourself with popular web resources in the Russian Federation and some CIS countries, where you can check the company and the entrepreneur using the initial data:

- Russia

To check Russian companies, government agencies offer several online services, including:

- Federal Tax Service, where you can get information without registration - https://egrul.nalog.ru - yes.

- Checking a financial organization is available on the Bank of Russia website – https://www.cbr.ru/fmp_check/.

- Data on bankruptcy of companies is presented on the portal https://fedresurs.ru/?attempt=1.

- Republic of Belarus

The portal where you can get an extract about individual entrepreneurs and legal entities is https://egr.gov.by/egrn/index.jsp?content=Find.

- Kazakhstan

Find a taxpayer - https://kgd.gov.kz/ru/services/taxpayer_search.

Search for inheritance cases - https://enis.kz/CheckTestament.

- Ukraine

The Unified State Register of Legal Entities and Individuals of Ukraine, where records of resident companies and entrepreneurs are stored – https://usr.minjust.gov.ua/content/home.

Public database of foreign companies - how to gain access

Conditions for access to public information about companies in foreign jurisdictions differ, but not by much. There are two options to receive an extract: free or for a fee. Also, in different countries, there are differences in mandatory registration when accessing the official portal or a completely open database, in which anyone can view information.

Links to online registers of foreign companies

To check the business reputation of a company and a future partner, you can always access a remote database. However, not all countries disclose information in full free of charge or even provide for closed registries, data from which are transferred to third parties only at the request of judicial authorities.

Sometimes it is much more profitable to immediately contact professional international economists and commercial specialists who will help on all corporate issues, including establishing partnerships, as well as selecting and purchasing an existing business.

| Jurisdiction | Online website (company registry) |

| Australia | https://connectonline.asic.gov.au/RegistrySearch/faces/landing/SearchRegisters.jspx |

| Antigua and Barbuda | https://abipco.gov.ag/efile/#/ |

| Belize | https://companysearch.bz/public_search/index.php |

| British Virgin Islands | https://www.bvifsc.vg/en-gb/divisions/registryofcorporateaffairs/certificateverification.aspx |

| Bahamas | https://www.bahamas.gov.bs/wps/myportal/public/rgd/company/company-search |

| Vanuatu | https://www.vfsc.vu/vanuatu-master/viewInstance/view.html?id=a5c1e83ff0a6678be092e2ef196729dde1df52e3b912e4cf&_timestamp=8474163572966134 |

| Hungary | https://www.e-cegjegyzek.hu/?cegkereses |

| Great Britain | https://www.gov.uk/get-information-about-a-company |

| Germany | https://www.unternehmensregister.de/ureg/?submitaction=language&language=en |

| Gibraltar | https://www.companieshouse.gi/login.html |

| Georgia | https://napr.gov.ge/dziebakomp |

| Guernsey | https://www.greg.gg/webCompSearch.aspx?r=1 |

| Hong Kong | https://www.icris.cr.gov.hk/csci/ |

| Denmark | https://datacvr.virk.dk/data/ |

| Delaware (USA) | https://icis.corp.delaware.gov/Ecorp/EntitySearch/NameSearch.aspx |

| Dominica | https://servicios.camarasantodomingo.do/consultaRm.aspx |

| Jersey | https://www.jerseyfsc.org/registry/documentsearch/ |

| Spain | https://www.rmc.es/Sociedades.aspx?lang=en |

| Italy | https://www.registroimprese.it/en/web/guest/home |

| Ireland | https://search.cro.ie/company/CompanySearch.aspx |

| Cameroon | https://ccima.cm/# |

| Canada | https://www.ic.gc.ca/app/scr/cc/CorporationsCanada/fdrlCrpSrch.html |

| Cayman islands | https://www.registry.gov.ky/verify/ |

| Cyprus | https://efiling.drcor.mcit.gov.cy/DrcorPublic/SearchForm.aspx?sc=1 |

| Curacao | https://www.curacao-chamber.cw/services/registry/search-company |

| Latvia | https://www.lursoft.lv/ |

| Liechtenstein | https://www.oera.li/cr-portal/suche/suche.xhtml |

| Mauritius | https://companies.govmu.org:4343/MNSOnlineSearch/ |

| Malta | https://rocsupport.mfsa.com.mt/pages/SearchCompanyInformation.aspx |

| Marshall Islands | https://resources.register-iri.com/CorpEntity/Corporate/Search |

| Macau, China | https://www.ipim.gov.mo/en/business-investment/macau-business-database/ |

| Netherlands | https://www.kvk.nl/ Information is provided for a fee |

| Panama | https://www.panadata.net/en/organizaciones |

| Seychelles | https://eservice.egov.sc/BizRegistration/WebSearchBusiness.aspx Data is provided only about resident companies |

| Singapore | https://www.bizfile.gov.sg/ |

| Saint Lucia | https://efiling.rocip.gov.lc/#/ |

| USA | https://www.sec.gov/edgar/searchedgar/companysearch.html |

| Finland | https://www.ytj.fi/ |

| Czech | https://portal.justice.cz/Justice2/Uvod/uvod.aspx |

| Switzerland | https://www.zefix.admin.ch/en/search/entity/welcome |

| Sweden | https://bolagsverket.se/en/info/buy/e-services/company-information/find-company-information-1.8875 |

| Estonia | https://ariregister.rik.ee/ |

This list is not complete and is annually supplemented by new countries that are ready to provide access to the open register of foreign/local companies.

In case of registration of a non-resident company, it is also recommended to first clarify information about the confidentiality of shareholders and beneficiaries. You can open an account and business abroad as correctly and reliably as possible with the support of experts from the International Wealth portal by leaving your contacts for feedback or sending a message by email.

Other sources of information

Verifying foreign companies through official registries of their countries of origin is probably the most reliable way. But far from the only one. In the end, official registers do not always provide access to an expanded list of data, often limiting themselves, although relevant, to general information that does not give a complete picture of the activities and successes of the future partner.

In addition to public registers, Russian entrepreneurs should also check other possible sources for obtaining up-to-date information about the counterparty, including:

- Russian and foreign specialized databases;

- open information from tax administrations around the world;

- Russian register of branches and representative offices;

- information about cooperation with the Chamber of Commerce and Industry;

- information from specialized intermediary companies, etc.

Let's look at some of them in more detail.

Russian specialized base

Unfortunately, the only truly Russian database can be considered only the Portal of Foreign Economic Activity, created by the Ministry of Economic Development. In addition to other information for exporters of Russian products, this portal contains a database of foreign partners. It contains information about foreign counterparties of Russian companies.

Information is entered from more than 30 authoritative sources: private companies, news agencies, trade missions, ministries and even the Chamber of Commerce and Industry. As a rule, the database contains registration information, place and address of registration, contacts, description, types of export and import activities, name of the general director and other information.

In addition, we recommend that readers pay attention to:

- to open databases of foreign countries posted on the Federal Tax Service website https://www.nalog.ru/rn77/about_fts/inttax/oppintevasion/obdig/. Here you can find information about public information resources of more than 100 foreign countries, with the help of which you can find information about any foreign company registered in this country. The links are for reference only, although they also include links to state registers;

- to the interactive platform “Russia’s Export Potential”. The database created by the Kommersant information agency to help potential participants in foreign economic activity allows you to find trading partners and interact with the Eurasian Economic Commission. The search can be carried out by the country of interest to the company or by the type of economic activity of interest.

Global Databases

We also recommend paying attention to international registers and information databases:

- The Open Ownership Register is a global registry of beneficial owners created to bring commercial transparency to the world. It is not state-owned, therefore, at the time of publication, it contains information about only 5.1 million companies. Contains not only registration information, but also information about the final beneficiaries;

- Interfax – Dun & Bradstreet is a joint venture between a news agency and a company that is a global leader in the market of information about legal entities. It not only has its own base of companies around the world, but also offers strategic information solutions.

- Compass. The global directory of enterprises contains information about companies from more than 60 countries. The information in it is structured not only by region, but also by type of activity and even by product manufactured. In total, the database includes more than 12 million companies;

- EUROPAGES is a European B2B platform covering more than 3 million enterprises registered in the system from 26 European countries (mainly EU countries). Provides search by industries and areas, products, location of the company or its name;

- Opencorporates is the largest open database of companies in the world currently in existence, with more than 163 million companies listed worldwide. With its help, you can obtain not only general information about contractors, but also information about management, founders, and current owners.

Tax administrations of foreign countries

Another source of electronic interaction is the websites of tax services of countries around the world. You can also find them on the Federal Tax Service website https://www.nalog.ru/rn77/about_fts/inttax/oppintevasion/naw/. In many of them, information about taxpayers who are legal entities is also in the public domain. Typically, the full name or identification number is sufficient to identify a specific taxpayer. The amount of information provided may vary depending on the country, but may include:

- date and place of fiscal registration;

- taxpayer identification number;

- residence of the organization;

- the taxation system used;

- presence of tax debts, etc.

Register of accredited representative offices

One of the forms of commercial activity of foreign enterprises in Russia is the opening of a branch or representative office. They, according to Art. 4 Federal Law No. 160 of 07/09/1999 “On Foreign Investments in the Russian Federation” can be valid in the Russian Federation only after passing accreditation. From the moment of its passage, all such representative offices are entered into a special register - RAFP. If a foreign company is not in the register, its activities are illegal.

To carry out the verification, it is enough to use one of the parameters: TIN, name or registration number. Based on the result, the system produces a set of publicly available information, the start date and termination date of accreditation.

Chamber of Commerce and Industry

Another source is the Chamber of Commerce and Industry, which has its offices around the world. Russian trade missions operate in many countries - these are government bodies that provide free support for the foreign economic activities of Russian businesses.

As part of projects to support Russian exports, trade missions of the Russian Federation provide Russian entrepreneurs with advisory assistance, for example, providing basic information about a foreign company/organization (in addition to contacts).

Both existing exporters and companies planning export activities can request such information. This can be done in two ways:

- using the electronic request service (available only to exporters registered on the portal);

- by sending a request to a specific trade mission, the addresses of which can be found here https://www.ved.gov.ru/exportcountries/.

Intermediary services

In addition to these sources, there are many intermediary companies on the market, including electronic Internet services that carry out inspections of counterparties on a paid basis. The cost of their services depends on the volume of necessary information requested and the urgency of its preparation.

Many of them also provide consular legalization and apostille. In addition to data from trade registers and other publicly available information, such companies conduct legal analysis and provide their own assessment of the risks of cooperation.

Obtaining information about a foreign legal entity

An organization may need information about a foreign legal entity in different situations. The most common ones include the need to check the counterparty before concluding a transaction or to clarify the current status of the current counterparty.

Checking the legal and economic status of a foreign partner (for example, a supplier, buyer, legal entity in which you are an investor, or a participant in your legal entity), assessing its financial solvency allows you to reduce the risk when carrying out foreign economic activity. At the same time, it is more difficult to obtain reliable and objective information about a foreign legal entity than about a Belarusian one. As a rule, the legal service is responsible for obtaining such information. Next, we will consider the main ways and sources of obtaining information about a foreign legal entity.

Request information from a counterparty

It is advisable to request:

— an extract from the register of the state in which the counterparty is registered;

— constituent documents. The names and contents of such documents vary from country to country;

— documents confirming the identity and powers of the company representative (the right to sign, negotiate, etc.);

— documents confirming the availability of the necessary resources, including tax reporting;

— documents confirming the availability of current accounts;

— other necessary documents.

It is advisable that the documents be translated into Russian or Belarusian and certified.

The counterparty's refusal to provide the requested information should raise red flags.

The information received from the counterparty should be verified. This can be done in one or more of the ways discussed below.

Obtaining information from open sources

You can find information about foreign counterparties on various websites that collect information about companies from one or several countries at once. Both government agencies and organizations in these countries, as well as commercial companies, have such portals.

The web portal of the Unified State Register of Legal Entities and Individual Entrepreneurs of Belarus provides links to online registers of some foreign countries.

The website of the Federal Tax Service of the Russian Federation provides links to open databases of 113 states.

Information about European companies can also be found on the website of the European Business Register (EBR), which provides links to national registers of European countries.

You can read more about the registers of European countries here.

When searching for information in national registers, the following must be considered. The amount of information that can be obtained free of charge depends on the specific country. As a rule, information is open: about the name, registration number, status (valid or not) and address of the legal entity. At the same time, all the information contained in the register, or most of it, can be open. For example, information about changes in registration data, participants, the size of the authorized fund (capital), etc. Typically, country registries provide basic information free of charge and additional information for a fee. In addition, in the registers of some countries, information is available only in national languages (for example, Ukraine, France).

It is important to remember that often such publicly available information is for informational purposes only and cannot be considered an official response from a government agency. At the same time, this is not always the case. It is necessary to look on the website of each register for an indication of whether the information provided is considered official or reference.

For example, information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs of the Russian Federation about a specific legal entity/individual entrepreneur is provided free of charge in the form of a complete extract from the relevant register or a certificate of absence of the requested information. The extract/certificate is uploaded in the form of an electronic document signed with an enhanced qualified electronic signature. To receive an extract/certificate, the applicant does not need an electronic signature key certificate (SKP). The extract/certificate is generated in PDF format, containing an enhanced qualified electronic signature and its visualization, which is also displayed when the extract/certificate is printed. It is equivalent to an extract/certificate on paper, signed with the handwritten signature of a tax authority official and certified by the seal of the tax authority <*>. Information in the service is updated daily.

In some cases, information from open sources (both free and those providing access for a fee) may be sufficient. For example, if they provide detailed information about a legal entity. Or, at the stage of the initial verification, it became clear that the register does not contain information about the registration of the counterparty, and therefore further waste of time and money on checking it is impractical.

Obtaining an extract from the register of the country of establishment of a foreign legal entity

You can request such an extract at your discretion. However, there are cases when this is necessary. It is an extract from the trade register of the country of establishment (or other equivalent evidence of the legal status of the organization in accordance with the legislation of the country of its establishment) that is necessary, for example, when preparing documents for state registration <*>:

— organizations when the owner of the property, founder (one of the founders) is a foreign organization;

— changes to the charter related to a change in the owner of the property, a change in the composition of participants, if the new owner of the property or participant is a foreign organization.

The extract must be dated no later than one year before the date of filing the application for state registration. As a general rule, such an extract requires legalization.

Note: Not all foreign official documents are subject to legalization. For example, on documents from states party to the Hague Convention Abolishing the Requirement for Legalization of Foreign Public Documents, an apostille is sufficient. Moreover, if the document is issued in a country with which Belarus has signed a bilateral or multilateral agreement on legal assistance that waives the legalization requirements, no additional special identification is required. A list of such international treaties is available on the website of the Supreme Court of the Republic of Belarus.

The procedure for obtaining an extract (sending a request, payment, deadline and methods for sending a completed extract), as a rule, can be found on the website of the register itself. For example, the procedure for obtaining an extract from the Lithuanian register can be found here. So, to receive an extract, you must fill out an application in the prescribed form and send it to:

— by mail to the address: Lvovo g. 25-101, 09320 Vilnius, attaching a copy of the manager’s identity document (no need to notarize the copy) and a document confirming payment for the service, or

— by email In this case, the application must be signed electronically.

Contacting organizations that provide services to provide information about companies and verify them

When a deeper and more comprehensive examination of a counterparty is needed, it is advisable to turn to specialists. However, this is associated with additional financial and time costs.

On the Internet you can find companies (both domestic and foreign) that provide services for providing information about foreign legal entities. The cost of services, as a rule, depends on the volume of information requested and the timing of its preparation.

Information about legal entities is provided in the form of business certificates. Such business certificates, as a rule, include: registration data of the legal entity and changes that have occurred; information about management, including persons with the right to sign; information about personnel, their number; the size of the authorized capital (capital), the history of its changes; information about the founders and the size of their shares, the company’s field of activity, the availability of real estate, affiliates, negative facts (existence of debt, delays in payments, etc.); additional information (for example, participation in trials, availability of transport, mentions in the media, etc.); financial data (balance sheets, profit and loss statements).

Companies providing information about foreign legal entities supplement business information with important analytical indicators characterizing the current solvency of the legal entity, its payment discipline, and also provide their own assessment of the possibility of cooperation with the legal entity being inspected. These indicators are formed using software products and with the help of financial analysts.

Some companies post on their websites examples of business references that they prepare for clients.

Some of these companies, in addition to providing business certificates, provide services for obtaining extracts from foreign registers, and also provide their consular legalization and apostille (if necessary).

Publicly available information

Depending on the country of origin of the counterparty, information contained in public registers and databases, as well as the instruments used, a Russian company can obtain the following information about the counterparty:

- genuine registration data: address, number, date, full name, official contacts and so on;

- legal status: active, in the process of liquidation or liquidated, information about reorganization and previous names;

- types of activities in accordance with the local classifier;

- details and basic information from the constituent documents (governance bodies, names of management);

- access to financial and, if possible, accounting reports, tax residency;

- the presence of tax and other debts, arrests and other encumbrances on property.

Let us repeat that the amount of information may differ from country to country; there is no uniform global practice.

Sources of information about foreign organizations

When choosing a source of information about the activities of a foreign company with which cooperation is expected, preference should be given to resources owned by government agencies and regularly updated.

You can find information about foreign counterparties:

- on the websites of tax authorities;

- on online resources open to the public;

- from company directories published in different countries;

- from specialized databases;

- by contacting the Chamber of Commerce and Industry;

- through a local specialized organization.

Specialized Russian databases for checking foreign companies

Our country has a specialized information retrieval system designed to check foreign counterparties -. The resource was organized by the Ministry of Economic Development as a tool to increase the level of efficiency of the country's foreign economic activity.

The main goals pursued by the portal developers:

- providing information to domestic and foreign companies;

- assistance in promoting domestic goods and services to international markets.

The operation of the system is under the authority of the Department of Development and Regulation of Foreign Trade Activities.

The system is being filled:

- structural divisions of the Ministry of Economic Development;

- Representative offices of the Russian Federation on trade and economic affairs abroad;

- regional administrations of the Russian Federation;

- business associations;

- industry unions;

- domestic companies engaged in exports.

Together with the global D&B network (Dun and Bradstreet), the Russian group has developed the Interfax-D&B system, adapted for work in the Russian Federation and the CIS countries. It allows you to obtain information from a global database of organizations, and also offers to order analytical services and conduct assessment activities to avoid credit risks.

Specialized databases of countries around the world for checking foreign counterparties

The maximum information about a foreign company can be found in specialized foreign databases. Relevant sources include:

- - a global network founded in 1841 and allowing you to find information about any enterprise from all countries of the world and draw conclusions on the basis of it about the possibility of beneficial cooperation. The advantages of the network are the huge volume of data on 200 million enterprises, as well as unique verification and standardization of data.

- – resource of the credit information agency Creditreform. Contains ready-made credit information and up-to-date information on 85% of European enterprises.

- – business-to-business database with data on more than 3 million companies from 60 countries. It is also possible to search by classifier of services and products. The user can submit a request for the supply of products and download a demo version of the directories.

Information about companies is quite detailed:activities,

- range of goods and services,

- trade marks,

- management composition,

- directions of export and import.

List of tax administrations of countries around the world on the Federal Tax Service website

An audit of the organization of interest can be carried out through the official website of the Russian tax service by opening the special section “International cooperation” and following the corresponding link to the website of one of the tax administrations of other states. There it will be possible to check the scope of services of foreign resources available to the user.

To communicate with tax administrations from abroad, it is enough to go online. On the portal of the Federal Tax Service of the Russian Federation they are systematized in tabular form for the convenience of the applicant.

Register of accredited branches and representative offices of foreign legal entities (RAFP)

In August 2021, the Federal Tax Service introduced a new online service that provides free access to information about all registered foreign branches and representative offices.

To send a request, just specify any of 3 search parameters:

- branch name,

- state number of the accreditation record (NRA),

- TIN.

Using the search, you can find out:

- full name of the foreign company,

- legal address,

- the date of receipt of the state number of the record of successful completion of accreditation,

- date of termination of accreditation.

This service expands the capabilities of Russian enterprises when checking the reliability of foreign companies and demonstrates how to check a foreign company for reliability for free.

Appeal to the Chamber of Commerce and Industry of the Russian Federation

Before concluding an agreement on international cooperation, you can contact a reliable intermediary to check the foreign counterparty - the regional one.

The process of applying for a service includes the following stages:

- Drawing up an application.

- Receive a work cost approval sheet.

- Receive an invoice for payment and transfer the amount indicated in it to the Chamber of Commerce and Industry account.

- Waiting for confirmation of successful payment.

- Waiting for a business certificate to be issued.

- Receive documentation and reports.

- Signing the act of providing the ordered service in full.

The result of the work of Chamber of Commerce and Industry employees will be a issued business certificate for a legal entity from abroad. It will contain:

- registration information;

- legal status;

- date of foundation;

- size of the authorized capital;

- financial statements;

- financial stability analysis report;

- information about the founders;

- data on the presence of subsidiaries;

- Contact details.

The Chamber of Commerce and Industry may refuse in the following cases:

- provision of an incomplete set of papers by the applicant;

- refusal to make an advance payment.

Services of local specialized companies

To contact a specialized organization offering, you must provide:

- details of the company being inspected;

- power of attorney to represent your interests.

Companies specializing in providing legal services, in addition to collecting all the information necessary to verify a foreign counterparty, often offer to draw up their own written advisory opinion regarding the company in respect of which the research was conducted. Some agencies undertake the translation of documents, the development of a foreign trade agreement and its legal examination.

What to pay attention to

Taking into account the current practice and recommendations set out in the letter of the Ministry of Finance No. 03-07-14/72647 dated December 11. 2021, order of the Federal Tax Service No. MM-3-06/ dated May 30, 2007, when conducting an independent audit of a counterparty, the taxpayer must pay attention to such signs of unreliability as:

- lack of information about the state registration of a legal entity in a foreign register;

- lack of personal contacts between management, reluctance to establish them;

- registration of a partner at the “mass” registration address;

- lack of information about the actual location of production facilities, head office, warehouse and other office premises;

- lack of documentary evidence of the authority of the company's management;

- lack of information about the counterparty in the public domain (lack of advertising, reviews, recommendations of other partners);

- inclusion of dubious conditions in the contract: long deferments in payments, deliveries without prepayment, payments through third parties, etc.;

- the presence of large debts, including in favor of the counterparty, in the absence of real actions aimed at collecting them;

- lack of obvious evidence of the possibility of fulfilling obligations (no licenses, capacity, required number of personnel), etc.

The combination of these factors allows tax authorities to regard a foreign partner as problematic, and contracts with him as questionable.

Methods for checking a foreign legal entity

Sometimes travel from abroad is carried out for personal purposes, when the business owner wants to make sure of its reliability. But most often it is organized to prove the company’s diligence to the tax service in order to avoid the loss of tax benefits and deductions. Depending on the purpose of studying the activities of foreign organizations, you may need a report on the activities in electronic or written form.

There are two main ways to check the legality of a foreign company:

- Request data from foreign registers via the Internet. Not only in Russia there are state registers of companies (such as the Unified State Register of Legal Entities, the Unified State Register of Individual Entrepreneurs), in other countries records are also kept of all legally established enterprises, and the information reflected in them appears more complete than in the Russian Federation - for example, you can see data on the amount of authorized capital sold shares, composition of founders and address. Information helps to assess the risks of cooperation with one of the foreign companies. Citizens of other states can also use the databases for a fee.

- Send a request to the authorized body that maintains the register to provide the necessary information in writing. The verification method is no different from that used for, and consists of submitting a request for an extract from a foreign register, certified by a notary.

Receiving information in electronic form

Today, the most convenient and fastest way to request a service of interest to a user is to send a request via the Internet. You can check the activities of a foreign counterparty online and receive reports with the required information in electronic form in the following ways:

- By contacting the tax administration of the state in whose territory the potential partner’s company is registered.

- By ordering certificates in specialized databases.

- Through legal agencies that provide consulting services for checking foreign counterparties.

- Through highly targeted registries that provide information about foreign companies.

However, the most reliable sources of information are government databases. Many states have created open databases with information about the reliability of taxpayers, the presence of debt obligations of companies, the payment of VAT by some companies, etc. Similar services are organized in:

- European countries. To get acquainted with data on organizations of 28 EU countries, you can use it, which has been in force since 1998. The purpose of the registry is to redirect the user to national distributors who will charge a fee for the provision of the service and provide the necessary data.

The advantage of obtaining an extract from the European Business Register is the ability to receive it in English and the speed of requesting information.

The opening was initiated by several international companies. Thanks to their initiative, it became possible to identify the ultimate owner of organizations that were registered offshore.

- In France, it operates, which contains data on the owners of legal entities, registered real estate, subsidiaries, affiliates, beneficiaries. The information is provided free of charge only in part - you will have to pay a fee for copies and extracts.

It is possible to order the following documents:a set of papers, including an extract from the cadastre;

- statutory documents with notes on changes that have occurred in the activities of companies;

- an extract on the organization’s government debts;

- an extract about the founders and managers of legal entities;

- legal addresses.

information about bankrupt and liquidated companies, as well as existing guarantees;

Using the first one involves going through a lengthy registration procedure, including:

- filling out the registration form;

waiting for the application to be approved by the portal administration;

The second, on the contrary, will seem convenient to the user, largely due to the ability to select one of 5 languages. After paying the fee, you can request the following documents:

- current statement of the organization;

- chronological extract;

- historical extract;

- statement about the owners;

- company documents.

- In the UK, the government has not provided for the issuance of information from the register of legal entities directly from the official government website, but intermediaries have developed a very convenient database for searching for any information of interest to the user, both official and unofficial. The State Register allows you to find information by company name, and commercial companies will help you find a specific person. The information provided free of charge includes information about the owner of the organization; all other information will be available after payment of the fee.

- In Ukraine. Inspection of enterprises can be carried out through. Available information includes company names, founders and managers. There is no data on the number of legal entities registered under one person.

Receiving a report in writing with notarization

The procedure for applying for a written report from a foreign register of companies does not differ from a similar request to Russian government agencies in order to check the reliability of a domestic counterparty.

The action plan is as follows:

- Visit, go to the “International Cooperation” section, find in the table a link to the website of the tax administration of the country in which the potential partner enterprise was registered.

- Follow the link, if necessary, register and verify the signature.

- Pay a fee for information services.

- Leave a request for an extract from the register, translation into Russian, affixing an apostille and sending it to the desired address.

- Wait for the requested documentation.

Cost and timing of inspection

The most economical option is to independently assess risks using available Internet services. Requests are usually processed instantly and almost always free of charge. In exceptional cases, you will need to pay a $5-10 fee. However, this method will provide only a minimum of information.

Obtaining written statements will require more expense and time. It will take 14-20 days to receive them from abroad (up to 1 month if apostille is required). In total, such requests, if they are carried out independently to several registries at once, will cost $150-200. Intermediary companies will charge 400-500, and in some cases even 1000 dollars for such a service.

The most expensive package will be a package of documents with an expert legal analysis of activities. The cost of such services is discussed individually by intermediary companies - prices start from $1,000. Preparation of documents will last 7-30 days depending on the complexity and composition of the information.