Russian legislation regulates the payment of pension benefits to immigrants from post-Soviet countries. These norms are of genuine interest to Kazakhs, who constitute one of the largest groups of migrants in the Russian Federation. Thanks to current legislative documents, pensions in Russia are required to accrue to those who moved from Kazakhstan - subject to a number of requirements.

What is resettlement

Migration of the population occurs for various reasons - economic, humanitarian, political, natural. They all divide migrants into two categories:

- forced;

- voluntary.

The latter decide to change their place of residence based on dissatisfaction with living conditions, inability to find a job or secure a decent income. All this forces them to move to economically more developed regions.

As for forced migrants, the reason for their displacement is most often processes that do not depend on them and which they themselves cannot influence. Usually these are epidemics, emergencies, military operations, etc.

If we consider migration in the context of one state, it can be divided into two types:

- internal - moving without going abroad;

- external – change of country of residence.

The territory of the Russian state is of greatest interest as a country for migration among residents of the former Soviet republics. Most often, the migration service has to deal with representatives of Kazakhstan, Uzbekistan, Kyrgyzstan and Ukraine. All of them can take advantage of the opportunity to resettle within the framework of the Compatriot program, which gives the right to a simplified procedure for obtaining Russian citizenship.

Pension for emigrating Russians

According to the legal norms prescribed in Article 4 of Federal Law No. 400, all Russian citizens without exception have the official right to a pension. It doesn’t matter here whether they live in Russian cities or not. The main requirement is that the state where they moved does not pay them a pension.

Also, according to the law, a citizen of Russia has the right to receive the required maintenance through a representative. He must have a power of attorney, drawn up and certified in accordance with the standards of Article 185 of the Civil Code of the Russian Federation.

The issuance of pension accruals by proxy cannot be issued indefinitely. Every year an emigrant must come to the Russian Federation or contact the consulate at his residence address.

Pension provision for relocation within the country

In Russia, pension support is provided for by modern federal legislation, as well as regional legislation. Accordingly, every pensioner, when moving to another locality, must provide information about leaving the city to the appropriate organization.

The right to receive regional transfers is granted only with permanent registration. In order not to lose such payments, a person is obliged to register with the Pension Fund in the new city. Here you need to submit a package of documents for transferring your pension to your new place of residence.

Pension provision in Russia

Let us recall that until 2001, the Russian Federation had a distribution model for calculating pension payments, which was inherited from the Soviet Union. The size of the basic part in it was fixed and had no dependence on either earnings or length of service.

Over the next few years, a pension reform was introduced, on the basis of which this methodology was abolished, and all employers were required to pay insurance premiums for their employees.

To date, the amount of payments is 22%, of which 16% is an insurance payment and 6% is a funded payment.

All pensions in Russia can be divided into the following groups:

- insurance (previously it was called labor);

- state provision of pensioners;

- non-state pension.

The insurance pension covers wages that a citizen cannot receive due to loss of ability to work. It has three subcategories:

- on disability;

- by old age;

- upon loss of a breadwinner.

The right to receive old-age payments in the Russian Federation is granted to persons who have reached a certain age: women - 55 years old, men - 60 years old, and who have an insurance record of at least 5 years.

The state pension is paid to those who have lost their income due to termination of civil service or loss of legal capacity. This includes long service, old age and social pensions.

Types of entitlement pension

Once a person receives the right of residence, he receives certain rights:

- Medical service;

- Free education;

- Establishment and receipt of pension accruals under the conditions prescribed in Federal Law No. 400 and other legal federal acts.

According to Federal Law No. 166, those who have received the status of migrants have the right to receive all possible types of pensions.

This right is granted to migrants on the same basis as to citizens of the Russian Federation by birth. They can receive such types of pension transfers as:

- By length of service;

- For disability;

- Standard old age pension;

- Support from the state for the loss of a breadwinner.

Social benefits for residents of Kazakhstan

To receive any payments, persons arriving in the Russian Federation from the Republic of Kazakhstan must confirm:

- fact of legal border crossing;

- legal stay in the Russian Federation;

- availability of grounds for receiving social benefits.

Participants in the State Resettlement Program must obtain the appropriate certificate. All other candidates will have to obtain a residence permit, on the basis of which they will have equal rights to Russian citizens in most matters, including receiving a pension.

Payments such as maternity capital for migrants from Kazakhstan will become available only after they receive citizenship. This is due to the fact that one of the requirements for participation in the program is Russian citizenship.

Agreement between the CIS countries on the provision of guarantees for the right to pay pensions

In 1992, the CIS member countries signed an agreement that still regulates the issue of pension provision for citizens of post-Soviet republics moving for permanent residence to one of the signatory countries.

The document says:

- the provision of pension payments to citizens of the countries participating in the agreement is carried out in accordance with the laws of the state in which they live;

- all payment costs are borne by the country that pays the pension;

- benefits are assigned only at the place of residence;

- the applicant’s work experience includes all years of work recorded in the territory of any of the participating states or in the USSR until the time the agreement came into force;

- When pensioners resettle, the provision of benefits in the country of previous residence is terminated if payment of the same purpose is provided for at the place of new residence.

Thus, how a pension is calculated in Russia for migrants from Kazakhstan depends on the standards in force in the Russian Federation at the time the applicant retires, taking into account the conditions set out in the agreement.

In addition to Kazakhstan, the signatories of the agreement today are Ukraine, Turkmenistan, Armenia, Belarus, Kyrgyzstan, Turkmenistan, Tajikistan, and Uzbekistan.

Is it possible to transfer a pension from Kazakhstan to Russia?

To move and transfer their pension payments to the Russian Federation, a citizen of the Kyrgyz Republic will have to perform several actions:

- It is legal to cross the Russian border.

- Register with the migration service.

- Obtain the status of a migrant, refugee or obtain a residence permit.

- Notify the Pension Fund of Kazakhstan that you have changed your place of residence and withdraw from the pension register in your country.

- Submit documents related to work experience to the Russian Pension Fund.

After a special commission examines the submitted documents and the candidate’s pension file and confirms their accuracy, it will set the amount of the monthly payment. All payments are transferred to a card account, which the pensioner must register by that time.

As an option, the pension can be delivered to the recipient by mail in the manner prescribed by law. Transferring a pension from Kazakhstan to Russia when moving for permanent residence is impossible if the applicant does not have a residence permit.

How to apply for a pension

So, we found out that we can move on to the issue of processing payments only when our stay in the Russian Federation is legalized. That is, it will be clear that the citizen intends to settle in Russia on a permanent basis. To ensure that the process does not drag on, it is very important to know exactly what documents the candidate will need and how much he can expect.

Preparing documents

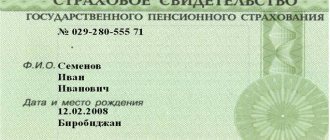

You can receive pension savings when moving to Russia from Kazakhstan on the basis of the following package of papers:

- Residence permit.

- Passport.

- Work book, which records the existing experience.

- A certificate from the pension fund of the country of citizenship stating that the applicant does not receive payments at the place of previous residence or that they have been discontinued.

- Certificate from the place of new residence.

- A certificate fixing the amount of insurance premiums.

If we are talking about a disability pension, then you will need a medical document and a certificate of family composition, including dependents. To assign a pension in the event of the loss of a breadwinner, you must attach to the package of documents a certificate of death of the breadwinner, documents that can confirm your relationship with him, a certificate of income or lack thereof. IDPs and refugees will definitely need a certificate confirming their status. According to the agreement signed by the CIS countries, legalization of documents for submission to the Pension Fund of the Russian Federation is not necessary.

Payment amount

To be able to withdraw pension savings, you will need a card account. But in order for the funds to go to him, payments will have to be recalculated. It is produced under the following conditions:

- Old age pension benefits are accrued when the applicant reaches the appropriate age and has at least 15 years of experience. In this case, the pension coefficient must be at least 30 points (depending on length of service).

- Disability benefits - to recalculate, you will have to re-pass a medical and social examination (MSEC) already on the territory of the Russian Federation and confirm your disability.

- In the event of the loss of the main breadwinner, it is necessary to confirm the death of this person and provide the documents specified above.

- By length of service - if you have harmful work experience or work in a certain position.

A pension on any of the above grounds includes two components:

- fixed payment (takes into account the norms of Article 16 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”);

- insurance (calculated in accordance with Article 15 of Federal Law No. 400).

The fixed amount of the old-age pension today is 4,558.93 rubles, and for the loss of a breadwinner and disability - 2,279 rubles.

The insurance pension is calculated using the formula: IPC (individual pension coefficient, which depends on contributions made to the Pension Fund) multiplied by the value of the pension point (in 2021 - 74.27 rubles). A fixed amount is added to the result obtained.

Thus, what kind of pension a Kazakhstan pensioner will receive when moving to Russia will depend on previous contributions, length of service and the value of the point, the amount of which increases every year.

If the country paying the pension uses a national currency, payments are calculated based on the official exchange rate at the time the benefit is awarded.

Who can receive a pension?

According to the law on providing for migrants, this category of citizens can rightfully count on such accruals as:

- For old age - upon reaching the required retirement age and having at least 15 years of experience. The accumulation of the pension coefficient is important here. It should be equal to 30 points. This indicator depends on the amount of insurance contributions made.

- For disability - after the degree of labor loss has been officially established and a medical examination has been carried out by the MSEC of the Russian Federation.

- For the loss of a breadwinner - upon official confirmation of the death of a family member who was entrusted with the responsibility to support children or the elderly.

- By length of service - the presence of work experience accumulated in hazardous industries. They must be included in a special list approved by law. It is equally important to occupy a position that fully complies with the requirements of the ETKS of the Russian Federation.

What to do if your place of residence has changed

Often, due to various circumstances, pensioners have to change their location and move to a new one. How to be in this case? It is worth noting that funds for pension payments are provided by local budgets. Therefore, it is imperative to deregister at the old address, and upon arrival, inform the Pension Fund and register in the new region.

Do not forget that pensions have some regional characteristics. This means that retirees may receive some additional payments to their benefits.

The re-registration procedure takes up to three days. There is no need to prepare a new package of papers. The case will be transferred through the internal system of the Pension Fund. Persons who earned their work experience in the Far North or in areas equivalent in terms of conditions to it retain their pension supplement wherever they move.

So, citizens of Kazakhstan who are officially registered in the Russian Federation and intend to settle here for permanent residence are equal in rights to Russians in all social issues, including receiving pensions.

Features of registration of pensions for citizens of Kazakhstan in the Russian Federation in 2021

Nationals of Kazakhstan enjoy the privileges provided for by international agreements with the Russian Federation within the framework of agreements between the CIS countries. These include the Agreement on guarantees of the rights of citizens of the CIS member states in the field of pensions dated March 13, 1992. The possibility of obtaining state support in the event of a change of country of permanent residence due to the peculiarity of the status of a foreigner is determined. The following norms of the international act apply to Kazakhs who moved to Russia:

- The accrual and payment of funds is carried out within the framework of pension provision according to the laws of the country to which the citizen from the CIS country moved.

- When determining the amount of payments, length of service earned within the CIS border on the territory of any state or in the former USSR is taken into account if the work was carried out before the adoption of the 1992 Agreement.

- It is not allowed to process payments in two countries at once - nationality and permanent residence - the Russian Federation. It is necessary to stop deductions by decision of the government agency in the state of origin.

- The pension is assigned according to the rules of the country to which the foreigner has moved with the right of permanent residence.

- It is necessary to acquire in the Russian Federation, where a citizen of Kazakhstan has moved, the right to permanent residence - a residence permit when applying to the migration authority at the place of registration or actual stay.