Consulting lawyer › Civil law

Send

- Ways to solve the problem

- Recovery procedure

- Collection of documents

- Filling out an application

- Contacting the territorial inspection

- Recovery by mail

- Via the Internet

- Estimated deadlines

A situation may arise in a person’s life when it is necessary to get an answer to the question of how to restore the TIN if lost. This taxpayer number reflects all possible deductions, including taxes and pensions. The loss of a certificate is due to the fact that it is practically not required to be provided anywhere, but is in the hands of a citizen.

Ways to solve the problem

Since all information about the tax payer number is contained in the Tax Service of the country, the restoration process is primarily associated with contacting the territorial department. Here we are talking about the location of the organ at the place of residence. It will be enough to write the appropriate application and receive a duplicate, which contains the same number that was originally.

In addition, you can use Internet resources not only to complete the entire procedure without contacting the authority, but to fill out documentation, send an application and other actions. The same applies to the use of mail through which documents are sent for consideration of the issue of issuing a duplicate to replace the lost certificate.

At the same time, it is important to pay the state fee for the activities carried out by government agencies. A receipt for this is attached to the entire list of papers.

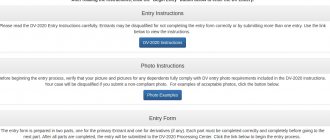

How to restore an individual’s TIN if lost through State Services

Restoring the TIN through State Services is currently impossible. After updating the service, this service was excluded from the catalog. Now it turns out to be exclusively the tax service. The procedure, in essence, does not differ from the initial registration of an individual as a taxpayer and receipt of a certificate with a unique number. The difference will be that the application for a duplicate indicates the reason why it is requested. This determines whether a state fee will be charged for re-issuing the certificate or whether a duplicate will be provided free of charge.

For free

The legislation of the Russian Federation guarantees free receipt of a certificate with a taxpayer identification number. The same applies to the re-issuance of a document by the tax authority. However, free restoration of the certificate is only allowed when changing personal data (for example, last name). At the same time, the citizen has the right not to change it, since the identification number does not change throughout his life. It is also important to note that when replacing due to a change in personal data, you will definitely need to submit an outdated certificate. Otherwise, the tax authorities will refuse to restore the certificate free of charge.

Recovery procedure

The register for taxpayers contains all the information about those persons who have a TIN. For this reason, there is no difficulty in how to carry out this procedure very easily and quickly. It is enough to submit an application personally or through a proxy, and the entire procedure will begin.

Everything will take about five days. In some cases, much less time will be spent for a separate fee. The most important thing here is to prepare and send to the authorized bodies all the required documents that may be required. Their set is most often minimal. But everything will depend directly on the current situation and on the specific case. So you should be prepared for anything.

Methods for restoring TIN

Let's move on to the second point - the method of submitting an application. Previously, there was only one option to restore the TIN - contact the tax office in person, but the world does not stand still. Now there are several of these options, so everyone will find the most convenient for themselves. Namely:

- contacting the Federal Tax Service in person or through an online service.

- sending an application by mail;

- via Multifunctional.

Let's take a closer look at how to get a duplicate TIN for each item.

Sending documents by mail

You can also send documents to restore your TIN by mail.

To do this, you need to fill out an application yourself. Its form can be found and downloaded on the Federal Tax Service website.

The application must be accompanied by notarized copies of identification and registration documents (for example, relevant pages of a passport) and sent along with a receipt for payment of the fee.

If the inspector does not accept the application in person, it is especially important to fill it out correctly. Even with a minor error, you may be denied restoration.

If the documents were sent by mail, this period is counted from the moment they are received by the inspection department.

For cases where a document is needed urgently, an expedited procedure has been introduced.

By paying 600 rubles, you can restore your TIN the very next day.

Rules for restoring TIN through State Services

It is easy for any citizen to figure out what to do if the TIN is lost. To save time and effort, many citizens prefer to perform the necessary actions online. But on the State Services website, individuals will not be able to restore the certificate. After updating the resource, the service was excluded from the proposed list. Now you can get the service if you lose a document on the Federal Tax Service website.

An application for a duplicate is created on the inspection website. It indicates the need to obtain a new document, since the old documentation was lost or destroyed.

Attention! A TIN is issued free of charge only for the first time or after a change in personal data, and if you need to make a document after loss, you will have to pay a fee of 300 rubles.

When filling out an application on the Federal Tax Service website, a citizen can indicate a specific inspection department where it is convenient for him to pick up new documentation. Based on the completed request, the person receives an official document from representatives of the service, after which he must come to the institution to obtain a TIN. Therefore, it will not be possible to perform absolutely all actions via the Internet, since you will still have to visit a government agency.

Collection of documents

To carry out the entire procedure for restoring the TIN, you will first need to prepare and provide a complete package of documents, which includes:

- Statement of the established form. It indicates the person’s request on how to restore the TIN of an individual. The same procedure is provided if it is necessary to receive a duplicate document. There is no clear form for writing an application. For this reason, a custom writing option is used.

- Identity documents. The most popular and in demand is a personal passport.

- It is worth providing information about the registration at the place of residence of the citizen who seeks help from the relevant authorities. Here you can show the established stamp, which is also made in the passport of a citizen of the country, displayed on the fifth page.

- If the appeal is made on behalf of a person, but a completely different person comes to the tax office, then a power of attorney should be issued in his name according to the sample.

- Pay the state fee and receive a receipt for it. The amount will be doubled if urgent restoration of the document is required. In the latter option, everything will take only a day.

Free legal advice over the phone will resolve any of your controversial issues.

Thank you, your feedback is important to us

26.12.2017

★★★★★

5 5 1

“Very often I seek the help of a lawyer over the phone. I ask any question of interest, be it family or criminal or any other law, and receive an immediate answer. It’s very convenient, firstly, it’s free, secondly, without a queue, and thirdly, full-fledged legal assistance. Now I started applying for a pension, but no TIN. I made a request on the website and eight minutes later they called me back. The lawyer explained everything to me in detail. Now I know everything without any problems. My thanks."

- Catherine

Registration price

One of the conditions that must be met when submitting an application for a copy of the TIN is payment of the state fee to the treasury. Restoring an individual number is subject to a state duty, the amount of which is set at 300 rubles. To speed up the processing of data on an application for a duplicate TIN, you will have to pay double the amount.

How long will it take to issue

In order to study the presented set of papers to obtain a duplicate TIN, the legislation gives the tax service 5 days. This time period does not include weekends and holidays. During this time, the correctness of filling out the application for issuance of a duplicate is checked, and the compliance of the information specified in it with the attached documents.

If the set of materials is complete and the information in the papers is identical to that stated, within a week the citizen will be given a duplicate TIN of the individual. If he chose the method of submitting an application for a duplicate by mail, this period will be longer. It must be counted from the date indicated in the notification of receipt of correspondence.

When a duplicate TIN is urgently needed, you must pay a double state fee, then you can receive a duplicate in your hands on the second day after submitting the application. In this case, the process will be expedited by a personal visit to the tax office by the person who has lost the TIN certificate, with a pre-filled application for a duplicate and a paid state fee to the treasury.

Filling out an application

Any procedure and each document requires care when filling it out. The situation is also the same with the application, which is drawn up in order to restore the TIN if lost. If you do not do everything correctly, as required, you will have to apply again. And this wastes your own time and money.

Among the basic rules is that printing or writing should be done on only one side of a sheet of paper. The integrity of the paper should not be compromised in any way. Therefore, no staplers or other office supplies will be allowed. When writing with your own hand, you can choose blue or black pens. The best option is in block letters. They allow you to read the written text more clearly and correctly.

When it comes to a typewritten version on a computer, a standard and most often default font size of 16 is used. Corrections are under no circumstances allowed. Proofreaders won’t even help here, since they are also not acceptable when filling out such documents. If corrections or adjustments appear, you will have to fill out the application again.

Now you can move on to the text itself, which should be written in the document. At the top of the first page the name of the body where the appeal is made and where the request is sent is indicated. This is basically the tax office at your place of residence. In addition, the person from whom the document is being written is indicated here. The full last name, first name, patronymic, his place of residence, as well as possible contact information, including telephone numbers, must be written here. There are cases when individuals do not have a middle name. In this case, the number “1” is written. If the appeal does not take place in person, but through other means, then information about all attached documents, indicating the full number and pages, must also be reflected in a special field.

After the document has been completely written, the date it was written is indicated, as well as the signature of the person who applied. Some columns will subsequently be completed by tax inspectors. So here you should know the correctness. If you can’t handle it on your own, then it’s best to seek help from qualified lawyers who will help with the preparation of documents and bring the entire procedure to its logical conclusion.

Contacting the territorial inspection

The territorial inspection is the authority where citizens mainly turn to in order to restore the TIN if it has been lost. It will be sufficient to write the corresponding statement, which was mentioned earlier. Its form is 2-2-Accounting. Specialists can also monitor the writing process so that there are no problems in the future. Otherwise, you can search for this sample via the Internet and perform all the actions yourself.

In this case, a guarantor can also be used, but he must be endowed with the appropriate right. We are talking here about writing a power of attorney as the main document on the basis of which a third party will act. There are numerous other methods that can replace this, but they may require extra costs and additional problems.

Recovery by mail

People are constantly looking for alternative ways to carry out the TIN restoration procedure more simply and quickly. Among them are the use of Russian mail, when a complete package of documents is sent through the post office, as well as work via the Internet. But it is worth noting that here you will immediately have to perform several manipulations and actions so that everything is competent and correct from the legal side.

A copy of your personal passport will have to be first certified by a notary, and only then attached to the documents. You will also need to provide a receipt indicating that the state fee has been paid. Next comes the registration of the application itself. You will need to visit the official website of the tax service and select the appropriate sample to fill out. You can later print it without any problems. For sending, a registered letter is used, which will serve as valid confirmation that the documents have been received by the addressee. Then all that remains is to monitor how the letter is processed and its subsequent procedure.

What documents are needed to restore the identification code?

To begin with, before submitting documents, you need to go to your tax office and take a standard application form and details for paying the state duty, since this service is not free. As of 2021, it costs 300 rubles to restore the TIN.

There are few documents submitted; they are almost identical in any form of submission. These include:

- Passport of a Russian citizen with a photocopy of pages containing personal data of the individual applicant, including registration information.

- Receipt for payment of state duty; it must be paid in advance at a bank institution or through the government services portal.

- The application is in the established form; we will discuss it below in the article.

Please note that if the current registration is not indicated in the passport, you will need to obtain and submit a registration certificate. A certificate is obtained from the migration division of the Russian Ministry of Internal Affairs.

If a package of documents will be submitted by a representative of the applicant, a power of attorney (notarized) and a photocopy of the power of attorney are additionally added.

If documents are sent through the post office, notarized copies of documents from the list, as well as a list of documents being sent, are attached to the original application.

Via the Internet

Unfortunately, technology has not yet reached the point where it would be possible to obtain a copy of the TIN certificate via the Internet. In this case, it will be useful to us in order to pay the established amount of state duty for this type of service. In addition, you can obtain information about the TIN itself via the Internet if all information about it is lost. Passport data will come in handy here; after entering it, all the information of interest will be displayed, including the identification number.

Estimated deadlines

Tax authorities can use five days to obtain a duplicate certificate. During this time, all documents are checked, after which a copy is issued. When it comes to using postal services, the deadlines remain the same, but they begin to expire after all documents are received at the Federal Tax Service department. All these terms can be reduced to a minimum. But then you will have to pay double the duty. On our website you can always consult a lawyer free of charge on any questions.

Save

Save