Why do you need an extract?

One of the main conditions for issuing a visa is the financial viability of the person entering the country. The primary task of the tourist is to prove to the consular officer that:

- the available funds are sufficient for one’s own maintenance during the entire stay in the territory of a foreign state;

- the purpose of entry corresponds to the stated one (illegal employment is not planned);

- there is no risk of not returning to their homeland (the traveler is provided with a comfortable existence and is prosperous).

A current bank account statement from Sberbank, demonstrating the applicant’s solvency, performs all these functions.

In what situations is an account statement needed?

If you do not take into account basic control of your income and expenses, a bank statement may be needed in the following cases:

- for obtaining a visa to countries that require evidence of the financial viability of tourists;

- for entry into visa-free countries that require proof of funds for the duration of the trip.

States are forced to request this information in order to limit the flow of illegal immigrants seeking a better life abroad. The higher the standard of living in a country, the higher the demands it places on the financial viability of travelers. When deciding whether to issue a visa, consular officers must be sure that the applicant has a reason to return to his home country. The main one is an official job with a stable income above average or another source of a comfortable existence.

Some people ask, do they check the bank account for a visa? In theory, a consular officer can double-check the validity of any information provided by the applicant, including financial documents. But if the applicant chose not to show the presence of a bank account and provided alternative information, no one will look for anything further.

What amount must be indicated on the visa statement?

When collecting supporting documents, it is important to take into account that the criteria and methods for assessing the material well-being of a leaving citizen differ. They depend primarily on the level of economic development of the state where the visit is planned. The following trend is observed - the higher the standard of living of the population, the more stringent the requirements for the certificate and the larger the amount in the bank account should be. Each consulate sets its own minimum monetary limit. Even Schengen countries with a uniform visa procedure have different requirements regarding proof of financial well-being. For a Schengen visa, the daily allowance can vary from 14 to 65 euros for one person. For example, in Latvia the established minimum is 14 euros; to travel to Lithuania, the amount of the account balance may be significantly higher. The final figure also largely depends on the circumstances and purpose of the trip (business trip, work, tourism, study, etc.). It is recommended to clarify this issue with a specific consulate.

In the Schengen countries, the rule often applies is 65 euros per day per person crossing the border. So, for example, for one person to travel to Europe for 10 days, the amount in the certificate must be at least 650 € . Naturally, the account currency can be any (dollars, pounds, rubles, etc.). It is necessary to focus on the conversion rate at the bank. It is best to indicate the amount with some reserve.

Statement from Sberbank bank account for visa

If you are going to travel to another country, then you will probably need to obtain visa documents. Usually, to obtain permission to visit another country, you need confirmation of your financial situation - a bank account statement.

Most Russians use the services of Sberbank, so today we will analyze a typical standard certificate from this bank.

Contents An extract is needed in two cases:

- Confirmation that the individual has enough money to support him financially during his trip around the country;

- Confirmation of the financial solvency of an individual.

Consulate employees request such certificates so that financially secure people enter their country, who will support the development of its economy and tourism with their expenses in this country, and not immigrants or low-income people who will add problems to local authorities.

What is a statement of account status?

In order for the document received from Sberbank to have legal force and serve as sufficient evidence of solvency, it is necessary to find out what requirements the consulate makes and what type of statements it accepts. It is advisable to study the presented sample - the design of the certificate, the validity period of the document, what information it contains, for what period, what seal it is certified with.

There are 2 types of statements. This could be a document reflecting:

- amount of money in the account (remaining amount as of the date of statement generation);

- all transactions performed during the specified period of time (expenditures and receipts).

As a guarantee of a comfortable stay abroad, only funds available to the applicant at any time are accepted, that is, those that can be withdrawn if necessary. The most reliable guarantee is a document reflecting the availability of a sufficient amount stored in the Sberbank account to which the card is linked. A statement of a nominal account or a credit card also serves as evidence of wealth. In the case when a Sberbank credit card statement is being prepared for a visa, you should make sure that there is no debt and that the approved credit limit corresponds to the required amount. Funds deposited into the deposit account are not taken into account. But information about the deposit amount and regularly received interest can be attached as additional evidence of financial well-being and connection to the place of residence (reason to return from abroad).

Certificate for Schengen visa

When going on a trip abroad, you need to worry in advance about ordering a document that will display the amount sufficient for the trip. According to the rules of migration legislation, in order to visit the Schengen countries in 2021, you must obtain such a certificate. When ordering from Sberbank, the latter must also be certified with a blue seal. If the amount is indicated in rubles, you must order a transfer indicating the euro equivalent for the current date. The document period should usually not exceed 30 days. You can request a Schengen visa certificate using a debit or credit card. For a credit card, it is important that the limit of free approved amounts is sufficient. The card should not expire until the end of the trip.

How is an extract for a visa issued from an account in Sberbank? Details

Reading time: 7 minutes

The Schengen visa is one of the most frequently issued visas among Russians. This is not surprising, because Schengen will allow you to visit many of the most beautiful European countries: from France, Italy and Germany to Portugal, Sweden and Denmark. This is a real opportunity to get acquainted with different cultures and national cuisines without applying for a visa to each individual country.

To apply for a Schengen visa you will need a set of documents. It includes a standard list of papers, among which there must be financial guarantees. One of the most important financial guarantees is a bank statement indicating the availability of funds in the account. You can obtain a certificate at any bank branch of the bank in which you have an account.

Russians often receive statements for visas from Sberbank, since many people have accounts there. In this article we will describe in detail how bank statements for Schengen visas are prepared, how to obtain account statements from Sberbank for Schengen registration, and what features need to be taken into account when preparing a statement for a visa.

What information should the certificate contain?

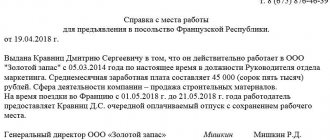

The certificate is issued on the official letterhead of Sberbank, certified by a round “wet” seal (not photocopied or faxed) and the original signature of the head of the department. The detailed statement must indicate:

- name of the Sberbank branch;

- bank details, address, branch phone number;

- Full name of the account (deposit, card) owner;

- account number;

- name of currency;

- balance (the difference between income and expense) at the beginning and end of the analyzed period;

- incoming and outgoing transactions, total turnover amounts, closing balance;

- date of issue.

You should know that consular officers can send a request to the bank to receive such an extended report (for the last quarter or six months) in order to study the flow of funds in more detail - how the account has changed, whether it was opened solely for visa processing and whether the document was not generated immediately after replenishing your account.

How to get an extract in 2021

There are several ways to request an account status report:

- Through an ATM or terminal, finding the “Information and Service” field and clicking on the “Card History” section. The printed receipt will reflect all transactions for the past quarter.

- Through Sberbank online by logging into your personal account and finding the “Statement” section.

- Using the mobile banking service (SMS banking), having previously downloaded the client mobile application.

- By mail (regular or electronic), leaving a corresponding order in any department.

And only by personally visiting the territorial branch of the bank, presenting the operator with a passport and a plastic bank card, can you issue a certificate of any type that meets the requirements of the consulate. By the way, at a Sberbank branch you can issue a visa statement about account balances in English. For more specific information, you can contact the office servicing the current account or the hotline.

How to make a statement on a Sberbank card online by phone

An account statement is required in various circumstances. Someone needs to confirm a transaction for which money was lost in transit; another client receives a visa and must confirm his solvency. Perhaps the client just wants to control movements on the account, no matter how the circumstances develop, it is worth knowing how a statement on a Sberbank card is issued through Sberbank Online.

We recommend reading: How much is the presidential scholarship in Russia in 2021

In 2021, the popularity of the Internet banking service is gaining momentum.

It allows you to resolve most of the typical questions that arise for a bank client online. Among them is the need to receive a free account statement. The process is completely simple and does not require special skills, the document is generated automatically, and the client receives a ready-made version for printing. The obtaining algorithm is as follows.

Let's log in to the Internet banking service; to do this, just enter the required pair in the authorization form and confirm the login using the code from the message.

Request a statement via Sberbank Online

In the new web version of Sberbank Online 2021 you need to:

- go to the “Catalogue” section;

- at the very bottom of the page, click “Extracts and certificates”;

- Click “Certificate of available balance for obtaining a visa”;

- Next, select the desired map and help language;

- Click create.

A document with a QR code will be displayed, which can be saved, printed or sent by mail to a government agency or company preparing the trip.

Algorithm of actions in photo illustration:

Sberbank contact center phone: +7

Translation of the statement

In accordance with the requirements, the document must be translated into English or the official national language (the one spoken in the country of the planned travel). This is done by specialized agencies - professional translation bureaus. They also certify these documents at the same time. In addition, you may need to convert Russian rubles into the currency of the country of your future stay. Sberbank clients can avoid these difficulties by immediately requesting a statement in English. The cost of such a service is 100-200 rubles.